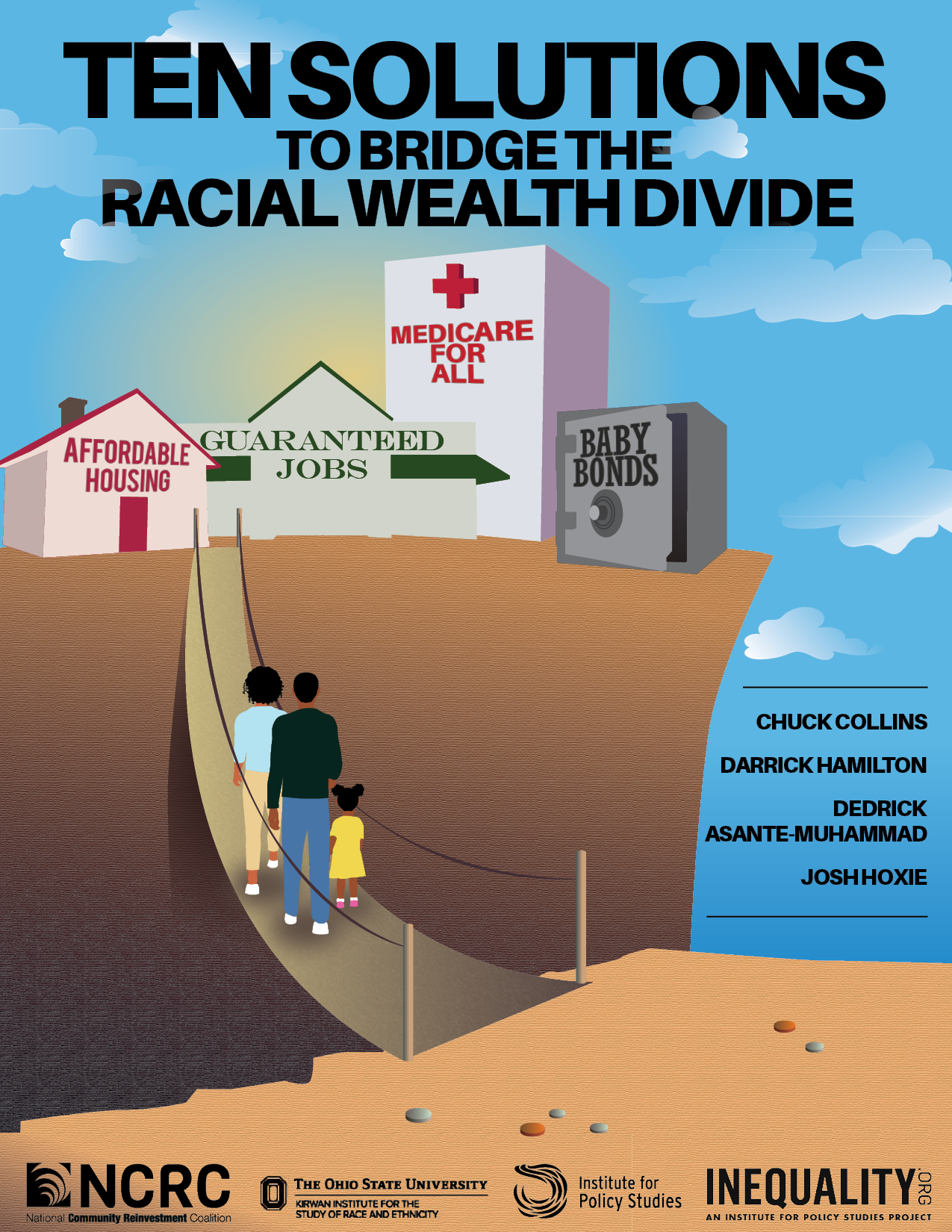

Ten Solutions to Bridge the Racial Wealth Divide

Chuck Collins | Darrick Hamilton

Dedrick Asante-Muhammed | Josh Hoxie

Introduction:

The deep and persistent racial wealth divide will not close without bold, structural reform. It has been created and held in place by public policies that have evolved with time including slavery, Jim Crow, red lining, mass incarceration, among many others. The racial wealth divide is greater today than it was nearly four decades ago and trends point to its continued widening

In this report, we offer ten bold solutions broken into three categories: Programs, Power, and Process. These solutions are designed to strike at the structural underpinnings holding the racial wealth divide in place while inspiring activists, organizers, academics, journalists, law makers, and others to think boldly about taking on this incredibly important challenge. You’ll also find a snapshot of the latest racial wealth divide data as outlined in our January 2019 report, Dreams Deferred, and a warning against false solutions.

