The Fix the Debt campaign, a large, well-funded corporate lobby group, has been leading the charge for massive new corporate tax cuts paid for with cuts to Social Security, Medicare, and Medicaid.

The nearly 100 CEOs who are leading Fix the Debt have relatively little to lose from cuts to these benefit programs, particularly when compared with low-wage workers.

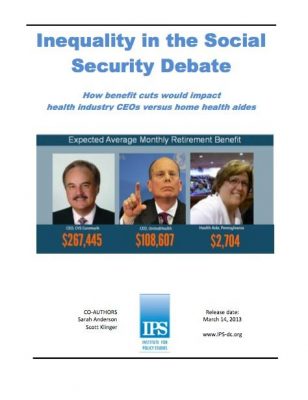

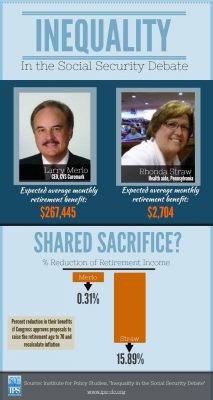

To illustrate this disparity, we analyzed the potential impact of several proposed Social Security reforms on two Fix the Debt CEOs from the health care industry and a representative low-wage worker from that same sector.

The CEOs we focus on in this report are the leaders of the nation’s largest drug retailer and the nation’s largest health insurer. CVS Caremark’s Larry Merlo is a member of Fix the Debt’s CEO Council and UnitedHealth Group is a corporate endorser. The worker we focus on is Rhonda Straw, a home health aide from Pennsylvania.

Extreme Inequality in Current Retirement Assets

Extreme Inequality in Current Retirement Assets

CVS Caremark and UnitedHealth CEOs

The CEOs of CVS Caremark and UnitedHealth illustrate how lucrative the health industry can be for those at the top. At CVS Caremark, Merlo has accumulated a retirement stash of $46 million, the fifth-largest of the Fix the Debt member CEOs.2 If invested in an annuity at age 65, Merlo’s employer-provided nest egg would deliver him a monthly retirement check of $263,169 for the rest of his life. Combined with Social Security benefits, Merlo could expect monthly retirement income of $267,445 on average over the next 20 years.

UnitedHealth CEO Stephen Hemsley, after only 15 years in the job, has an $18 million retirement cache, enough to provide him a $104,671 monthly retirement check if he converted his golden egg into an annuity at age 65. Combined with Social Security benefits, Hemsley could expect average monthly retirement income of $108,607.

Fix the Debt member CEOs of publicly held firms as a whole have average retirement assets of $9.1 million, according to the IPS report “A Pension Deficit Disorder.”

Home Health Aide

In contrast to the Fix the Debt CEOs, home health aide Rhonda Straw will need to rely almost entirely on Social Security in her retirement years. Straw enjoys her work caring for elderly, disabled, and cognitively impaired patients. At 51, she works 40 hours per week, often in the evenings, performing such tasks as administering medications, checking vital signs, and changing bandages as well as communicating her observations and concerns to the patient’s health care team.

Despite the high level of responsibility in her job, she has not earned enough to put much away for her retirement. Her current wage is $9 per hour. (The median wage for the nearly one million people in her profession across the country is $9.91 per hour, or $20,610 per year, according to the Bureau of Labor Statistics. Aside from a five-year period when she ceased paid work to care for a sick relative, she has worked full-time since she was 18, but often earning only a little more than the minimum wage. As a result, it’s been difficult to put money away for retirement. She has $475 in a 401(k) account, which could be expected to deliver a monthly payment of only $2 after she retires. Together with her Social Security benefits, her retirement income over 20 years is expected to average about $2,704 per month.

Despite the high level of responsibility in her job, she has not earned enough to put much away for her retirement. Her current wage is $9 per hour. (The median wage for the nearly one million people in her profession across the country is $9.91 per hour, or $20,610 per year, according to the Bureau of Labor Statistics. Aside from a five-year period when she ceased paid work to care for a sick relative, she has worked full-time since she was 18, but often earning only a little more than the minimum wage. As a result, it’s been difficult to put money away for retirement. She has $475 in a 401(k) account, which could be expected to deliver a monthly payment of only $2 after she retires. Together with her Social Security benefits, her retirement income over 20 years is expected to average about $2,704 per month.

