Who Is Lobbying against Common-Sense Charity Reform?

Meet the foundations, donor-advised fund sponsors, and community foundations spending money and time to defend the indefensible status quo.

Chuck Collins | Helen Flannery

Key Findings

- As U.S. philanthropy becomes increasingly commandeered by ultra-high-net-worth donors, we see more examples of charitable abuses and self-dealing, along with growing public distrust in the charity system. And, in 2022, 41 percent of all individual donations went to private foundations and donor-advised funds, or DAFs — leading to concerns that these intermediaries are warehousing charitable funds.

- Because of this, there is growing popular bipartisan support for charity reform — as evidenced by a recent Ipsos poll and an emerging Donor Revolt for Charity Reform.

- Yet the DAF industry has spent millions lobbying to block even basic common-sense changes. For example, the Accelerating Charitable Efforts Act, or ACE Act, was introduced in 2021 with bipartisan support and proposed relatively modest reforms. But it failed to get traction thanks to aggressive lobbying both by organizations that manage DAFs and by industry advocacy groups that support them.

- We estimate that since 2018, 21 for-profit firms and nonprofit organizations have spent a combined $11 million in lobbying efforts that included attempts to influence policy around DAFs one way or another.

- An estimated $3 million of that total was spent to defeat the ACE Act. Much of the funding against the ACE Act came from large commercially-affiliated DAF sponsors such as Fidelity Charitable, Schwab, and Vanguard Charitable.

- The organizations spending the most on lobbying include not only DAF sponsors but also umbrella groups that advocate for the DAF industry. The Community Foundation Awareness Initiative, or CFAI, a network representing community foundations around the country, spent an estimated $4 million between 2018 and 2023 on lobbying, including an estimated $900,000 spent on the ACE Act. The Council on Foundations and Philanthropy Roundtable, both of which are philanthropy advocacy groups, spent a combined $795,000 lobbying around charity reform, with an estimated $450,000 aimed at the ACE Act.

Chasing the Charity Lobby

We need common-sense charity reform to increase the flow of funds to nonprofits and discourage the warehousing of charitable dollars in intermediaries. For example, donor-advised funds, or DAFs, should have at least a minimal incentive to pay out funds. Unfortunately, however, those invested in maintaining the status quo have deep pockets, and spend a great deal of money to pressure legislators to block needed reforms.

Our charitable sector is becoming dominated by large legacy foundations and donor-advised funds while working nonprofit charities face greater fiscal austerity. An ever-larger share of charitable dollars — currently 41 percent of all individual giving — is diverted into these wealth warehousing vehicles, rather than going to nonprofits serving critical needs. And ultra-wealthy donors are increasingly able to use charitable gifts to opt out of paying their fair share in taxes to support the public infrastructure we all rely on.

Without intervention, wealthy philanthropists will continue to divert more and more charity dollars from operating nonprofits, and will rival state and local governments in their ability to shape public policy in their interest. This means less money going towards the issues the general public cares about, and more going towards the pet issues of major donors, all at the public’s expense. We urgently need to overhaul the rules governing philanthropy to discourage the warehousing of charitable wealth, to align tax incentives with the public interest, and to encourage broad-based giving across all segments of society.

But those that benefit from the current system — such as donor-advised fund sponsors, wealth advisors, and the funders of anti-tax organizations — continue to push against changes in charitable regulations. In this policy brief, we lay out what we know about the parties that are working against reform.

Organizations Lobbying against the ACE Act

The most recent attempt to correct the charitable system at the federal level was in 2021, when the Accelerating Charitable Efforts (“ACE”) Act was introduced into both the House and the Senate. Reform opponents, including several large donor-advised fund sponsors, fought hard against even this relatively moderate bill, and it never reached the floor for a vote.

The organizations listed in our chart lobbied on the Senate (S.1981) and/or the House (H.R.6595) ACE Act bills from 2021 (when the Act was introduced) through the second quarter of 2023 (the most recent time period available).

Many of these organizations lobbied on more bills than just the ACE Act during this period. Because of the way the data is stored in the U.S. Congress’ lobbying disclosure database, we know how much money each organization spent in total on lobbying, but we do not know how much money each organization spent on each individual bill.

For that reason, the amount of money we estimate that these organizations spent on the ACE Act assumes an equal distribution of money spent on all the bills they lobbied on during the time period.

Lobbying on Donor-Advised Funds outside of the ACE Act

Aside from the ACE Act, donor-advised fund sponsors, wealth advisors, and the funders of anti-tax organizations have a history of putting big dollars behind their efforts to quash charitable reform, and those efforts continue today.

