Thank you for helping us spread the word about the new IPS report “Warehousing Wealth: Donor-Advised Charity Funds Sequestering Billions in the Face of Growing Inequality” Please use the hashtag #CollegeForAll when sharing with your community.

Below are some sample Twitter and Facebook posts. You can find the key findings and full report here.

Twitter:

- New @ips_dc report takes a close look at donor advised funds, or DAFs, and the risks they pose to the independent charitable sector, taxpayers, and the public interest. #StopWarehousingWealth https://ips-dc.org/report-warehousing-wealth/ [Graphic #3]

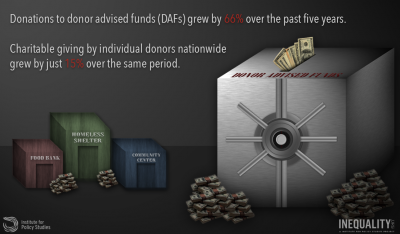

- Donations to DAFs increased from just under $14 billion in 2012 to $23 billion in 2016—growth of 66% over five years. In contrast, charitable giving by individual donors nationwide grew by just 15% over the same time. #GiveToRealCharities https://ips-dc.org/report-warehousing-wealth/ [Graphic #2]

- Latest @IPS_DC report highlights how donor advised funds provide loopholes for both donors and private foundations to get around tax restrictions and significantly reduce transparency and accountability. #StopWarehousingWealth [Graphic #3] https://ips-dc.org/report-warehousing-wealth/

- New @IPS_DC report found that is no legal requirement for donor advised funds to pay out their money to qualified charities—ever. The average annual payout rate for DAFs in 2016 was 20 percent, with some DAFs give considerably less. #GiveToRealCharities https://ips-dc.org/report-warehousing-wealth/ [Graphic #4]

- The largest donor advised fund, #Fidelity Charitable, grew from $1.7 billion in annual donations in 2011 to $6.8 billion in donations in 2017, an increase of over 400 percent—shifting giving away from active charities. #StopWarehousingWealth https://ips-dc.org/report-warehousing-wealth/ [Graphic #1]

Facebook:

- At a time of staggering inequality, the ultra-wealthy are using donor advised funds (DAFs) to claim substantial tax benefits, while often failing to move funds in a timely way to independent nonprofits addressing urgent social needs. https://ips-dc.org/report-warehousing-wealth/ [Graphic 3]

- Our new report highlights the the dramatic expansion of DAFs and the risks an unregulated DAF system poses to the public interest and the charitable sector. https://ips-dc.org/report-warehousing-wealth/ [Graphic 2]

- In 2016, for the first time ever, a DAF—Fidelity Charitable—was the top single recipient of charitable giving in the U.S. In 2017, 6 of the top 10 recipients of charitable giving were DAFs – shifting giving away from active charities. https://ips-dc.org/report-warehousing-wealth/ [Graphic #1]

- Donor advised funds (DAFS) are now the fastest-growing recipients of charitable giving in the U.S. In contrast, charitable giving by individual donors nationwide has grown minimally. https://ips-dc.org/report-warehousing-wealth/ [Graphic 4]

Graphic 1

Graphic 2

Graphic 3

Graphic 4