Still A Dream: Over 500 Years to Black Economic Equality

Dedrick Asante-Muhammad | Chuck Collins | Omar Ocampo | Sally Sim

Introduction:

Our country has taken significant steps towards racial equity since the Civil Rights Movement of the 1950s and ‘60s. But growing income and wealth inequality over the last four decades has supercharged historic racial wealth disparities, slowing and even reversing many of those gains.

Sixty years without substantially narrowing the Black-white wealth divide is a policy failure. But just as federal policy helped create the racial wealth gap, it can also help close it. In this report, we look in detail at the state of that divide and recommend policy reforms that would substantially narrow it within one to two generations.

The full version of the report is available here. A summary follows.

Key Findings

In a few areas, African Americans have made substantial socioeconomic advancements since the 1960s.

- In 1963, Black Americans had a stunningly high poverty rate of 51 percent, compared to 15 percent for white Americans. By 2021, poverty rates had declined, with white poverty at 8 percent and Black poverty at 20 percent. Though this is a substantial decline, it still means almost one in 12 white Americans are in poverty and one in five Black Americans live in poverty.

- The rate of Black high school attainment has sharply increased over the past 60 years, from 24.8 percent in 1962 to 90.1 percent in 2022. But while the college attainment advantage for whites in 2022 (1.7 times that of Black Americans) was substantially lower than it was in 1962 (2.4 times), there is still a substantial divide between Black college attainment (27.6 percent) and white college attainment (37.9 percent).

- Unemployment has been historically low for African Americans over the last few years. Between 1974 and 1994, Black unemployment consistently remained in the double digits, with rates twice as high as those for white Americans. From 1994 to 2017, Black unemployment rates varied between 7 percent and 10 percent, occasionally spiking to nearly 17 percent during recessions. However, since 2018, Black unemployment has reached record lows of 5 percent and 6 percent, except during the 18-month recession caused by COVID-19.

Yet there has been minimal progress in most socioeconomic indicators. At this pace, it would still take centuries for African Americans to reach parity with white Americans.