Straw is not alone in her dependence on Social Security for a dignified retirement. A Congressional Research Service analysis of U.S. Census Bureau data found that one in two private sector workers had no retirement program other than Social Security. According to the Social Security Administration, 23 percent of elderly married couples and 46 percent of elderly unmarried citizens receive 90 percent or more of their total income from Social Security. The average Social Security monthly retirement check in 2012 was $1,237, or about the amount Merlo’s CVS Caremark expected retirement check would deliver in less than four hours.

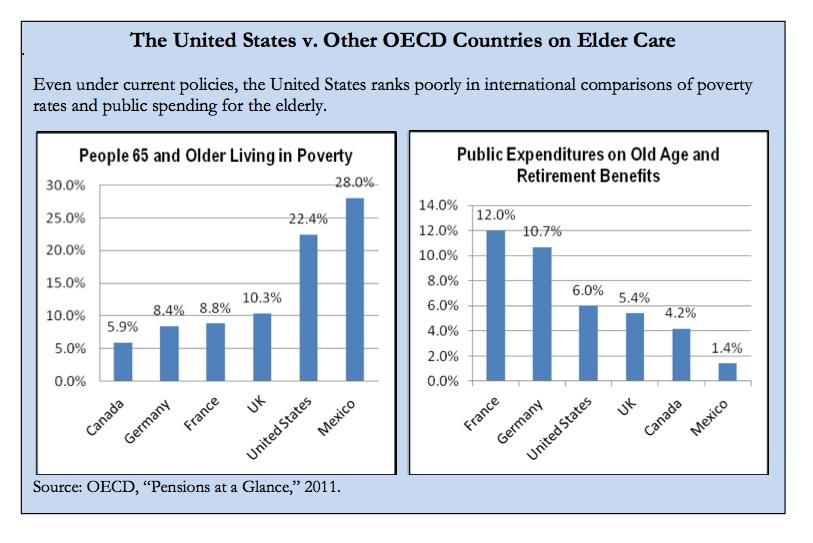

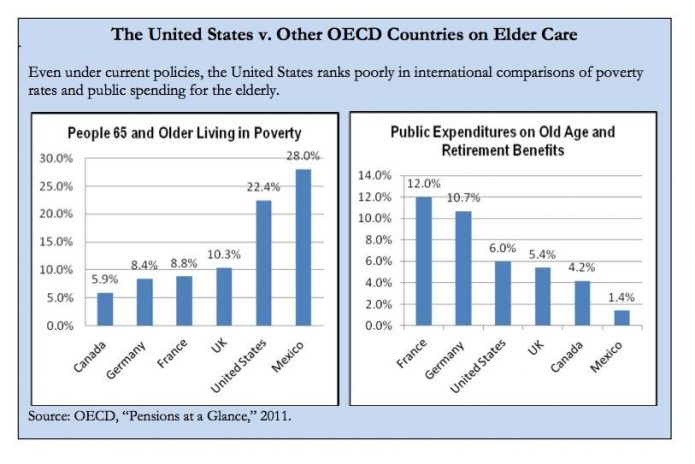

The current lack of adequate retirement assets helps explain why the United States has the seventh-highest rate of elder poverty (22.4 percent) among the 30 member states of the Organization for Economic Co-operation and Development (OECD), an organization comprised of the wealthiest nations. If proposed cuts are adopted, the situation would grow even worse.

Proposed Cuts Would Widen the Divide

Among the various possible ways to cut Social Security, two seem to have the most traction in the current budget debate:

Chained CPI: President Barack Obama and some members of Congress from both sides of the aisle have expressed support for a proposal to replace the current measure of inflation used to set annual cost of living adjustments with the “chained CPI.” The Social Security Administration estimates that this change would lower beneficiaries’ cost of living adjustments by 0.3 percent a year. It doesn’t sound like much, but after 20 years the average Social Security recipient’s benefit check would be about $100 a month lower than if the traditional inflation adjustment had remained in place.

