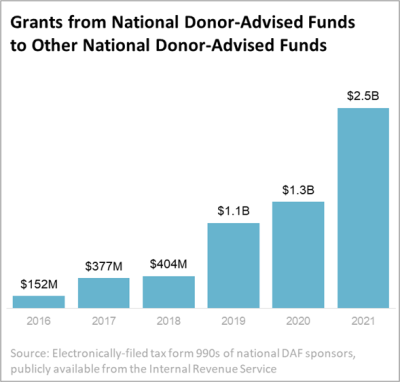

The IRS just released two years of long-awaited nonprofit tax filings and this is what we found: $2.5B in grants going from national donor-advised funds, or DAFs, to other national donor-advised funds in 2021 alone.

This is an enormous jump up from just the year before. And it’s almost certainly an undercount, since we could only analyze the DAF sponsors that filed online — not the ones that filed on paper — and it doesn’t include DAF-to-DAF transfers to and from community foundation sponsors.

DAF-to-DAF granting can happen for several reasons. Donors may switch between commercial DAFs when they change banks, because having their personal portfolio and their DAF held in the same institution makes management easier. They may want to take advantage of better giving advice, lower fees, or higher yields. And donors may switch between commercial DAFs because doing so allows them to drop their name from grants out of the recipient DAF, rendering their gifts completely anonymous.

But this sort of transfer shouldn’t count as charity. Donors get tax deductions for putting money into DAFs so that money can go to real charities. But, instead, it’s cycling between investment portfolios.

For more information, see our previous reporting on this at Inequality.org.