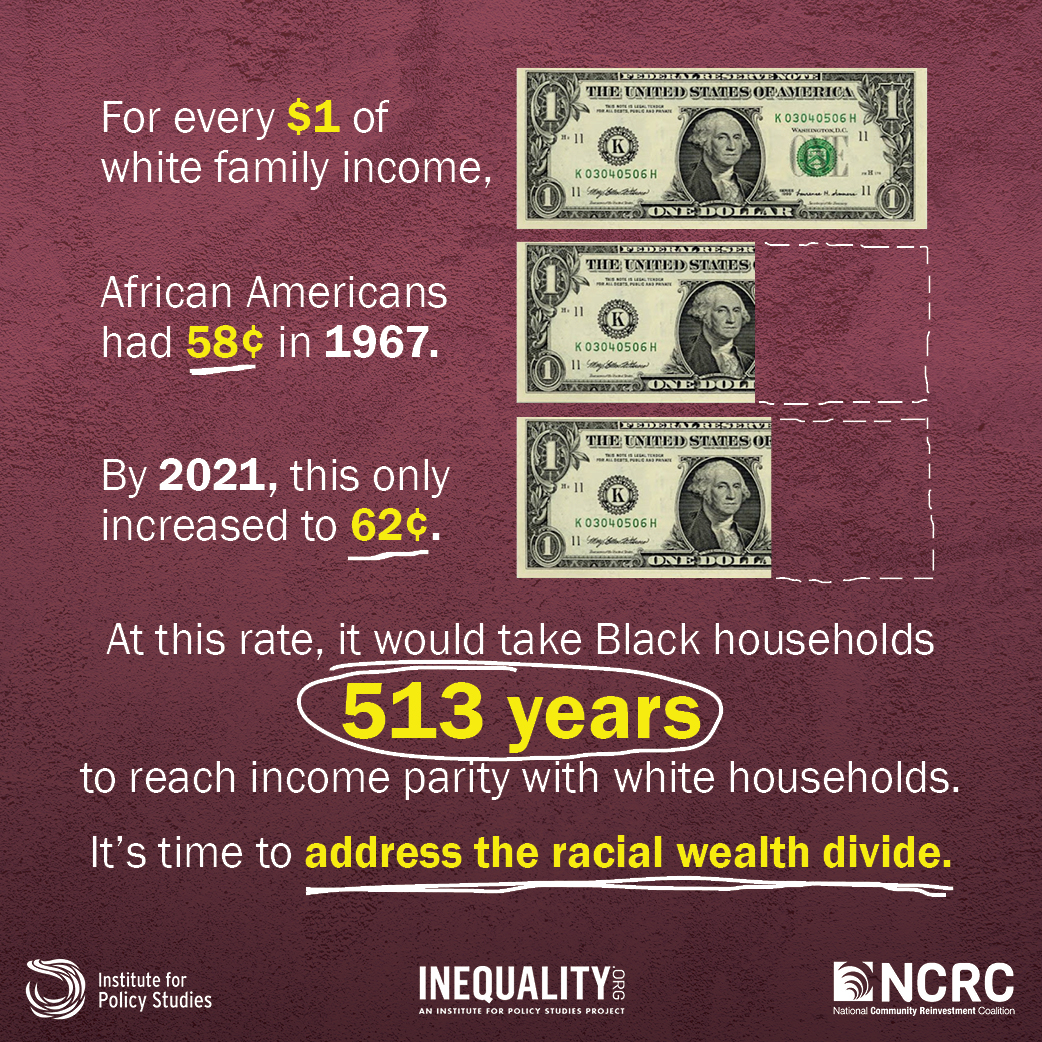

- For every dollar of white family income, African Americans had 58 cents in 1967. In 2021 African Americans had 62 cents to the white household’s dollar. At this rate, it would take Black households 513 years to reach income parity with white households.

- Median household income for African Americans has grown just 0.36 percent since the turn of the century and it is still lower today than the white median family income in 1963.

- In 1962, African Americans had 12 cents for every dollar of wealth of non-Black Americans. By 2019, African Americans had 18 cents for every dollar of wealth of non-Black Americans. At this rate it would take 780 years for Black wealth to equal non-Black wealth.

- Black homeownership increased from 38 percent in 1960 to 44 percent in 2021, an increase of 6 percentage points. White homeownership has increased from 64 percent in 1960 to 74 percent in 2021, a 10 percentage point increase. In over 60 years, there has not been a bridging of the Black-white homeownership divide.

Solutions and Interventions

“Depressed living standards for Negroes are not simply the consequences of neglect. Nor can they be explained by the myth of the Negro’s innate incapacities, or by the more sophisticated rationalization of his acquired infirmities. They are a structural part of the economic system in the United States.”

