“Donor Revolt for Charity Reform” Campaign Highlights Strong Demand for Changes to Philanthropy Rules

A new report also reveals who has spent millions lobbying against charity reform.

A new report also reveals who has spent millions lobbying against charity reform.

As DAFs become an ever-larger portion of the nonprofit funding system, both sponsors and donors must be held to a higher standard.

The Ipsos poll found that a solid majority (75%) believe there should be a maximum amount that ultra-wealthy donors can claim to reduce their taxes.

Some donor-advised fund sponsors claim to democratize giving. They are making themselves look more egalitarian than they actually are.

DAFs channel huge amounts of cash to ‘culture war’ groups – anonymously. Why do people get tax breaks for using them?

Foundation-to-DAF conversions make up only about 5 percent of all dissolving foundations, but they represent a much larger portion of the dollars.

Like a blind squirrel finding a nut, Bill Ackman’s antics reveal a huge flaw in donor-advised fund regulation.

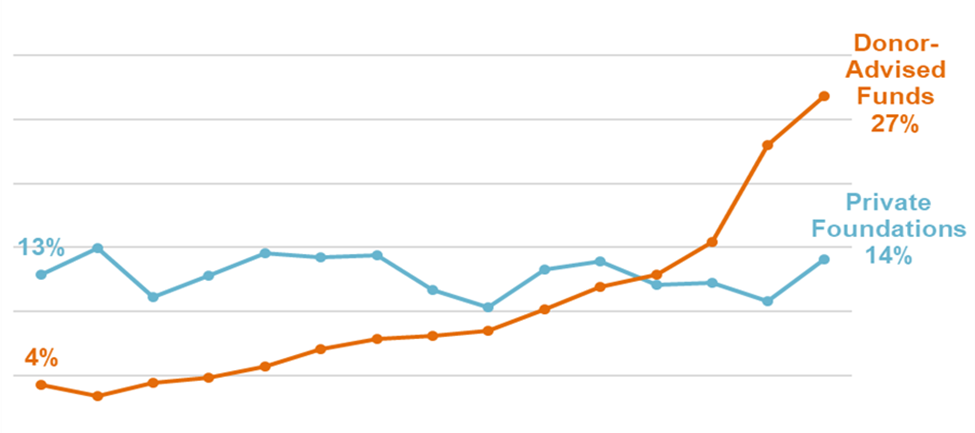

The National Philanthropic Trust’s latest report on DAFs reveals just how rapidly they’re growing.

In this season of giving, tax laws designed to support charities may actually protect billionaire wealth — at our expense.

The first edition of a new Inequality.org newsletter focused on transforming philanthropy for our common good.

At Scripps News, Chuck Collins breaks down the true cost of billionaire philanthropy — and how to put charitable donations back in the hands of actual charities.

How the ultra-wealthy use charitable giving to avoid taxes and exert influence — while ordinary taxpayers foot the bill.

Our report estimates that the direct taxpayer subsidy for charitable giving is $111 billion a year.

The new analysis details how the ultra-wealthy use charitable giving to avoid taxes and exert influence, while ordinary taxpayers foot the bill.

It’s pretty hard to figure out donor-advised funds’ MOs. Our new analysis discerns sponsor priorities from their public websites.