Offered below are a number of promising solutions that could have a significant impact on reducing the racial wealth divide. Each is rooted in a public policy shift that can have a structural impact across society, not simply individual behavior changes. This is not an exhaustive or all-encompassing list, but rather a number of bold ideas that can have a systemic impact.

The solutions in this report include:

- Baby Bonds

- Guarantee Employment and Significantly Raise the Minimum Wage

- Invest in Affordable Housing

- Medicare for All

- Postal Banking

- Significantly Raise Taxes on the Ultra-Wealthy

- Turn Upside-Down Tax Expenditures Right-Side Up

- Congressional Committee on Reparations

- Improve Data Collection on Race and Wealth

- Racial Wealth Audit

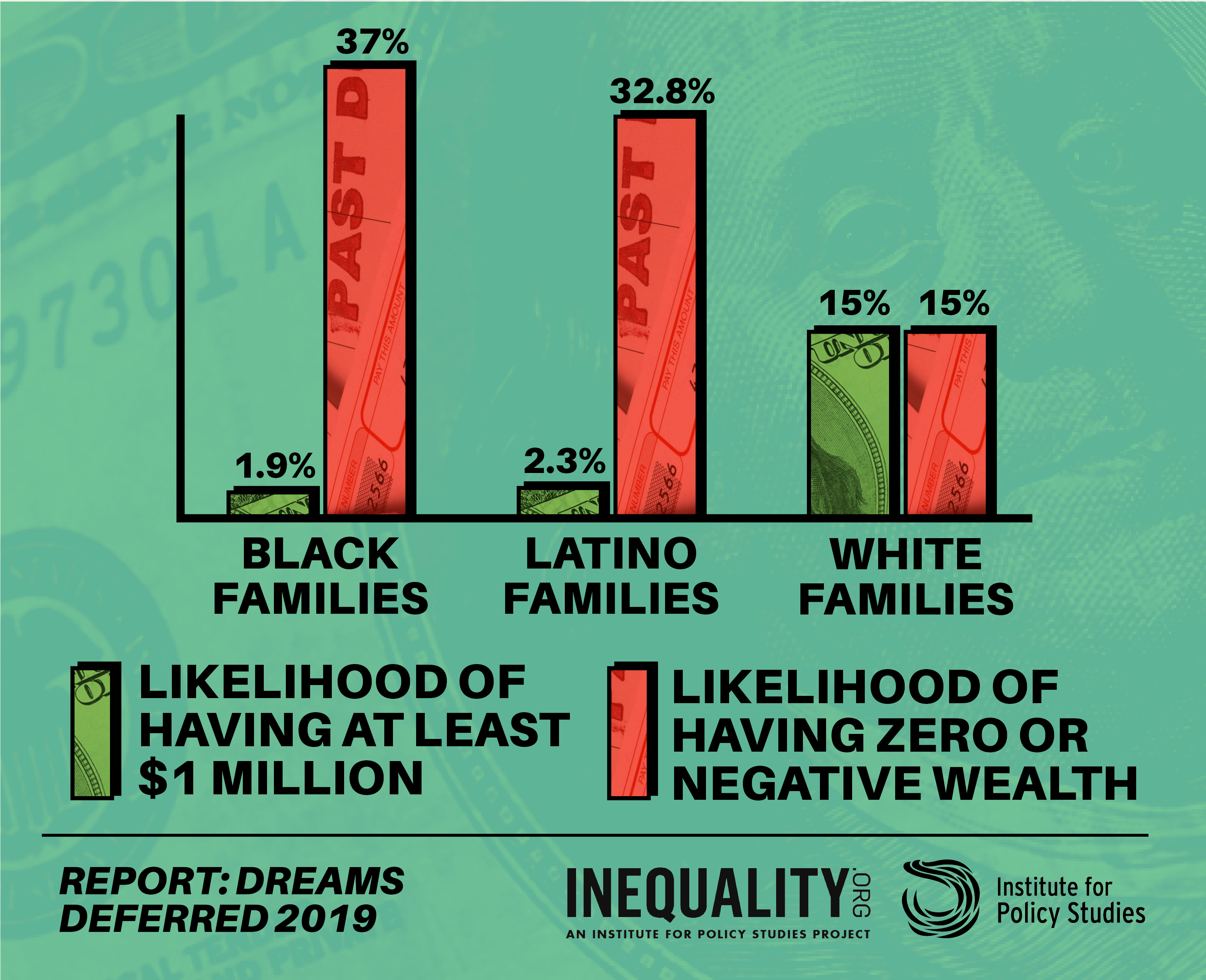

In January 2019, our report, Dreams Deferred, presented a snapshot of the racial wealth divide in the United States today, looking at the current state of household wealth, income, homeownership, debt, and other economic factors. It also reviewed long-term trends that led to this current moment, as well as, the historical policies and contributors to this deepening divide. You can find the full report here, but below are a few of its findings.

- Between 1983 and 2016, the median Black family saw their wealth drop by more than half after adjusting for inflation, compared to a 33 percent increase for the median White household.

- The Forbes 400 richest Americans own more wealth than all Black households plus a quarter of Latino households.

- Black families are about 20 times more likely to have zero or negative wealth (37 percent) than they are to have $1 million or more in assets (1.9 percent). Latino families are 14 times more likely to have zero or negative wealth (32.8 percent) than they are to reach the millionaire threshold (2.3 percent). White families are equally likely to have zero or negative wealth (about 15 percent) as they are to be a millionaire (15 percent).

In this section, programs refer to new government programs that could have a major impact on improving the financial prospects of low-wealth families. For example, a new child savings account program, or postal banking service.

Read More

1. Baby Bonds — these can help balance historical injustices of unequal distribution of inherited advantage. They are federally managed accounts set up at birth that grow over time and can be used for education, homeownership, or starting a business once the child reaches adulthood. Research shows this could reduce the gap by more than tenfold.

2. Guarantee Employment and Significantly Raise the Minimum Wage — A federal jobs guarantee would provide universal job coverage for all adult Americans and eliminate involuntary unemployment and raising the wage would have an outsized impact on reducing the divide given the disproportionate number of low-income, non-white households.

