Who Wants to Be a Trillionaire?

Don’t laugh. That’s exactly where America’s oligarchic policies are taking us.

Don’t laugh. That’s exactly where America’s oligarchic policies are taking us.

Four years after the start of the COVID-19 pandemic, the United States has 737 billionaires with a combined wealth of $5.529 trillion.

But who set the stage for that billionaire?

This expensive, carbon-intensive form of travel is bad for both the earth and the taxpayers who subsidize it for the ultra-rich.

New research from the Institute for Policy Studies and Patriotic Millionaires reveals 10 stunning facts about the high-flying private jet industry.

The report includes country-by-country data on wealth inequality and the revenue possibilities of national wealth taxes.

An annual wealth tax on the world’s richest could raise $1.7 trillion globally.

You never know when an editorial can come in handy. Just ask Jeff Bezos.

Marc Steiner spoke with Chuck Collins and Kalena Thomhave about their new IPS report on the 13 US states that the worst enablers of billionaire wealth hiding.

A new report from the Institute for Policy Studies shows how 13 U.S. states shield billionaires – and what we can do about it.

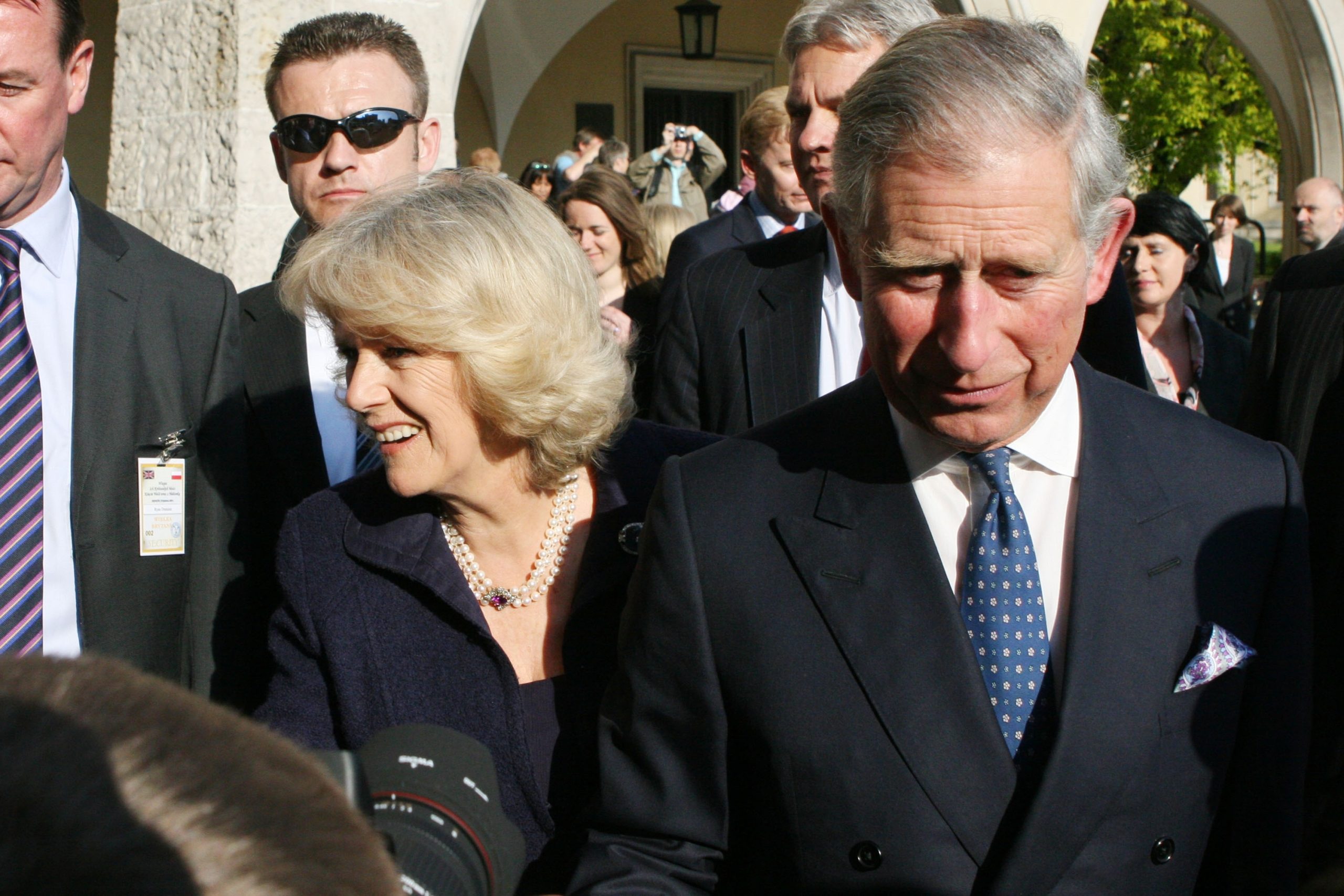

We expected Charles to get the crown. We didn’t expect him to make a billion-dollar fortune first.

Extreme inequality is the preexisting condition that made our society more vulnerable to disease and undermined a robust global public health response.

A new analysis by the Fight Inequality Alliance, Institute for Policy Studies, Oxfam, and Patriotic Millionaires found a shocking rise in global wealth among the world’s richest people despite deepening inequality during the COVID-19 pandemic.

A new joint report from Fight Inequality Alliance, Institute for Policy Studies, Oxfam, and Patriotic Millionaires details what can be funded by simply taxing the rich.

Today’s ‘utopians’ have reserved heaven on Earth for the richest among us.