Apple Avoided $40 Billion in Taxes. Now It Wants a Gold Star?

What Apple really unveiled were plans to collect a massive windfall from the GOP’s corporate tax handout.

What Apple really unveiled were plans to collect a massive windfall from the GOP’s corporate tax handout.

A new book draws from thousands of years of history to show that innovation flourishes in egalitarian settings and is stifled by cut-throat by competition.

The feds dropped the ball on a key terrorism case, so now they’re going after privacy itself.

Billionaire Carl Icahn launches a super-PAC with aims to cut taxes for corporations and increase his own influence in Washington.

While the rest of us pay the sticker price, lawmakers are considering a special deluxe tax rate for giant corporations.

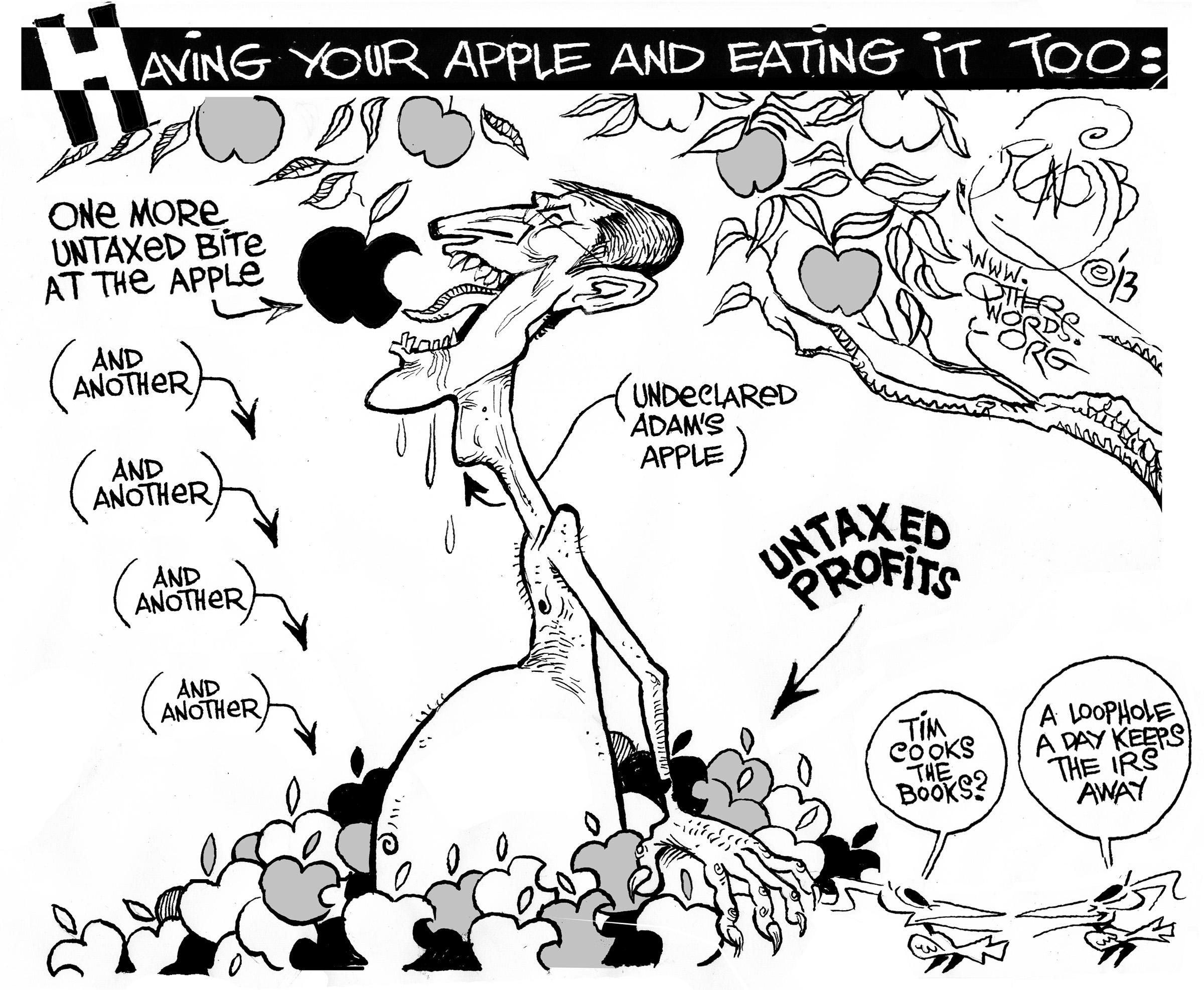

President Obama and some members of Congress think the easiest way to fund infrastructure is by granting corporations a large tax cut on their untaxed offshore profits.