Raising the retirement age: Another often proposed change to Social Security involves raising the retirement age beyond the current 66 years (scheduled to rise to 67 years by 2022). We looked at the impact of increases to either age 68 or 70. Such changes would be particularly detrimental to people in low-wage, physically demanding work, since both characteristics lead to shortened life expectancies.

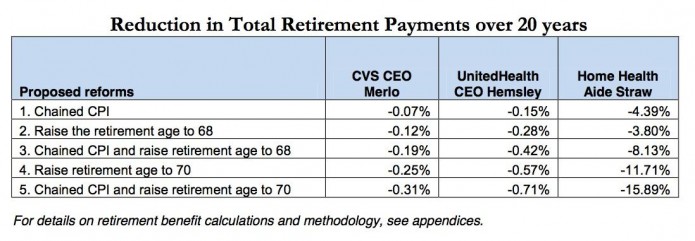

Not surprisingly, when we compared the potential impact of these proposals on the UnitedHealth and CVS CEOs and a typical middle-aged home health aide, we found that the health aide stands to be hurt much more by these changes.

If Congress adopts the most draconian approach — a combination of “chained CPI” and raising the retirement age to 70 — health aide Rhonda Straw could face a nearly 16 percent reduction in her total retirement payments over 20 years. That’s compared to reductions of only 0.3 percent and 0.7 percent for Merlo and Hemsley, respectively.

Both Merlo and Hemsley are members of the Business Roundtable, which recently issued a proposal for Social Security reform that would raise the retirement age to 70 and adopt the chained CPI method of calculating cost of living adjustments.

Business Roundtable members have little skin in the game when it comes to increasing the Social Security retirement age. Not only does Social Security make up a miniscule share of their retirement income, but most of the Roundtable’s CEO members are men in the final ten years of their working life. This means that any reform enacted now would be unlikely to affect them.

Fair Retirement Security Reforms

If the CEO leaders of Fix the Debt are truly interested in fixing the debt, preserving Social Security for years to come, and ensuring a dignified retirement for all Americans, here are a few important initiatives they should get behind:

1. Eliminating the Cap on Wages Subject to Social Security Taxes

Presently just the first $113,700 of an American worker’s wage income is subject to a 12.4 percent Social Security tax. Honeywell CEO David Cote had the highest cash compensation among the Fix the Debt CEOs in 2011 (the most recent year data is available) — $25.1 million. Cote paid just $11,107 in Social Security taxes in 2011. If the cap were lifted, Cote would have paid $2.6 million in Social Security taxes. New legislation introduced by Senator Mark Begich (D-AK) proposes eliminating the cap on Social Security taxes for upper income earners like Cote. The Congressional Research Service analyzed a similar proposal in 2010 and found that it would eliminate 95 percent of the expected Social Security shortfall over the next 75 years.

2. End the Ability of CEOs and Other High-Income Executives to Defer Unlimited Amounts of Pay in Their Retirement Plans

Regular employees 50 years old and older can set aside no more than $23,000 tax-free each year in their 401(k) plans. Corporate executives face no such limits. In 2011, Fix the Debt member Thomas Monahan, CEO of Corporate Executive Board Corporation, set aside $1,360,491 tax-free in his company’s executive deferred compensation program. If Monahan had been bound by the same rules as other workers, he would have paid an additional $468,472 in federal income taxes in 2011. In the past, Congress has considered legislation to close this CEO-friendly loophole, but no legislation to address this is currently pending.

3. Support Universal, Secure and Adaptable (USA) Retirement Funds

Senator Tom Harkin (D-IA) has proposed a plan that recognizes the shared responsibility between employees, employers, and government to ensure that every worker enjoys a secure retirement. To provide this, Harkin’s proposal would require employers currently not providing retirement benefits to contribute to a USA Retirement Fund on their workers’ behalf. These funds would be pooled and professionally managed, ensuring that all workers have some pension assets to supplement their Social Security.

DOWNLOAD THE FULL REPORT FOR GRAPHICS, APPENDICES, ENDNOTES, AND MORE.