Planet CEO vs. Planet Worker

Realigning the interests of CEOs with their employees and the rest of our country would be good for the economy and national morale.

Realigning the interests of CEOs with their employees and the rest of our country would be good for the economy and national morale.

A nine-figure income may seem like a lot, but I’ll take nine lives.

Want to be able to make every bump that comes your way just another springboard to grand fortune, just like CEOs? Here’s what you need to do.

Would you let shareholders regulate their CEOs’ reckless behavior?

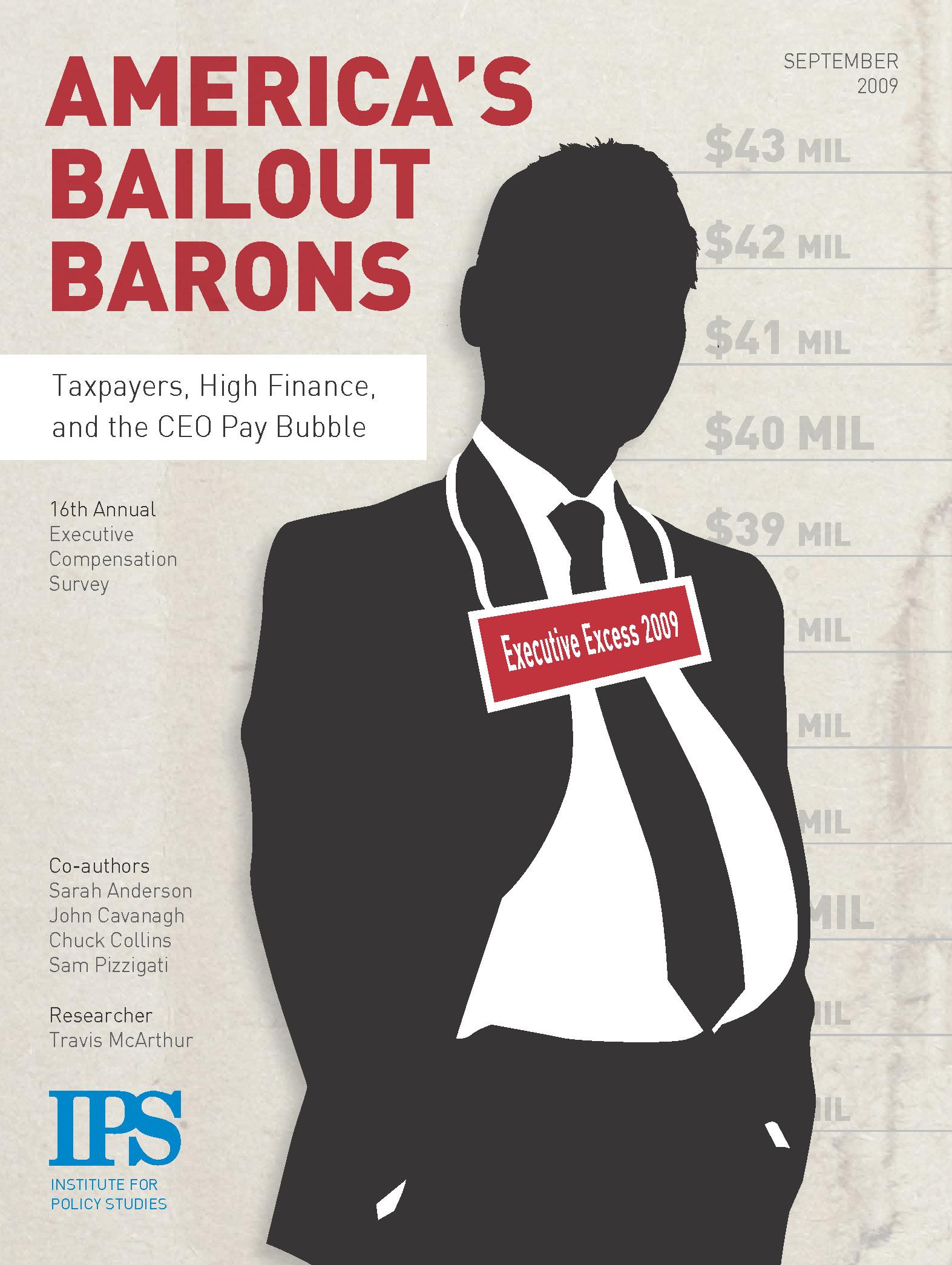

The 16th annual Institute for Policy Studies “Executive Excess” report exposes this year’s windfalls for top financial bailout recipients.

New corporate regulation across the Atlantic may help deflate bloated executive compensation.

Outrageously large rewards for executives give executives an incentive to behave outrageously — and engage in behaviors that put the rest of us at risk.

New Treasury rules have backpedaled on CEO pay reform for bailed-out companies. But we can no longer afford the status quo.

Many taxpayer subsidies for executive excess have not yet hit the headlines.

This memo summarizes the key provisions in the stimulus legislation to restrict compensation for executives of bailed-out companies.

This fact sheet sums up and dissects the major arguments against public policy action on CEO pay.

We applaud efforts to cap bailout pay, but are concerned about reports of weak Treasury rules.

An analysis of new proposals for change.

The bailout does precious little to limit the extravagant pay that gives top executives the incentive to behave outrageously.

Foreign aid and diplomacy are key to strategic success.