Investors and Employees Gain a New Tool to Fight Inequality

The new SEC disclosure regulation finally sees daylight, bringing changes for shareholders, employees, and even consumers, Sarah Anderson explains in this Bloomberg Q+A.

The new SEC disclosure regulation finally sees daylight, bringing changes for shareholders, employees, and even consumers, Sarah Anderson explains in this Bloomberg Q+A.

Fortune 500 chiefs make twice as much in a month as U.S. workers make in a decade. But any move to require corporations to document that disparity would be shameful, a new Trump appointee argues.

While candidates are busy ranting about Wall Street’s fat cats, taxpayers are left picking up their billion-dollar tab.

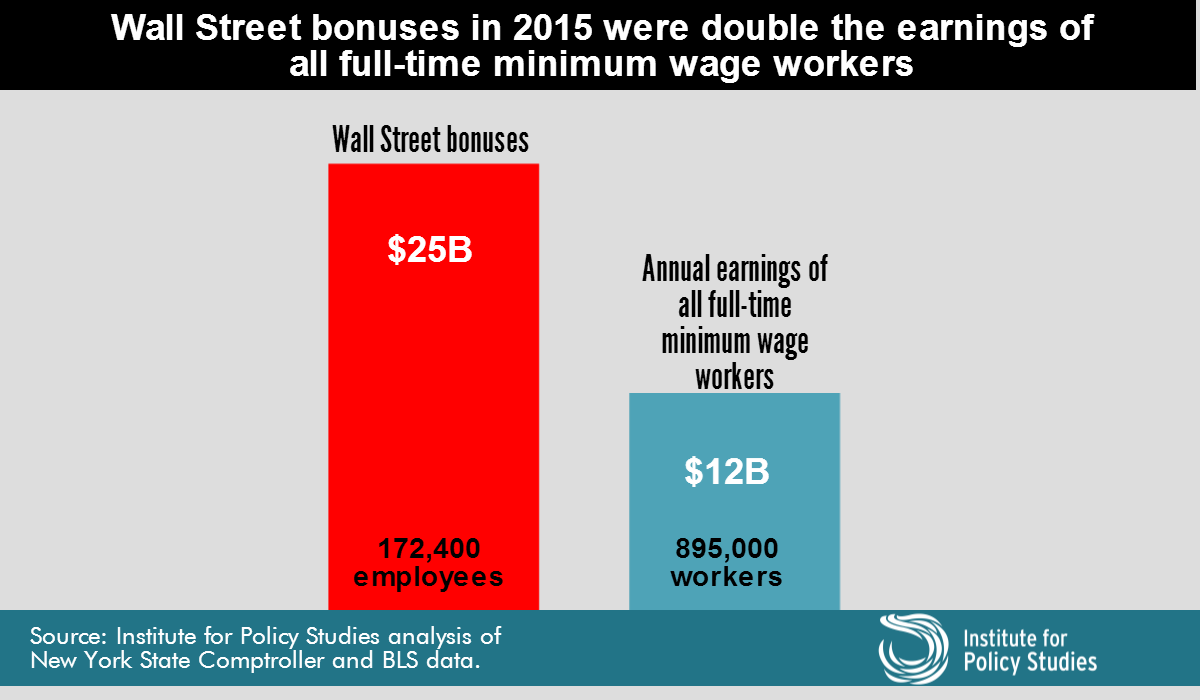

The financial industry’s 2015 bonuses were double the combined earnings of all Americans who work full-time at the federal minimum wage.

In India, major corporations now have to disclose their CEO and median worker pay. U.S. corporations may soon have to finally follow suit.

Five years after Dodd-Frank, we’re still waiting for Wall Street pay reforms.

As Dodd-Frank turns five, the SEC hasn’t been able to put the regulations into practice.

A proliferation of 2016 progressive policy agendas include CEO pay reform.

The latest executive compensation regs proposed by the Securities and Exchange Commission won’t put any real brake on CEO pay excess. What would? We have a list!

The SEC finally moves, ever so slightly, against wagers that reward CEOs when their companies fail.

While the European Union’s new banker pay standards may be imperfect, they do represent tougher regulations that the U.S. can learn from.

Since Congress is sitting on its hands, progress on reining in executive over-compensation is cropping up elsewhere.

IPS executive compensation experts available to comment on SEC rule released today.

IPS executive compensation experts available to comment on SEC rules expected Wednesday