There would be no need for our elected leaders to trim our safety net if our richest corporations didn’t turn avoiding their fair share of taxes into an art form.

The creation of a new genetically modified apple highlights once again the need for clear labeling of this kind of food.

If we had actual competition for mobile phone services in America, AT&T’s decision to charge you more for less would never fly.

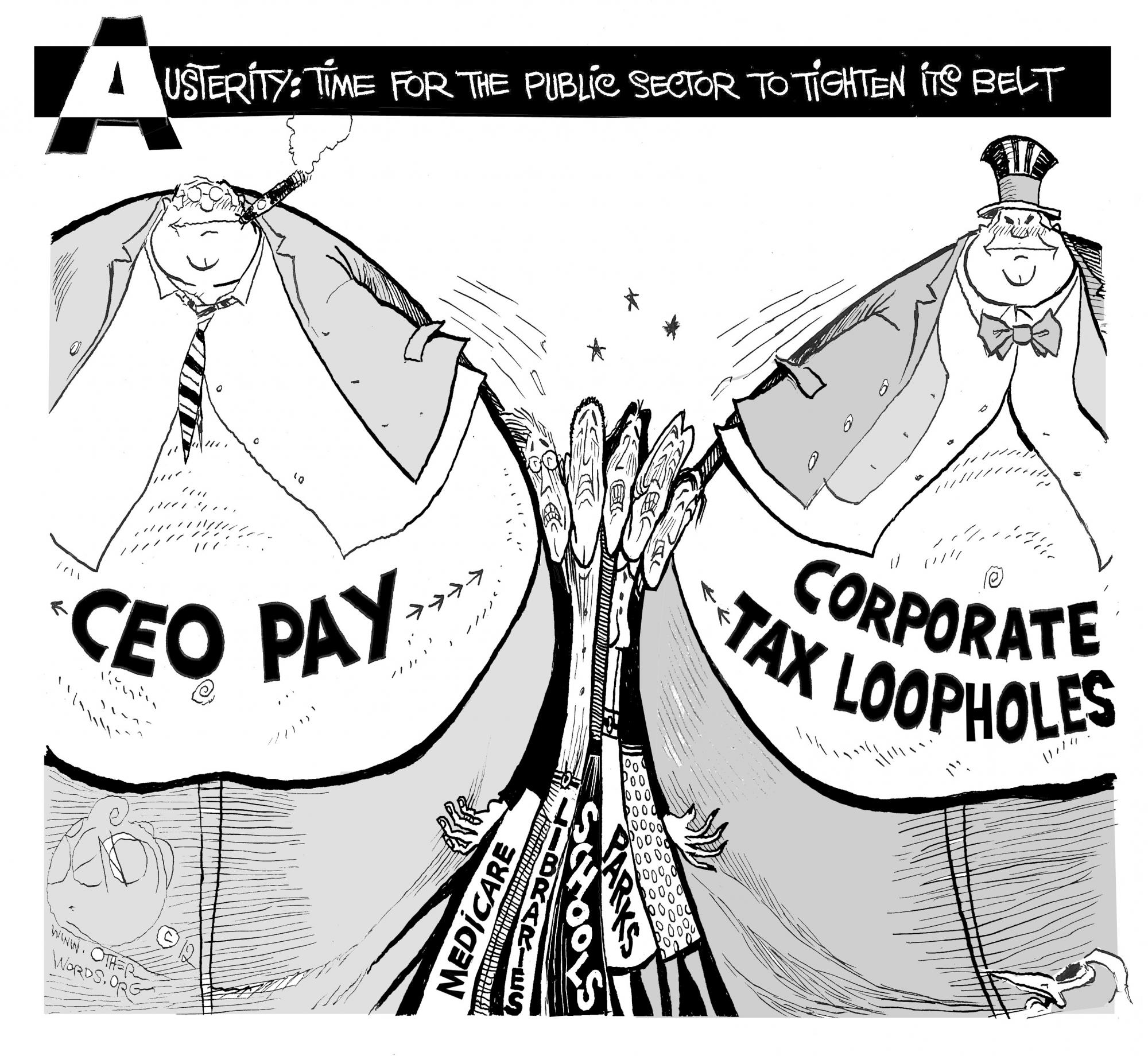

We’re letting top executives of giant corporations expropriate public “property” for private gain.

It’s time to close the tax loopholes that subsidize runaway executive compensation.

Can new technologies become part of the new economy movement? High tech companies seem more participatory, less hierarchical, and more community-oriented than traditional industries.

A coalition of big corporations has lost a battle to nab a huge tax break.

The Mike Daisey saga has shown that melodrama and sentimental fiction cannot alone change the world, but they have a place in progressive politics.

Mike Daisey’s appearance on “This American Life” has made it impossible to ignore Apple’s labor abuses.