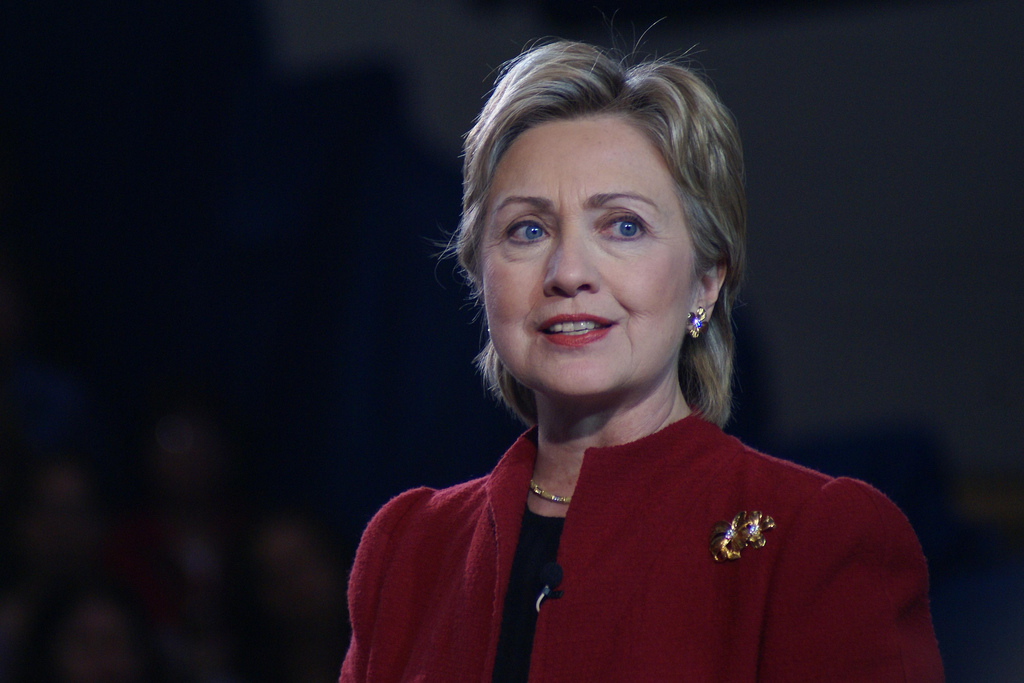

(Photo: Marc Nozell/Flickr)

Hillary Clinton’s proposal to strengthen the federal estate tax is the best idea yet to reverse our national drift toward extreme wealth inequality.

Clinton proposes an expansion of the federal estate tax, our nation’s only levy on the transfer of accumulated wealth of multimillionaires and billionaires. The tax falls on fewer than two out of 1,000 estates, yet puts a brake on concentrated wealth, encourages charitable giving, and raises substantial revenue from those most able to pay.

Her plan would generate $260 billion over ten years, exclusively from multimillionaires and billionaires, that she plans to use for investments in expanding opportunity, such as reducing college debt, simplifying small business taxes and expanding the child tax credit.

The estate tax, which celebrates its 100th anniversary this month, was viewed at its inception as a way to address the excesses of the first Gilded Age. The impetus to pass a tax on inherited wealth came from rural populists and enlightened industrialists. In his 1889 essay, Wealth, steel magnate Andrew Carnegie observed about that estate tax “of all forms of taxation, this seems the wisest.”

President Theodore Roosevelt advocated for “a graduated inheritance tax on big fortunes” that should be “properly safeguarded against evasion” and must increase “rapidly in amount with the size of the estate.” Estate taxes, Roosevelt argued, were required “to preserve a measurable equality of opportunity.”