Economic Justice

Combating inequality means both lifting up and building power at the bottom, and breaking up concentration of wealth and power at the top. That’s why we work at the intersection of economic and racial justice through projects designed to build leadership and self-empowerment of black workers, immigrant workers, and low-wage workers, youth and families affected by incarceration, along with projects aiming to reverse the rules that criminalize poor people of color, and projects fighting to ensure that the wealthy and Wall Street corporations pay their fair share of taxes.

Latest Work

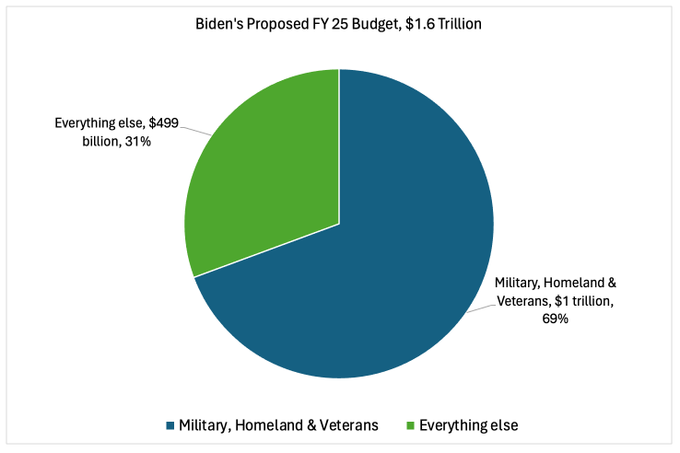

Militarized Funding in Biden Budget Totals Well Over $1 Trillion (and it will grow)

Unless the administration changes its approach, these wars will continue to deprive us of the security we actually need.

The Gilded Age Then, The Gildest Age Now

Our world’s deepest pockets are still buzzing about this year’s — this century’s — biggest bash yet.

Parsing Biden’s 2024 State of the Union Address

President Biden credited progressive economics with a strong post-COVID recovery. But on Gaza and immigration, he failed to draw much distinction with his conservative opponents.

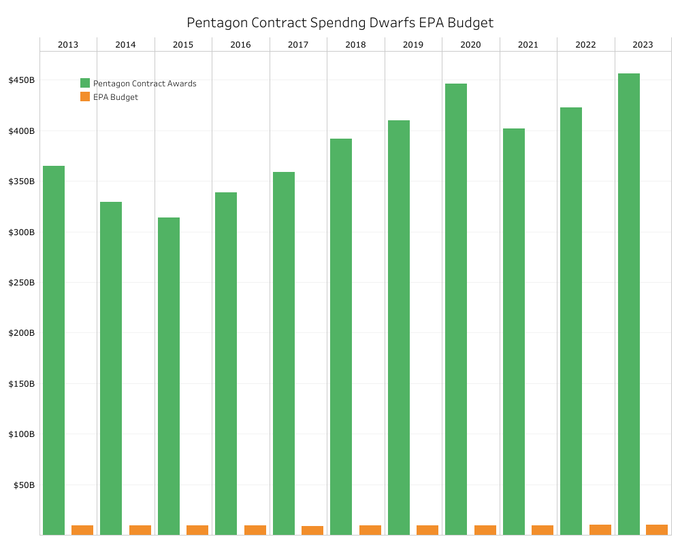

What We Spend on the EPA Compared to Pentagon Contractors

We need to invest in the agency that can prevent and reverse ecological disasters.

Can Brazil Convince the World To Tax Billionaire Wealth?

To confront climate change, Brazil is warning, we need to start confronting grand fortune.

Billionaires Can’t Save American Journalism

The start of 2024 has been catastrophic for news outlets all over the country, even the ones owned by billionaires. What could an alternative look like?

Do High Taxes on Our Rich Make Any Sense?

Serious tax rates, apologists for our wealthy claim, can’t work. The stats suggest otherwise.

The USPS Network Consolidation Plan: What’s at Stake for Southern Oregon

A postal facility in Medford is one of many across the country facing the transfer of processing functions to a regional hub hundreds of miles away.

Congress Should Embrace the Vitality That Immigration Brings

We must refuse to be divided by those who want to scare us, and enact some genuine immigration reform.

Progressive Dreams for Public Transit

Car-centric infrastructure drives inequality. As voters and advocates, we have the power to shape transit’s future for the better.

Reports

REPORT: Who Is Lobbying against Common-Sense Charity Reform?

REPORT: The True Cost of Billionaire Philanthropy

REPORT: Hanscom High Flyers

REPORT: Executive Excess 2023

REPORT: Still A Dream: Over 500 Years to Black Economic Equality

REPORT: A Tale of Two Retirements 2023

Report: High Flyers 2023: How Ultra-Rich Private Jet Travel Costs the Rest of Us and Burns Up the Planet

Report: “Extreme Wealth: The growing number of people with extreme wealth and what an annual wealth tax could raise”

REPORT: Homecoming: The Greater Birmingham Community Speaks on Regional Cooperation and a More Inclusive Economy

Report: Gilded Giving 2022

The Other Side of the Storm

Bay State Billionaires

Executive Excess 2022

Report: Taxing the World’s Richest Would Raise $2.52 Trillion a Year

REPORT: Silver Spoon Oligarchs

Executive Excess 2021