3. Invest in Affordable Housing — A comprehensive approach like the “American Housing and Economic Mobility Act” is needed to ameliorate historical injustices in housing and to address the current crisis. The most direct way the bill works to reduce the racial wealth divide is a provision that provides down payment assistance to first-time homebuyers living in formerly redlined or officially segregated areas.

4. Medicare for All — Poor access to health care and poor health outcomes is inextricably tied to race in the United States. Furthermore, the high cost of healthcare continues to put low wealth families further at risk. A universal healthcare system is essential.

5. Postal Banking — Predatory financial services targeting low-wealth families have thrived due to the lack of competition from a public banking option. People of color are particularly vulnerable to being unbanked, as are rural populations, the very young, and the elderly. The postal service is uniquely positioned to provide essential financial services to these families.

In this section, power refers to changes to the federal tax code that could have a redistributive revenue impact on the current and deeply skewed division of wealth in the country. For example, raising taxes on the ultra-wealthy through a direct tax on extreme wealth.

Read More

1. Significantly raise taxes on the ultra-wealthy — this serves both the intrinsic value of reducing the corrupting influence of plutocratic power and the instrumental value of producing public revenue that can be invested in creating wealth building opportunities for those who have been historically blocked from generating wealth.

2. Turn Upside-Down Tax Expenditures Right-Side Up — we took a big step backward with the passage of the Tax Cuts and Jobs Act of 2017, shifting tax expenditures toward wealth-building programs for low-wealth people would have a monumental impact in reducing the racial wealth divide. This could take many forms, including revising the mortgage interest deduction to be a refundable credit that prioritizes first time homebuyers, or using freed up funds for rental assistance programs.

In this section, process refers to changes in the way our government operates in regards to race and wealth. For example, instituting a racial wealth divide audit would change how Congress processes policy and its impact.

Read More

1. Congressional Committee on Reparations — For decades Congress has considered the topic of reparations, but never created a formal commission to take on the issue or grapple with what it would really look like. Legislation like HR 40 proposes to create a commission to study the issue and then propose what an apology and policy might look like.

