At a time of staggering inequality, wealthy individuals are using donor-advised funds, or DAFs, to claim substantial tax benefits, while often failing to move funds in a timely manner to independent nonprofits addressing urgent social needs. Of particular concern are the growing number of DAFs founded by for-profit Wall Street financial corporations that provide incentives for the warehousing of wealth. This report, Warehousing Wealth: Donor-Advised Charity Funds Sequestering Billions in the Face of Growing Inequality, documents the dramatic expansion of DAFs and the risks an unregulated DAF system poses to the public interest and the charitable sector.

At a time of staggering inequality, wealthy individuals are using donor-advised funds, or DAFs, to claim substantial tax benefits, while often failing to move funds in a timely manner to independent nonprofits addressing urgent social needs. Of particular concern are the growing number of DAFs founded by for-profit Wall Street financial corporations that provide incentives for the warehousing of wealth. This report, Warehousing Wealth: Donor-Advised Charity Funds Sequestering Billions in the Face of Growing Inequality, documents the dramatic expansion of DAFs and the risks an unregulated DAF system poses to the public interest and the charitable sector.

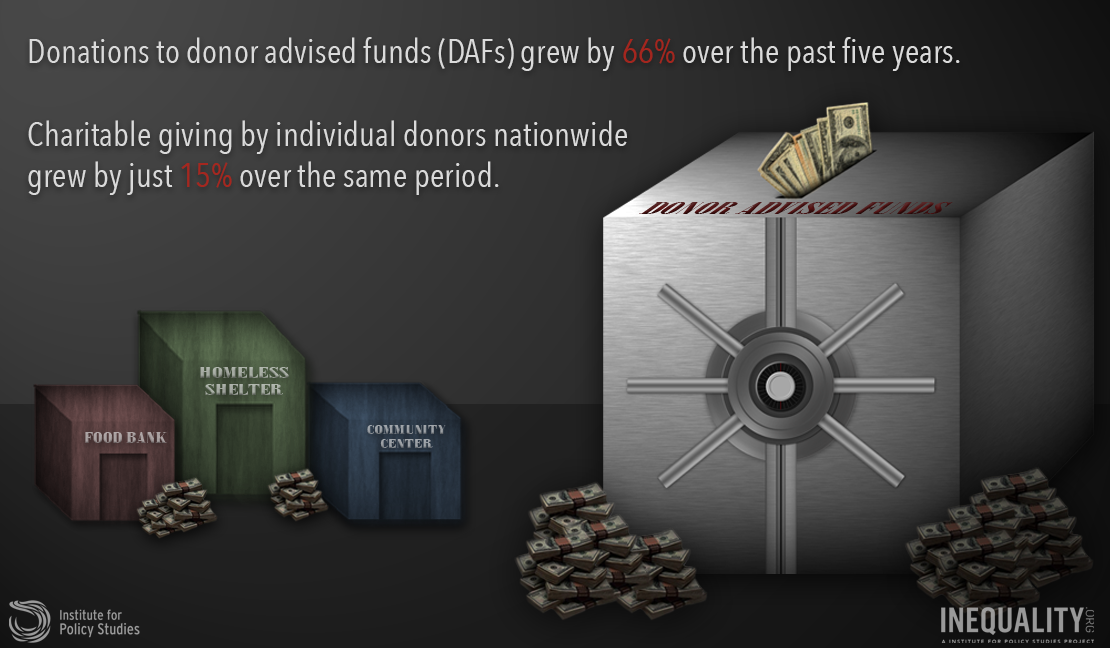

Explosive Growth

- DAFs are now the fastest-growing recipients of charitable giving in the U.S. Donations to DAFs increased from just under $14 billion in 2012 to $23 billion in 2016—growth of 66 percent over five years. In contrast, charitable giving by individual donors nationwide grew by just 15 percent over the same five years.

- DAFs appear to be shifting giving away from active charities. The share of total U.S. individual charitable giving that is going to DAFs, rather than to direct charities, has nearly doubled over the past seven years—from 4.4 percent in 2010 to 8.3 percent in 2016.

- In 2016, for the first time ever, a DAF—Fidelity Charitable—was the top single recipient of charitable giving in the U.S. In 2017, six of the top 10 recipients of charitable giving were DAFs.

- Fidelity Charitable grew from $1.7 billion in annual donations in 2011 to $6.8 billion in annual donations in 2017, for total growth of more than 400 percent over seven years. Fidelity Charitable held nearly $16 billion in assets in 2016— more than half the total assets of all community foundations in the U.S. combined.

- The average DAF donor is a member of the wealthiest one-tenth of one percent of U.S. Americans, with annual income over $1 million. The primary attractions for the use of DAFs among the super-wealthy are the advantages related to the relief of capital gains tax burdens, and the easy donation of non-cash appreciated assets— an area of charitable giving rife with potential abuses.

Potential Risks

- There is no legal requirement for DAFs to pay out their funds to qualified charities—ever. According to one estimate, the average annual payout rate for DAFs in 2016 was 20 percent, although some DAFs give considerably less.

- Even as the amount of funds flowing to DAFs has increased, payout rates have been steadily decreasing.

- As currently structured, DAFs encourage a wealth preservation mentality in donors, rather than incentives to move donations to qualified charities. This delays the public benefit from those donations, which has an opportunity cost for society.

- DAFs provide loopholes for both donors and private foundations to get around tax restrictions and significantly reduce transparency and accountability.

- In many cases, financial advisors are rewarded for steering their clients towards DAFs affiliated with their corporation, and financial advisors and corporate fund managers are rewarded for keeping money in DAFs once they are established.

Recommendations and Policy Changes

This report offers several recommendations for mitigating the risks of DAFs, including:

- Require distribution of DAF donations within three years.

- Delay donor tax deduction until the funds are paid out to an active charity.

- Establish a specific pay out rate.

- Bar private foundation donations to DAFs and vice versa.

- Increase scrutiny of the rules around donations of non-cash appreciated assets to ensure public interest and taxpayers are protected.

- Cap management fees for commercial advisors of DAFs.

- Require that a donor’s DAF cannot be managed by the same organization that handles the donor’s personal assets.