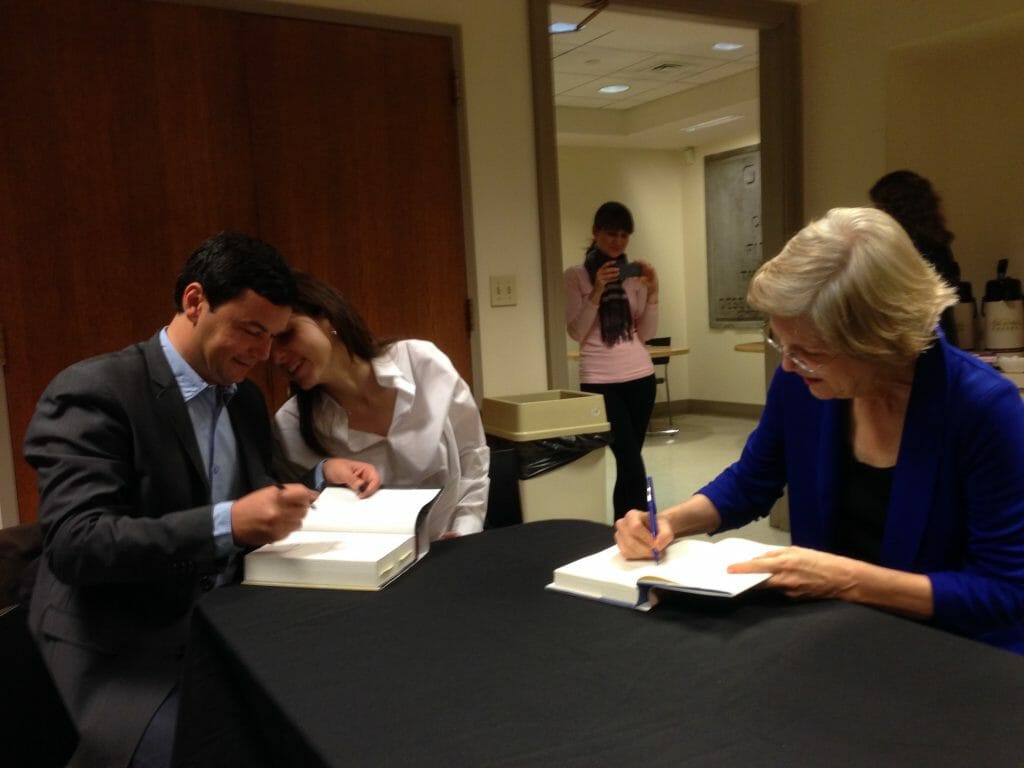

Senator Warren’s Wealth Tax: The Moment of Conception

There are great moments in intellectual cross-fertilization. This may have been one of them.

There are great moments in intellectual cross-fertilization. This may have been one of them.

House Republicans are doubling down on reforms that awarded tax giveaways to corporations and the wealthy.

As another corporate giveaway, the plan would put major public infrastructure up for sale, and would loosen environmental rules designed to protect local communities.

While Republicans may succeed in scoring a short term win for their donors, their tax plan is sparking a new moral movement against inequality.

What history will the 2017 tax clash end up making?

Tax cuts for the wealthiest 1 percent alone could fund coverage for 12 million Americans.

At his inauguration Trump promised a government controlled by the people. How are the people faring so far?

The private jets provision in the Senate bill is indicative of who’s at the table – the wealthiest presidential cabinet in American history and their billionaire friends.