2. Improve Data Collection on Race and Wealth — It is difficult to understand the breadth and scope of the racial wealth divide without the necessary data on the full range of racial diversity in the United States. Currently the primary source of racial wealth data derives from the national Survey of Income and Program Participation or the national Survey of Consumer Finances, which only provide data for the country as a whole amongst the largest racial and ethnic groups. It would be a significant benefit to have local racial wealth data, so we can understand differences between, for example, Cuban and Mexican Americans, as well as smaller racial groups, like Native Americans, to provide better insight into the nation’s racial and economic differences.

3. Racial Wealth Audit — Analytical tools like the “racial wealth audit” from the Institute on Assets and social policy provide a framework to assess how legislation will widen on narrow the divide. Congress and state legislatures should adopt a Racial Wealth Audit to make closing the gap a priority. Similar policy analysis currently exists for Congress to assess how legislation that adjusts revenue or spending contributes to the national debt.

Changes in individual behavior will not close the racial wealth divide, only structural systemic policy change can do that. Adjustments to Black and Latino education rates, homeownership, savings, and employment do not greatly reduce the racial wealth divide due to the structural underpinnings holding the racial wealth divide in place.

Wealth is not the only measure that shows how divided economic prosperity in the United States is among racial groups. Employment, income, homeownership, stock ownership, entrepreneurship, and virtually every other economic indicator shows a stark divide around race. Many commentators look at this data and come to the conclusion that this outcome is the result of individual behavior. A series of recent studies shows that this is indeed not the case, including:

- “What We Get Wrong About Closing the Racial Wealth Gap”

- “Umbrellas Don’t Make it Rain”

- “The Asset Value of Whiteness”

If the past several decades are to teach us anything about race and wealth, it should be that the racial wealth divide will not be closed without a structural change to the status quo.

A new report released today, “10 Solutions to Bridge the Racial Wealth Divide,” offers policy proposals to inspire activists, organizers, academics, journalists, legislators and others to think boldly about closing the #racialwealthdivide. Share on Twitter

The #RacialWealthDivide is greater today than it was 40 years ago. A new report from @IPS_DC, @Inequalityorg, @NCRC, and @KirwanInstitute highlights 10 policies to bridge this economic rift: https://inequality.org/great-divide/ten-solutions-bridge-racial-wealth-divide Share on Twitter

Today’s #Forbes400 own more wealth than all Black households in the U.S. PLUS a quarter of Latinx households. A new report from @IPS_DC, @Inequalityorg, @NCRC, and @KirwanInstitute shows us what can be done to bridge the #RacialWealthDivide: https://inequality.org/great-divide/ten-solutions-bridge-racial-wealth-divide Share on Twitter

The median black family in the U.S. owns just 2% of the wealth of the median white family; the median Latinx family only 4%. What is to be done? A new report gives us “Ten Policies to Bridge the #RacialWealthDivide” https://inequality.org/great-divide/ten-solutions-bridge-racial-wealth-divide Share on Twitter

In a new report, @DarrickHamilton highlights how Baby Bonds can reduce the #RacialWealthDivide by more than tenfold. Learn more:https://inequality.org/great-divide/ten-solutions-bridge-racial-wealth-divide Share on Twitter

“Baby bonds are an essential universal race-conscious program” to address the racial wealth divide – @DarrickHamilton, co-author of new report, Ten Policies to Bridge the #RacialWealthDivide https://inequality.org/great-divide/ten-solutions-bridge-racial-wealth-divide Share on Twitter

New report on the #RacialWealthDivide demonstrates how taxing the rich can reduce the divide by providing necessary revenue for fair and equitable wealth building programs. https://inequality.org/great-divide/ten-solutions-bridge-racial-wealth-divide Share on Twitter

The racial wealth divide is greater today than it was 40 years ago. What can we do to bridge this economic rift? A new report by the Institute for Policy Studies, Inequality.org, the NCRC, and the Kirwan Institute shows us Ten Policies to Bridge the Racial Wealth Divide. Share on Facebook

A new report offers 10 policy solutions to bridge the racial wealth divide, one of them being Baby Bonds, that can reduce this divide by more than tenfold. Learn more: Share on Facebook

It’s impossible to address the racial wealth divide without also addressing the massive wealth concentration by the top 1 and 0.1% of the income distribution. A new report demonstrates how taxing the rich can reduce the divide by providing necessary revenue for fair and equitable wealth building programs. Share on Facebook

Download our Press Release [PDF]

Download the report Executive Summary [PDF]

Media Contacts:

Robert Alvarez

robert@ips-dc.org

202-787-5205

Jessicah Pierre

jessicah@ips-dc.org

617-401-1470