— Dr. Martin Luther King, Jr., 1968

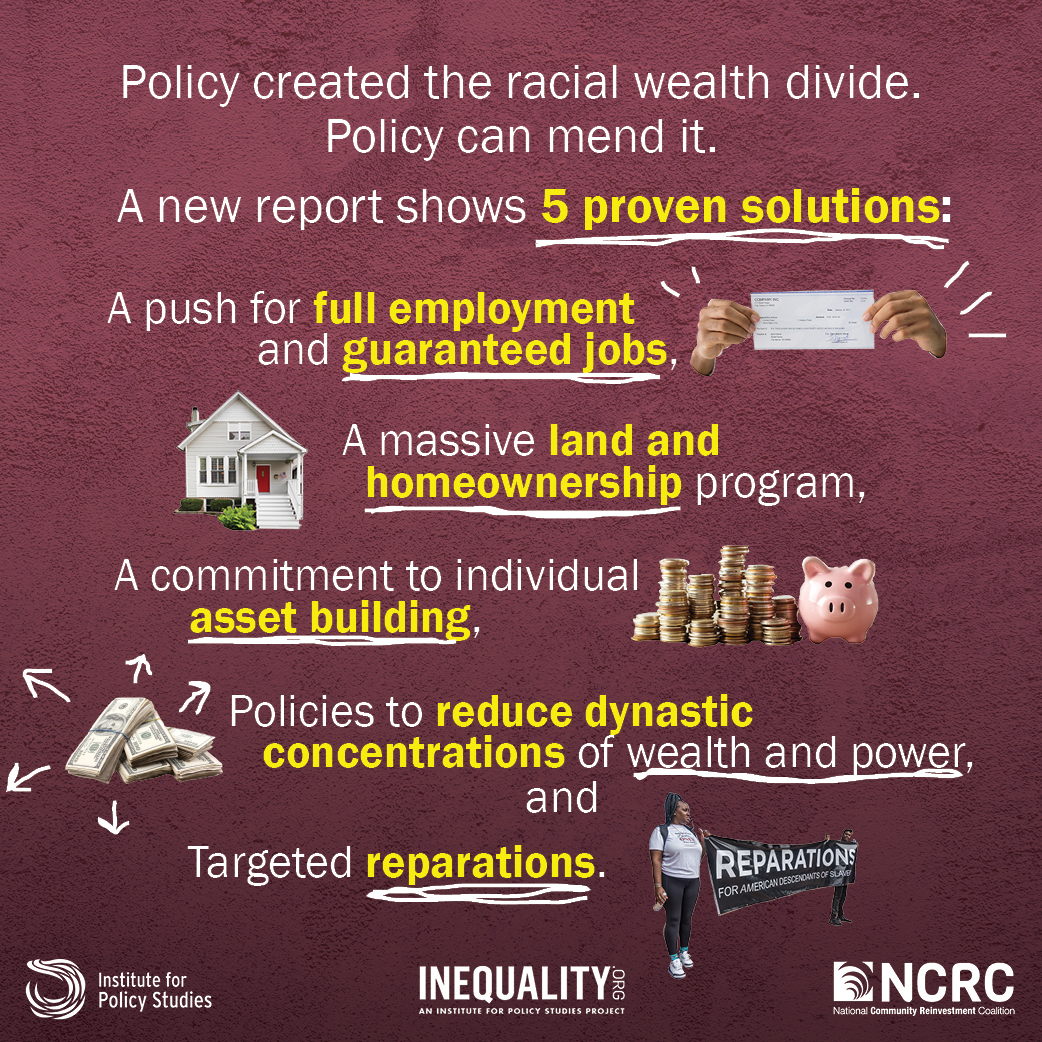

There are a wide range of solutions necessary to narrow the racial economic divide. The five that we believe would make the most difference are:

- A push for full employment and guaranteed jobs.

- A massive land and homeownership program.

- A commitment to individual asset building.

- Policies to reduce dynastic concentrations of wealth and power.

- Targeted reparations and universal health care.

Full Employment and Guaranteed Jobs

A federal jobs guarantee would provide universal job coverage for all adults and eliminate involuntary unemployment. It would offer existing workers a viable alternative to jobs with low wages, inadequate benefits, and undesirable working conditions. Moreover, the work would be used to create and improve our nation’s physical and human infrastructure, in the spirit of the Works Progress Administration during the Great Depression.

To maximize the impact on reducing Black unemployment and narrow the racial earnings gap, the program should:

- Be funded and administered by the federal government.

- Provide technical assistance to the most economically disadvantaged communities.

- Provide longer term subsidies, as long as 10 years, along with economic development support.

- Subsidize only net new jobs at prevailing wages.

- Include public agencies, nonprofit organizations, and for-profit companies as eligible for wage subsidies.

- Target communities with persistently low prime-age employment.

Land and Homeownership

Expanding access to land and home ownership is a critical intervention in reversing the multi-generational nature of the Black-white wealth divide. As our report has shown, the legacy of discrimination in mortgage lending, redlining, steering and appraisal differentials has thwarted progress.

