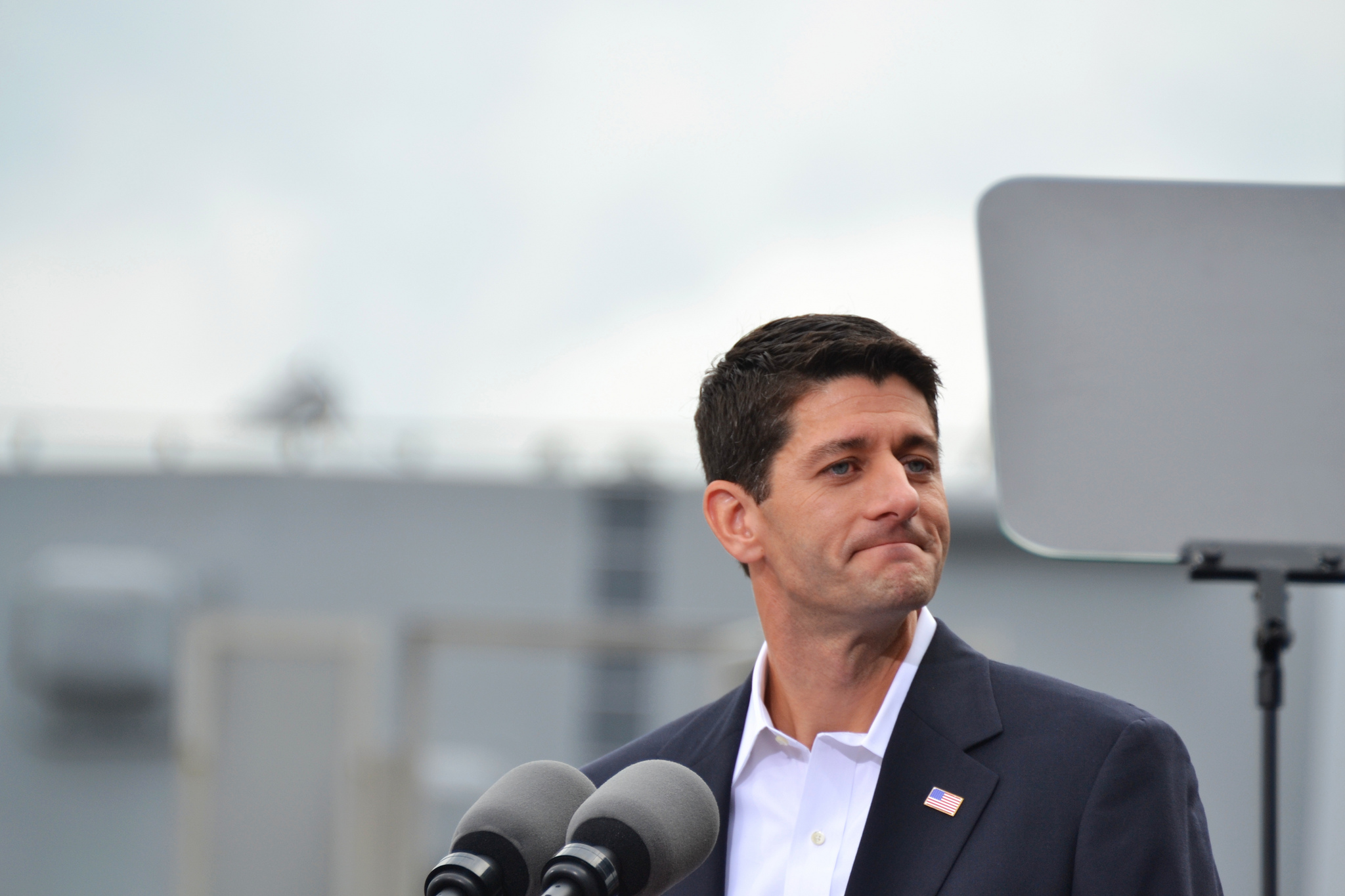

Paul Ryan’s “A Better Way” Proposal is Anything But

Predictable as ever, the House Speaker’s plan would give an average annual tax break of nearly $800,000 to the top 0.1 percent.

Predictable as ever, the House Speaker’s plan would give an average annual tax break of nearly $800,000 to the top 0.1 percent.

Massachusetts, California, and Oregon are all launching campaigns to combat rising inequality. Other states should take note.

The late pop star eschewed tax-dodging chicanery and will still leave a sizable fortune to his heirs—as well as to the taxpayers who helped him succeed.

We can’t just tax billionaires’ paychecks. We should tax the wealth they’ve already amassed.

Americans are used to paying sales taxes on basic goods and services, but when a Wall Street trader buys millions of dollars’ worth of stocks or derivatives, there’s no tax at all.

Kasich tries to present himself as the moderate anti-Trump, but his time as governor has been marked by regressive tax reform that helps the rich and hurts the rest.

A network of 200 business leaders and high net worth individuals, are making their case in Albany for closing this egregious Wall Street handout.

Eight bold solutions, rooted in social movements, that can break through our broken political system.

The White House is going after the tax code provision that lets the super rich avoid billions of dollars of taxes.

Families with two breadwinners can end up paying more than twice as much in Social Security taxes as families with just one income.