America’s Huge Racial Wealth Gap Is No Accident

For the first time, Democrats are acknowledging America’s deep racial wealth gap — Here’s how we can start to close it.

For the first time, Democrats are acknowledging America’s deep racial wealth gap — Here’s how we can start to close it.

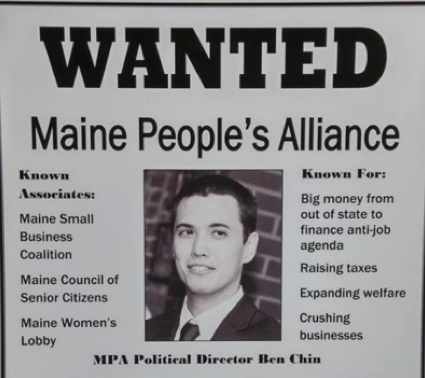

An interview with rising progressive star, Ben Chin, Political Director of Maine People’s Alliance.

Tax reform, Wall Street accountability, and the racial wealth divide are all acknowledged in this year’s agenda.

Working families are turning their anger at Wall Street into action.

If nothing changes in our tax code, the wealthiest 1 percent will claim half of all U.S. wealth in just 20 years.

We can’t just tax billionaires’ paychecks. We should tax the wealth they’ve already amassed.

Congress can only ignore the blatantly dishonest practice of offshore tax evasion for so long.

A network of 200 business leaders and high net worth individuals, are making their case in Albany for closing this egregious Wall Street handout.

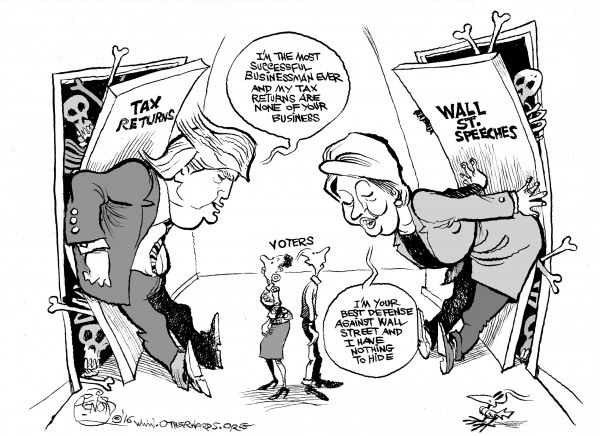

Bernie and Hillary have each laid out detailed plans to reduce inequality through reforming the tax code. Here’s where they stand.

Loophole allowed 10 companies to shave $180 million off their taxes for CEO pay last year.

Congress needs to shut down offshore tax shelters without rewarding the corporations that built them.

With all the NFL scandals from this past season, the one that has received the least attention is the easiest to solve: the league’s tax-exempt status.

The White House is going after the tax code provision that lets the super rich avoid billions of dollars of taxes.

Congress should reinforce the inheritance tax, not scrap it.

Fixing the estate tax could be the single most important intervention in reducing wealth dynasties in the U.S.