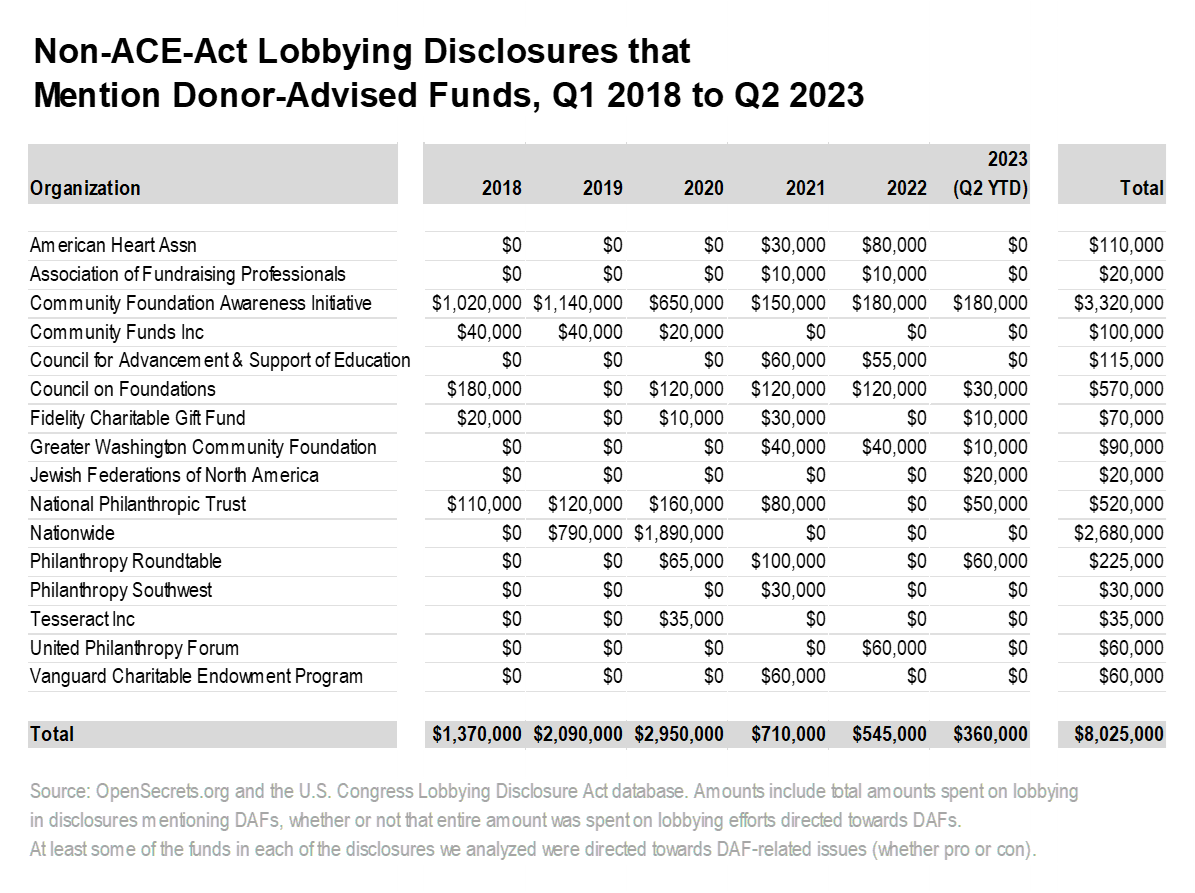

The amounts below are from lobbying disclosure reports that do not mention the ACE Act, but do list donor-advised funds, or DAFs, as at least one of the issues lobbied. These disclosures are from 2018 to the second quarter of 2023 (the most recent time period available).

In total, those lobbying around DAFs outside of the ACE Act spent $8,025,000 on lobbying efforts over the past five and a half years. Not all of these expenditures are necessarily directed towards DAF lobbying. This is because when an organization lists multiple issues or bills in their lobbying disclosures, we do not know how much money was spent by these organizations on each specific issue or bill. For this reason, the amounts shown here represent the amount spent in total on each lobbying disclosure that mentions DAFs, whether or not that entire amount was directed towards DAF-related lobbying efforts.

It is also important to note that not all of these expenditures are necessarily directed against DAF reform. For example, we were able to identify that one organization, Tesseract — a 501(c)(4) advocacy organization affiliated with the Patriotic Millionaires — spent $35,000 on lobbying in support of DAF reforms.

Most of the organizations lobbying on donor-advised funds in general, and the ACE Act in particular, however, are nonprofit donor-advised fund sponsors that, in theory, have a financial interest in maintaining the current rules governing DAFs and charitable giving. But reform opponents are also supported by for-profit firms that lobby on their behalf.

One of the most active of these firms is the Community Foundation Awareness Initiative, or CFAI. The issues lobbied by the CFAI generally revolve around community foundation and donor-advised fund regulation and tax policy. The CFAI is a project of the government affairs firm Van Scoyoc Associates, which has engaged three lobbyists over the years — Jeff Hamond, Susie Gorden, and Robin Rubin. In total, from 2018 to the second quarter of 2023, the CFAI has spent $4,440,000 on lobbying efforts, much of which has been directed towards either the ACE Act or donor-advised funds more generally.

Deep Pockets Make for a Powerful Voice against Reform

Philanthropy is an expression of our collective generosity and human solidarity. But the growing concentration of wealth and power is distorting philanthropy and imperiling our democratic institutions.

And yet our research shows that since 2018, a total of 21 organizations have spent an estimated $11 million to lobby around DAFs — much of which was likely spent fighting the common-sense reforms that would make our charitable system more responsive and transparent. An estimated $3 million of that total was spent to defeat the ACE Act alone.

The last time Congress overhauled the legal framework for the philanthropic sector was in 1969, when wealth was considerably less concentrated than it is now. This framework provided important tax-reduction incentives to encourage timely giving to charity, but it also created the loophole that allowed for the commercial exploitation of donor-advised funds. The Pension Protection Act of 2006 later tweaked some of the regulations around tax-exempt organizations — including DAFs — but didn’t address the key concerns surrounding them, such as payout and transparency. It is high time to modernize the rules governing philanthropy to prevent abuses of the tax system, discourage the warehousing of charitable wealth, and protect democracy and public society from the undue influence of private wealth and power.

The public agrees that reform is needed. When taxpayers are aware of the ways wealthy donors can abuse charity, they show overwhelming support for increased oversight. According to a March 2023 Ipsos Poll, 81 percent of Americans do not believe that taxpayer money should subsidize the creation of perpetual private foundations. 69 percent want to double the minimum payout requirement for private foundations. And 72 percent want donor-advised funds to pay out their funds in five years or less.

Unfortunately, anti-tax donors, large DAF sponsors, and the network of organizations that support them are flooding the political arena with lobbying revenue aimed at defeating charitable reform. We must ensure that the public good triumphs in the end.