This originally appeared in The American Prospect.

seadigs/Flickr

At the Institute for Policy Studies, we’ve tallied the top 25 highest-paid CEOs for each of the past 20 years.

That’s a total of 500 richly rewarded executives—each one of whom made more in a week than average workers could make in a year. We’re told CEOs deserve these massive rewards because they add exceptional “value” to their businesses. They’re getting “paid for performance.”

Really? Hmm. Let’s consult the numbers.

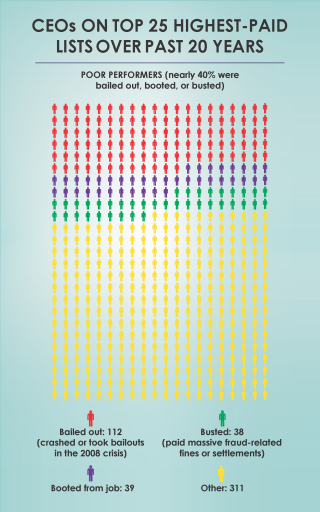

Let’s start with the firms that led our nation into financial crisis. Of the 500 places on our annual top-paid lists, 112 are filled by Wall Street CEOs who drove their companies to bankruptcy or bailout in 2008. Richard Fuld of Lehman Brothers made the top 25 highest-paid list for eight consecutive years until his firm’s bankruptcy precipitated the financial crisis.

And how about CEOs who end up getting fired? No one could possibly consider them “high performers.” Yet fired CEOs make up another 39 names on the highest-paid CEO lists of the past 20 years. Compaq Computer CEO Eckhard Pfeiffer, named one of Business Insider’s “15 Worst CEOs in History,” got the boot in 1999, but made off with a golden parachute valued at $410 million.

And how about CEOs who cook the books? Another 38 of our pay leaders have led companies that have had to pay massive fines or settlements for serious fraud. Two served prison time for their crimes (Dennis Kozlowski of Tyco and Joseph Nacchio of Qwest), a third died before sentencing (Kenneth Lay of Enron), and a fourth (Bruce Karatz of KB Home) is on probation.

Altogether, the bailed-out, the booted, and the busted made up nearly 40 percent of the companies shelling out top dollar for their CEOs on our list.

These numbers don’t tell the full story. Left out, for example, are all the CEOs who’ve boosted their compensation by manipulating marketplace monopolies, freezing their workers’ paychecks, or cutting corners on environmental protections.

Even by the narrowest of definitions, the percentage of highly paid CEOs who performed poorly is shockingly high.

The Taxpayer Trough Club

Financial bailouts are just one example of how a significant number of CEO pay leaders owe much of their good fortune to taxpayers. Government contracts are another. CEOs of firms on the federal government’s top 100 contractors list occupied 62 of the 500 slots on the annual highest-paid CEO lists of the last 20 years. In the same years that their CEOs pocketed some of corporate America’s fattest paychecks, these firms received $255 billion in taxpayer-funded federal contracts.

Even if a corporation is not receiving government funds directly, taxpayers are subsidizing all highly paid CEOs through a giant loophole in the federal tax code. Under current rules corporations can deduct unlimited amounts off their income taxes for the expense of executive stock options and other so-called “performance-based” pay. The more corporations pay their CEOs, the less they pay in taxes.

The Boy’s Club

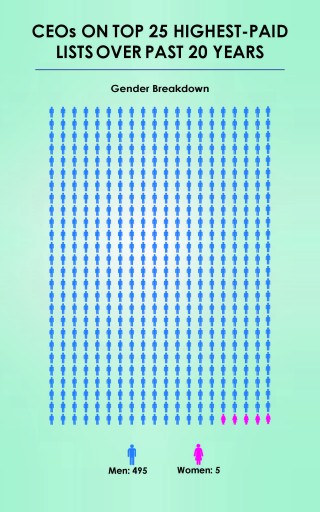

It will come as no surprise that most of the CEOs in this uppermost echelon of Corporate America are men. Of the 500 places on the top 25 highest-paid CEO lists over the past 20 years, only five (1 percent) are held by women. One—Andrea Jung of Avon—made the list twice. The others who made it into America’s loftiest CEO circles: Carol Bartz of Yahoo, Irene Rosenfeld of Mondelez International (formerly part of Kraft), and Marion Sandler of Golden West Financial.

This doesn’t mean we can solve the CEO pay problem by simply getting more women into corner offices. American corporate culture offers incentives for CEOs—whether male or female—to behave in ways that undermine workers, taxpayers, and shareholders. Our tax and government contracting policies reinforce this perverse reward system.

Until all this changes, the gender of our top corporate leaders won’t make much of a difference.