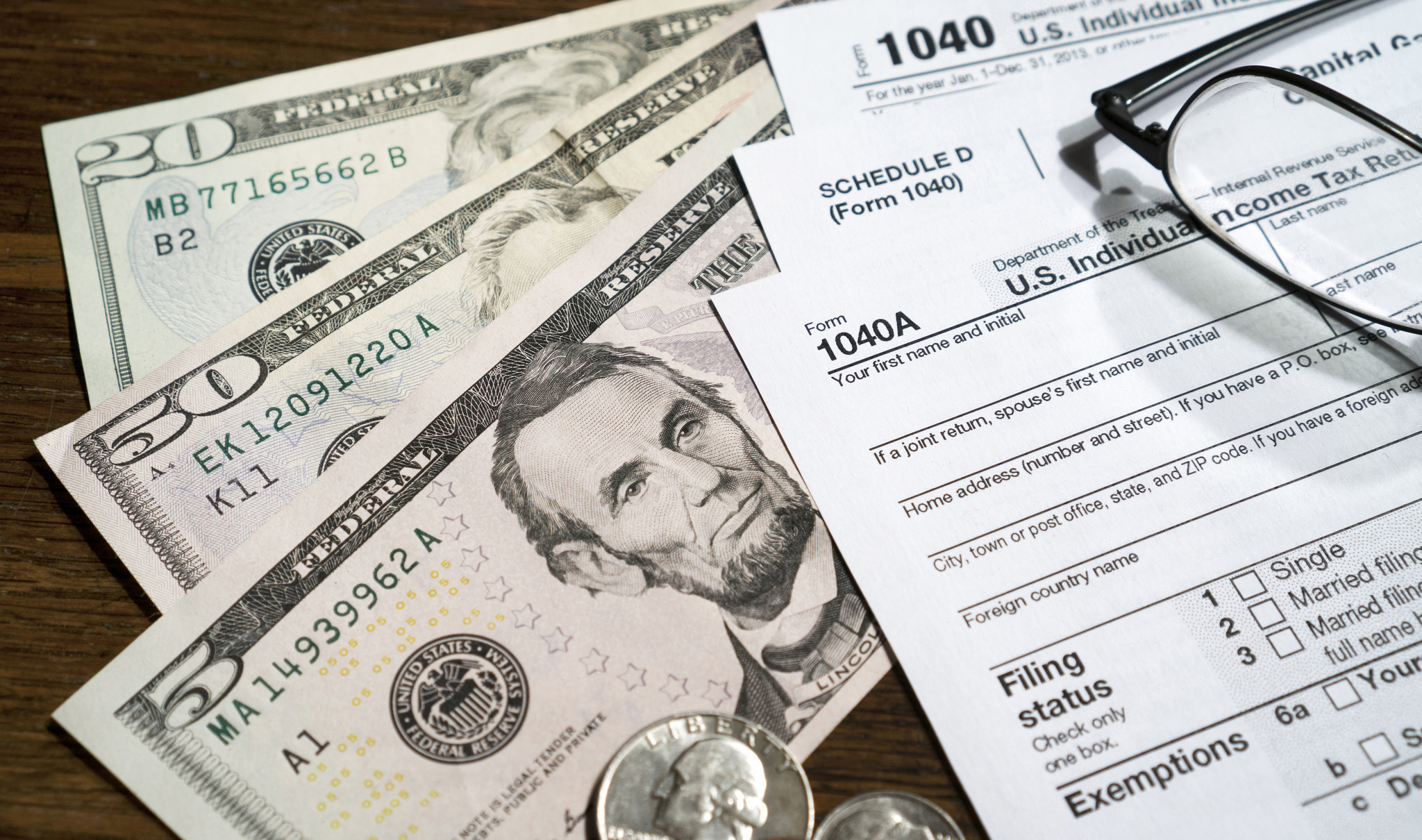

Are the Flat Tax Folks Winning — or Have They Already Won?

It’s time to end the free ride that our richest are getting from flat tax rates during tax season.

It’s time to end the free ride that our richest are getting from flat tax rates during tax season.

There are now 813 billionaires with $5.7 trillion in wealth, making the ten-figure club even more powerful economically and politically. We need a progressive taxation system to reverse inequality.

The Supreme Court is erasing our shared responsibility for educating each and every child.

Last year’s Wall Street bonus pool was large enough to raise New York City’s minimum wage to $21.25 — with $24 billion left over.

Voters approved proposals to tax the rich, build worker power, and make housing and education more affordable.

A promising new national campaign is aiming to ‘TURN’ around a profoundly unequal USA.

Turning up the spotlight on tax dodging by the wealthy would increase momentum for fair taxation to pay for needed public investments.

While working families are suffering under the pandemic, corporate boards have bent the rules to protect massive CEO paychecks.

Here’s the simplest way to collect more revenue from the richest 0.2 percent of Americans.

Innovative proposals like tying income tax rates for America’s riches to the minimum wage for America’s poorest could help high tax rates survive over the long haul.

The youngest lawmaker in Congress delivers a history lesson America has needed for years.

The newspaper publishing giant E.W. Scripps would be deeply distressed to see what has become of his namesake company – and beloved country.

The Rockefellers saw their wealth slimmed down by taxes—but it grew back.

America’s top earners will be rushing to maximize their 2016 income if Democrats gain a sweep in November. But what happens next will be what really matters.

Our tax codes incentivize medical entrepreneurs to go for gold while patients are left juggling what’s best for them versus what they can afford.