Getting Past Stars and Swipes Forever

In 1776, public-spirited patriots emerged from the ranks of America’s most privileged. Today’s richest offer up precious little of that public spirit. Why?

In 1776, public-spirited patriots emerged from the ranks of America’s most privileged. Today’s richest offer up precious little of that public spirit. Why?

New Economic Policy Institute research exposes just how top-heavy many of the places Americans call home have become.

With the estate tax further weakened, is it time to pivot to an inheritance tax?

Taxing high-end real estate transfers can help keep city living affordable for everyone.

Luxury buildings drive up housing costs, suck up energy, and help rich people warehouse wealth. They should pay a lot more than property taxes.

Instead of helping average working families, Trump’s tax agenda actually targets those already most vulnerable.

The often praised and all-too-powerful generation is taken to task in this searing critique of the contributions Baby Boomers have made.

These deep pocket picks reflect the harsh reality of America’s unequal distribution of wealth.

With a little good faith, liberals and conservatives can work together to tackle the real issues putting the American Dream out of reach.

America’s top earners will be rushing to maximize their 2016 income if Democrats gain a sweep in November. But what happens next will be what really matters.

After the election, we need to focus on forcing the next president to address inequality and fix our upside down tax code.

The growing class divide on airplanes feels a lot like America’s.

With middle-class net worth crumbling, the Forbes 400 grow wealthier than ever.

Large corporations — particulaly in oil, gas, mining, and land acquisition — dominate the table alongside the U.S. government in the U.S.-Africa Leaders Summit.

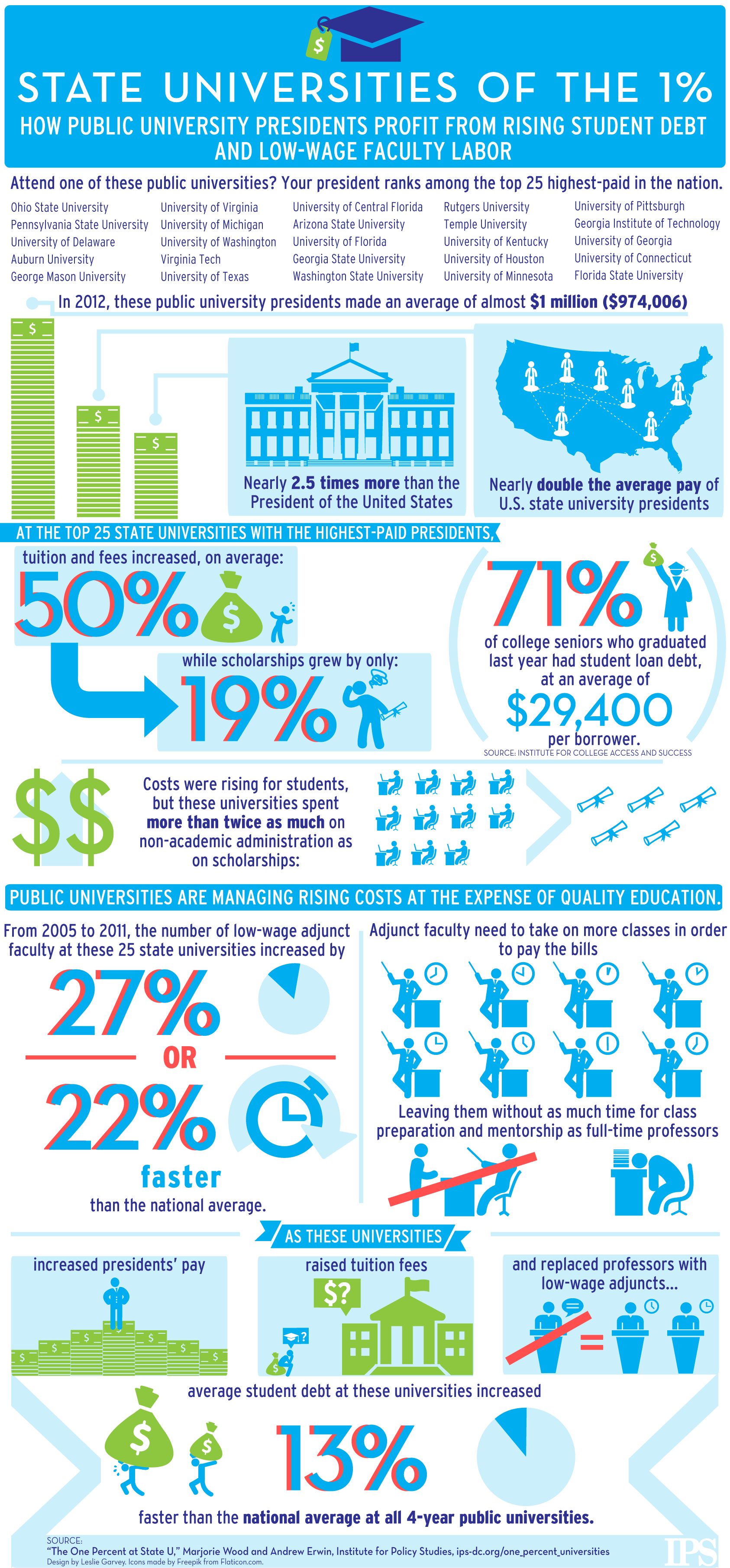

New report finds that student debt and low-wage faculty labor are rising faster at state universities with the highest-paid presidents.