White Supremacy is the Preexisting Condition:

Eight Solutions to Ensure Economic Recovery Reduces the Racial Wealth Divide

Preface: Darrick Hamilton | Co-Authors: Dedrick Asante-Muhammad, Chuck Collins, and Omar Ocampo

Introduction:

For months now, a deadly pandemic and deep recession have pummeled the U.S. economy. Yet even as tens of millions of Americans lost their jobs, U.S. billionaires saw their collective wealth increase by leaps and bounds.

At the same time, the Movement for Black Lives has drawn attention not just to police brutality against Black Americans, but to systemic racism more broadly. A huge cause and consequence of that systemic injustice is the underlying racial wealth divide — the financial legacy of centuries of white supremacy.

Even before the pandemic, we found that median white families had literally dozens of times the net worth of median Black and Latino families. The pandemic is supercharging that inequality, with the skyrocketing wealth of the largely white billionaire class putting most Americans, especially people of color, further and further behind.

White supremacy is the pre-existing condition that’s made this pandemic deadlier for people of color and held back our economic recovery. We have to learn the lessons of our failed responses to the 2008 recession, and bring an intentional commitment to racial equity in the design of economic stimulus and recovery measures.

It demands a robust policy response, which we detail in this report.

Key Findings

- The U.S. spends an estimated $729 billion a year to assist with individual wealth building, mostly on the already wealthy. For example, 90 percent of $90 billion in tax-related housing assistance goes to households with incomes over $100,000. Those earning $50,000 get roughly 1 percent.

- In the 12 weeks between March 18 and June 11, the combined wealth of all U.S. billionaires increased by more than $637 billion, the equivalent of more than 13 percent of all Black wealth.

- U.S. billionaires together have $3.581 trillion in wealth, more than all Latino wealth combined, which is $3.49 trillion. In other words, 640 billionaires have as much wealth as 59 million Latinos.

- Total U.S. billionaire wealth is equal to three-quarters of all Black wealth combined, which is $4.68 trillion.

- The top 12 U.S. billionaires have a combined wealth of $921 billion, which is equivalent to all the home equity wealth of the entire Black population, over 17 million households.

- The top 70 U.S. billionaires together hold $1.9 trillion, the equivalent to the home equity wealth of all Black and Latino households combined.

The racial wealth divide is a pre-existing condition that has worsened the severe health and economic impacts of the Covid-19 crisis on communities of color. Nationally, Black Americans have Covid-19 mortality rates that are more than twice as high as other races.

Black and brown workers are significantly more likely to be exposed at work. About 37.7 percent of Black workers are employed in essential industries, compared to 26.9 percent of whites. Black workers are 40 percent more likely than whites to work in hospitals, and are significantly less likely to have the option to telework.

Although many people of color are doing essential work, overall they have suffered greater job and income losses. Sixty-one percent of Latino households and 44 percent of Black households have had a job or wage loss due to the pandemic, compared to 38 percent of white households.

Although it will be many months until we have a full national picture of the pandemic, the crisis is clearly taking its heaviest toll on people of color.