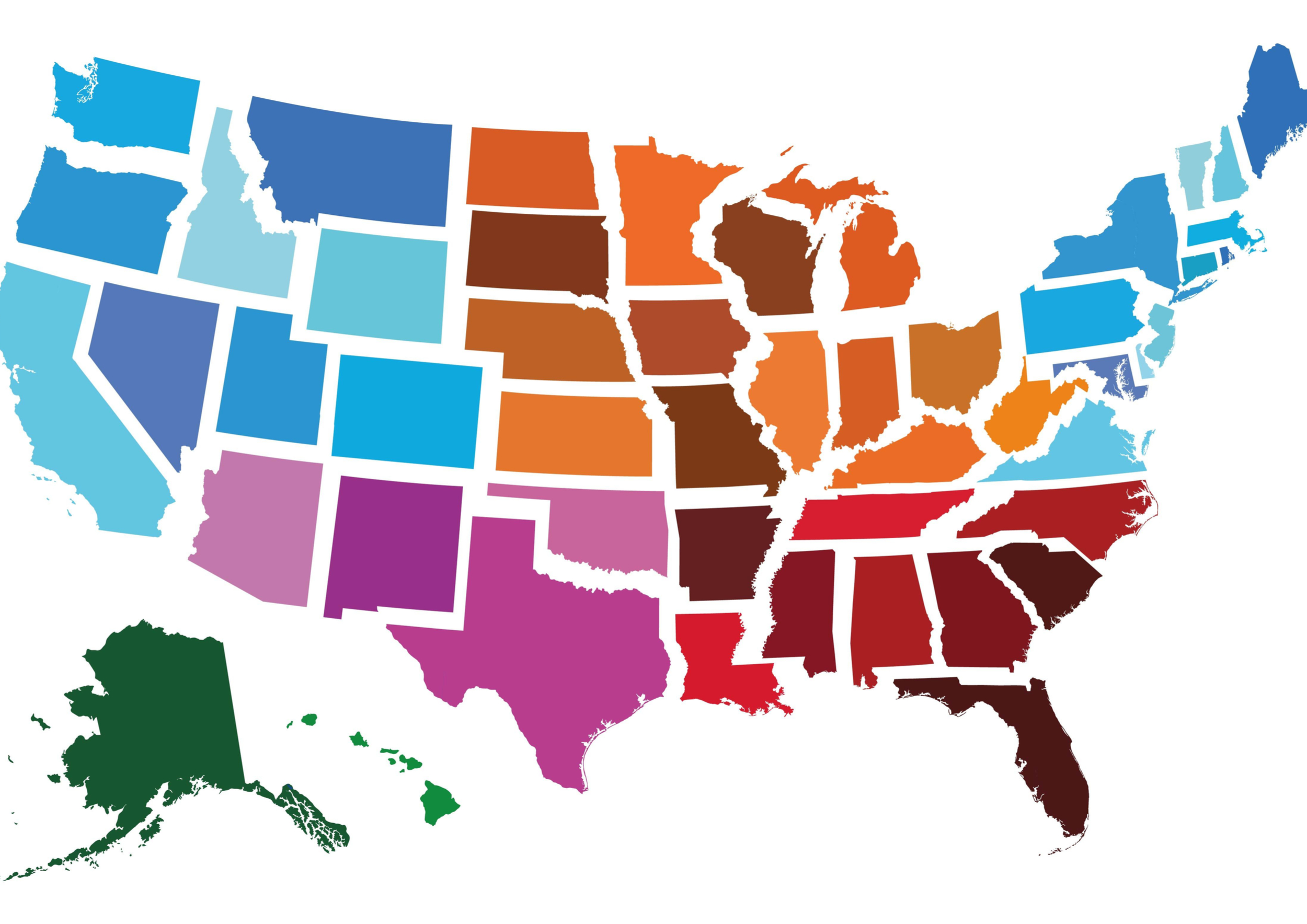

New data from our National Priorities Project shows what’s at stake if America’s richest get a tax cut.

If it passes, this plan would have our national tax burden resting overwhelmingly on income from the labor of working people.

A failed experiment left the state with underfunded schools, gaps in public services—and lessons for the rest of us.

The Tax Cuts and Jobs Act is nothing short of a boon to the very wealthy at the expense of everyone else.

the House GOP decided to keep the top federal income tax rate at 39.6 percent. But the really rich won’t be paying taxes at anywhere near that rate.

Rep. Jayapal of Seattle is among the leading Progessive Democrats working to educate constituents about a fast-moving Republican tax plan.

A look at the real-life horrors our government is peddling this year — and a look at the movements rising up to stop them.