Governments around the world are struggling to deal with the crushing problems of joblessness, poverty, and climate change. A financial speculation tax (also known as a financial transactions tax) is the best option on the table to raise the massive revenues needed to address these urgent needs.

What is a Financial Speculation Tax?

A tiny tax (0.25% or less) on each trade of stocks, derivatives, and other financial instruments. It would not apply to ordinary consumer transactions such as ATM withdrawals or cross-border remittances.

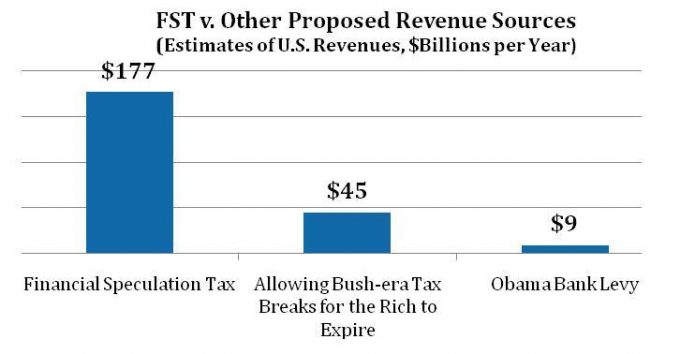

How Much Could an FST Raise?

The Center for Economic and Policy Research estimates that a broad-based FST could generate $177 billion a year in the U.S. alone. That’s far more than other leading revenue proposals, such as allowing Bush-era tax breaks for the rich to expire or Obama’s proposed levy on top banks.

How Would the Tax Affect Ordinary Investors?

Nurses call for taxing Wall Street

This tax would target the high flyers in the global casino who are most responsible for the financial crisis. It would raise the cost of highly leveraged derivatives trading and stock-flipping enough to discourage the most dangerous behavior. For ordinary investors, the costs would be negligible, like a tiny insurance fee to protect against crashes caused by speculation.

Would Financial Speculation Taxes have Changed the Outcome of Financial Fiascos?

Speculation taxes alone would not have prevented the financial crisis, but they are one important tool for curbing the greed-crazed behavior that drove our economy off a cliff. They could also help shrink Wall Street, so it no longer dominates the rest of the economy. Some real world examples:

- Flash Crash: Remember when the Dow plummeted nearly 1,000 points on May 6, 2010? If a financial speculation tax of 0.25 percent had been in place for just the 20 minutes of wildest trading on that day, it could have generated $142 million. Large investors also might have thought twice before placing their bets, instead of relying on computer-driven high-frequency trading.

- AIG Collapse: A financial speculation tax on the insurance giant’s $440 billion worth of exceptionally risky credit default swaps would’ve amounted to as much as $1.1 billion. That’s enough to cover the annual salaries of more than 20,000 elementary school teachers.

Who Supports Financial Speculation Taxes?

- With Germany and France leading the push, the European Commission just released proposed legislation for an EU-wide financial transaction tax. The German finance minister said, “Before the end of the autumn we are going to create a tax on financial transactions. If necessary, I’m sure, just in the eurozone.”

- Prominent Economists and Business Leaders: for example, Bill Gates, Joseph Stiglitz, Paul Krugman, Dani Rodrick, Jeffrey Sachs, George Soros, Warren Buffett.

- Wide Range of Activist Groups: AFL-CIO, SEIU, National Nurses United, and other unions; Jobs with Justice, National Peoples Action, and other grassroots groups; Friends of the Earth, Health GAP, and other health and climate groups. Joined by allies in many countries.

Where Does the U.S. Government Stand?

President Obama was committed to implementing such taxes, until chief economic advisor Larry Summers put a stop to it, according to Ron Suskind’s new book “Confidence Men.” Several members of Congress have introduced bills to create FSTs, including Rep. Peter DeFazio’s “Let Wall Street Pay for the Restoration of Main Street Act” and Rep. Pete Stark’s “Investing in Our Future Act.”

This is a summary of the report: “Taxing the Wall Street Casino”

Download this article as a fact sheet for easy distrubution.