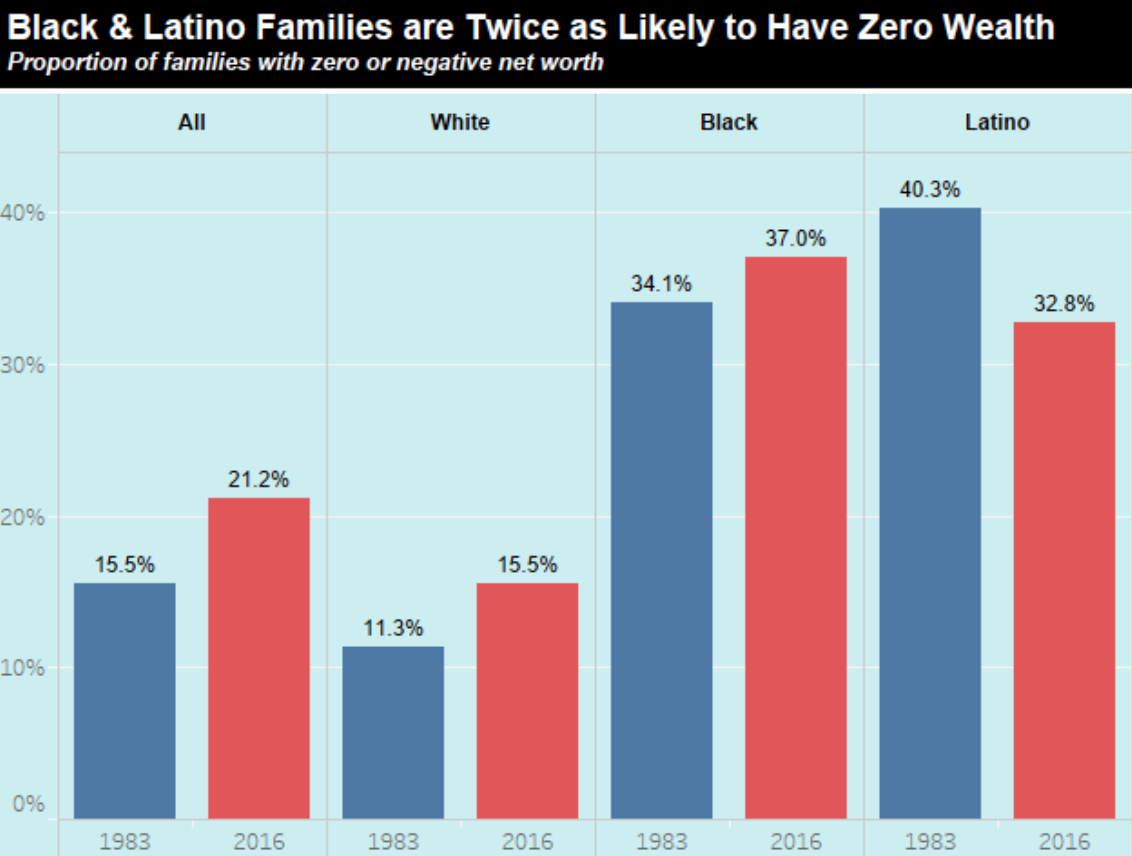

Our 2019 report, “Ten Solutions to Bridge the Racial Wealth Divide,” found that racial wealth inequality increased by more than $40,000 from 1983 to 2016. Over those decades, the median Black family saw their wealth drop by more than half. Median white households, on the other hand, saw their wealth jump by a third. The median Latino family saw their wealth rise only marginally.

Thirty-seven percent of Black families and 33 percent of Latino families have zero or negative wealth, compared to just 15.5 percent of white families. Black Americans have a homeownership rate of just 44 percent, compared to a white homeownership rate over 70 percent.

During the current crisis, these racial wealth divides are exacerbating racial disparities in health and income impacts.

This growing racial wealth divide has occurred at a time when wealth has shifted largely into the hands of the very wealthy. Since the early 1980s, the richest 0.1 percent have seen their wealth jump 133 percent. The total wealth of 640 U.S. billionaires on June 11, 2020, was $3.581 trillion, an increase of almost 20 percent from the spring of 2019.

Meanwhile, more than $6.5 trillion in household wealth vanished during the first three months of this year. We can imagine this wealth loss disproportionately hit Black, Latino, and Native households the hardest.

One major reason the racial wealth divide was so wide at the onset of the Covid-19 crisis is the disastrous effect of the 2008 financial crash on people of color.

Between 2007 and 2010, Black wealth suffered a 33 percent decline. After several decades of rising homeownership, Latino households experienced a 47 percent decline in net home equity.

In response to the 2008 crash, the federal government handed out more than $1 trillion to save banks and other large corporations, benefiting their overwhelmingly white top executives and shareholders. The nearly 10 million homeowners who lost their homes to foreclosures got next to nothing.

While Congress has approved some aid for the poor and working class in the Covid-19 crisis, undocumented immigrants and many others in need are largely excluded. Meanwhile, trillions in Federal Reserve assistance is inflating the wealth holdings of those at the top, who are largely white.

The country must stop advancing trillion-dollar packages that disproportionately benefit large businesses and the wealthy in ways that will only further widen the racial wealth divide.

Phase One: Emergency Measures

- Improve Racial Data Collection as Part of Emergency Investments. Congress should mandate dramatically increased federal, state, and regional data collection of racial and ethnic data, both in terms of health impacts as well as the application of stimulus and other economic programs.

- Audit Crisis Relief and Recovery Policies for Racial Equity. Congress should conduct a “Racial Wealth Audit” of each stimulus bill and economic recovery proposal to answer the question: Did this policy reduce the racial wealth divide or make it more pronounced?

- Implement Income Supports that Expand to Guaranteed Income. A guaranteed income set above the poverty line would provide households with income security, especially in times of crisis. It could also provide the minimum decency floor for low-wage workers.

- Institute Postal Banking. Congress should expand the Postal Service’s mandate to provide financial services to the millions of U.S. households that are unbanked or underbanked — including 47 percent of Black and 42 percent of Latino households — and reduce exposure to predatory lenders.

Phase Two: Emerging from Recession

- Delink Health Care from Employment. The racial disparities in Covid-19 mortality dramatize the moral necessity to have a Medicare for All system that boosts overall health equity and wellness.

- Expand Inclusive Housing and Ownership. Congress should reverse four decades of federal policy retreat to expand the supply of decent affordable rental housing and reverse the slide in homeownership, a critical component of wealth-building.

- Create a Federal Jobs Guarantee with a Living Wage. Like the Works Project Administration (WPA) during the Great Depression, a Federal Jobs Guarantee gives people the opportunity to access a job. An emergency guaranteed job could be deployed during local and regional disasters as a means of mobilizing much-needed labor to assist with reconstruction, public health infrastructure, and a transition to a green economy.

- Institute Baby Bonds. Every newborn should be provided with an account endowed and managed by the federal government with funds that can be accessed in adulthood for wealth-building investments such as homeownership, enterprise start-ups, and higher education without debt.

Phase Three: Interrupting Inequality

Tax policy reforms would reduce the destructive concentrations of wealth and power that supercharge the racial economic divide — and raise revenue for investments to reduce racial and economic inequalities. They include…

- Reverse upside-down tax subsidies that benefit the already wealthy.

- Levy an emergency 10 percent millionaire income surtax.

- Institute a financial transaction tax.

- Make the federal estate tax more progressive and institute a wealth tax.

- Shut down the global hidden wealth system.

Download our Press Release [PDF]

Media Contacts:

Bob Keener

bobknr@ips-dc.org

617-610-6766

Chuck Collins

chuck@ips-dc.org