To restore progress, we’ll need:

- Targeted federal housing policies like the American Housing and Economic Mobility Act, which would provide down payment assistance to first-time homebuyers living in formerly redlined or officially segregated areas.

- Federal legislation like the Neighborhood Homes Investment Act, which would create a federal tax credit to cover the “appraisal gap” that significantly devalues homes in majority-Black neighborhoods.

- Luxury transfer taxes on extremely high-end property sales to fund affordable housing.

Individual Asset Building

Individual wealth inequalities should be addressed through bold multi-generational approaches.

Individual asset accounts, sometimes called Baby Bonds when they are initiated at childhood, are an essential program to address historical injustices that undergird the current racial wealth divide. They could be administered in a manner that is universal but race conscious.

To truly effect the deep multi-generational asset poverty seen in the African American community, baby bonds would need to be widespread throughout the community and have returns in the tens of thousands of dollars — money that could then be reinvested in wealth building opportunities.

Senator Cory Booker and U.S. Representative Ayanna Pressley have introduced the American Opportunity Accounts Act, a federal baby bond program that would provide an initial $1,000 for every U.S.-born child, with additional amounts up to $3,000 deposited for the lowest income children. States are also exploring similar legislation.

Breaking Up Concentrated Wealth

The growing concentration of wealth has translated to a growing concentration of economic and political power by the ultra-wealthy, those in the top one-tenth of one percent. This tiny, overwhelmingly white group has been the primary beneficiary of the past five decades of economic growth and of historically low tax rates.

Significantly raising taxes on the ultra-wealthy serves both the intrinsic value of reducing the corrupting influence of plutocratic power, as well as the instrumental value of producing significant public revenue that can be invested in creating wealth building opportunities for those who have been blocked from generating wealth.

Another corrective action would be to eliminate the set of federal tax subsidies, estimated at over $600 billion per year, that dramatically skew to the benefit of the ultra-wealthy and affluent. Shifting these tax expenditures toward wealth-building programs for people with low-levels of wealth, particularly those of color, would have a monumental impact in reducing the racial wealth divide and solving economic inequality more broadly.

Reparations

Many of the solutions described here are universally targeted and broadly accessible to all low-wage and low-wealth households. Reparations solutions are directly targeted to African American households to repair historical and present-day wealth disparities. Communities across the nation — from San Francisco to Evanston, Illinois — are exploring what reparations might entail.

But only the federal government has the financial capacity to undertake the broad and bold endeavors necessary to address the deep-rooted issue of white socioeconomic supremacy.

The funding for reparations can primarily come from taxes and fees levied on the ultra-wealthy who have benefitted from windfall income and wealth gains, not ordinary working taxpayers. A national Reparations Trust Fund could be financed from a graduated tax on wealth and inherited assets, the closure of tax loopholes, and penalties for high-end tax evasion.

The first step toward a national reparations policy would be for Congress to establish a national commission to examine the legacy of slavery and propose reparations and reconciliation programs funded by breaking up concentrated wealth in the United States.

Universal Health Care

People of color accounted for more than half of the total 32 million nonelderly uninsured in 2016. Poor access to health care and poor health outcomes are inextricably tied to race in the United States.

The privatized healthcare system in the United States continues to leave behind millions of families despite progress made by the Affordable Care Act. This deeply unfair and immoral system leaves low-income and low-wealth people in the most vulnerable position. The number one cause of bankruptcy is an illness to oneself or a family member.

Medicare for All removes the burden and stigma associated with finances at the point of the delivery of medical care. Medicare for All would guarantee high quality healthcare as a human right, not a privilege.

Download our Press Release [PDF]

Media Contacts:

Olivia Alperstein

olivia@ips-dc.org

202-787-5205

Alan Pyke, apyke@ncrc.org

Ryan Rudominer, ryan@redhorsestrategies.com

Olivia James, olivia@redhorsestrategies.com