A coalition of progressive labor and community organizations is pressing to plug up New York State’s budget deficit with some targeted taxes aimed at the very wealthy.

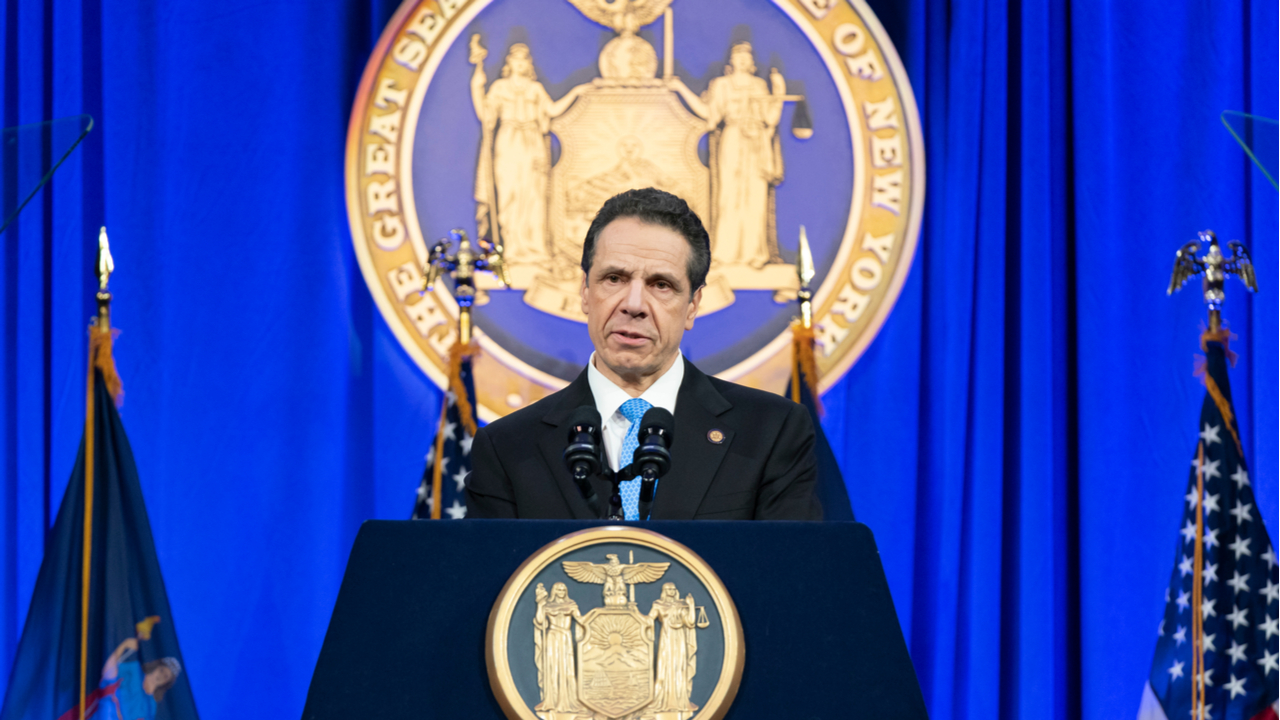

New York Governor Andrew Cuomo has proposed budget cuts and more broad-based taxes, such as a levy on marijuana businesses, to close the $6.1 billion gap, the result of Medicaid expenses. But the Strong For All coalition is pressing for “budget justice,” a package of higher taxes on the very rich rather than austerity budget cuts and new levies that hit the non-wealthy. They want to go beyond the deficit mentality.

A group of Democratic lawmakers in the state are answering the call. They are putting forward a revenue proposal that would generate over $30 billion a year by targeting the state’s highest income earners and billionaires. Funds would be directed towards affordable housing, a Green New Deal, and investments in education, transportation and infrastructure. A recent poll found that 67 percent of New Yorkers support these measures.

“We are trying to make sure lawmakers have a good, strong menu of items to look at that only target the superrich,” Michael Kink, the executive director of the Strong for All coalition, told a reporter from The Wall Street Journal. Kink also pointed out that tax increases on the wealthy are more popular with voters than cuts to government services.

The menu includes 14 proposals such as a state wealth tax that would raise $10 billion a year, several new top income tax rates on income over $5 million, that would raise $2.2 billion a year, and a “pied-a terre” luxury housing vacancy tax that would raise $650 million a year.

The wealth tax is a state version of the proposal put forward by presidential candidates and U.S. Senators Elizabeth Warren and Bernie Sanders. Other states are exploring an annual wealth tax, including California. The Democratic candidate for governor of West Virginia, Stephen Smith, has also called for a state wealth tax.

Other New York state proposals include the elimination of tax breaks for private jets and yachts, and a state elimination of the carried interest loophole that benefits hedge fund managers, a measure that would raise $3.5 billion for the state.

“Why on Earth should a billionaire get a tax break on the purchase of a yacht or private plane?” asked state Senator Brad Hoylman, lead sponsor of the package who represents the west side of Manhattan. “This is not the 21st century approach to making certain we have the revenue for schools and affordable housing and mass transit.”