Executive Excess 2016: The Wall Street CEO Bonus Loophole

For release Wednesday, August 31, 2016

Dear partners: Thank you for helping us spread the word about the Institute for Policy Studies’s 23rd annual Executive Excess Report, “The Wall Street CEO Bonus Loophole”. Please use the hashtag #BonusLoophole when sharing with your community.

You can find the executive summary and full report on Wednesday, August 31, 2016 here.

Twitter:

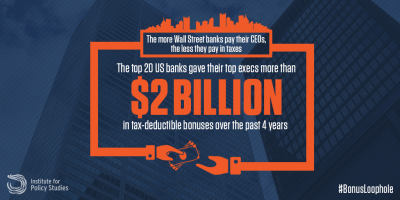

- OMG: We are all subsidizing Wall Street bonuses https://ips-dc.org/executive-excess-2016-the-wall-street-ceo-bonus-loophole #BonusLoophole [Image 1]

- While homeowners & shareholders suffered, Wall St execs cashed in on crisis https://ips-dc.org/executive-excess-2016-the-wall-street-ceo-bonus-loophole #BonusLoopHole [Image 3]

- Wells Fargo got a huge write-off for CEO’s $150M in bonuses https://ips-dc.org/executive-excess-2016-the-wall-street-ceo-bonus-loophole #BonusLoophole [Image 2]

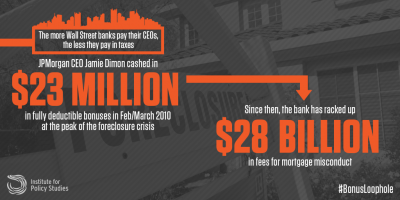

- When CEO cashed in $23M at foreclosure peak, JPMorgan got huge tax write-off https://ips-dc.org/executive-excess-2016-the-wall-street-ceo-bonus-loophole #BonusLoophole [Image 4]

- A Bill Clinton #CEOpay reform backfired. Learn why and how we can fix it in new @IPS_DC report https://ips-dc.org/executive-excess-2016-the-wall-street-ceo-bonus-loophole

- New from @IPS_DC: The more corporations hand out in CEO bonuses, the less they pay in #taxes. https://ips-dc.org/executive-excess-2016-the-wall-street-ceo-bonus-loophole #BonusLoophole

- New @ips_dc report on #BonusLoophole provides catalog of #CEOPay solutions https://ips-dc.org/executive-excess-2016-the-wall-street-ceo-bonus-loophole

Facebook:

- Breaking: The top 20 U.S. banks paid out more than $2 billion in fully deductible performance bonuses to their top executives between 2012 and 2015. Read the new report on the #BonusLoophole by the Institute for Policy Studies at https://ips-dc.org/executive-excess-2016-the-wall-street-ceo-bonus-loophole

- A new report by IPS found that the more U.S. corporations hand out in CEO bonuses, the less they pay in taxes. How can we rein in executive excess? Read on: https://ips-dc.org/executive-excess-2016-the-wall-street-ceo-bonus-loophole

- At the peak of the foreclosure crisis, JPMorgan Chase CEO Jamie Dimon cashed in $23 million in stock options. Since then, the bank has racked up more than $28 billion in mortgage and other financial misconduct fees. Read the new report “Wall St. CEO Bonus Loophole” here: https://ips-dc.org/executive-excess-2016-the-wall-street-ceo-bonus-loophole

Graphics:

Image 1

Image 2

Image 3

Image 4