For media inquires about this report, please contact Chuck Collins chuckcollins7@mac.com or Josh Hoxie Josh@ips-dc.org.

Gilded Giving: Top-Heavy Philanthropy in an Age of Extreme Inequality

Unprecedented levels of charitable giving in recent years mask a troubling trend. This report shows that charities are increasingly relying on larger and larger donations from smaller numbers of high-income, high-wealth donors. Meanwhile, they are receiving shrinking amounts of revenue from the vast population of donors at lower and middle-income levels. This trend mirrors the increasing concentration of wealth in larger society.

The report finds that this has significant implications for the practice of fundraising, the role of the independent nonprofit sector, and the health of our larger democratic civil society. The increasing power of a small number of donors also increases the potential for mission distortion.

This study tracks significant changes in philanthropic giving in recent years, puts forward a number of possible implications of these changes, and offers some solutions.

Key Findings:

- Charitable contributions from donors at the top of the income and wealth ladder have increased significantly over the past decade. From 2003 to 2013, itemized charitable contributions from people making $500,000 or more—roughly the top one percent of income earners in the United States—increased by 57 percent. And itemized contributions from people making $10 million or more increased by almost double that rate—104 percent—over the same period.

- The number of private grant-making foundations has shown similar dramatic growth. The number of grant-making foundations in the United States has doubled since 1993, from 43,956 to 67,736 in 2004, and to 86,726 in 2014. Between 2004 and 2014, the number of foundations increased 28 percent, and the amount of assets held in those foundations increased 35 percent.

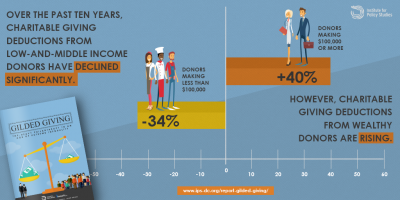

- Over the past ten years, charitable giving deductions from lower income donors have declined significantly, at almost the same rate that contributions from higher income donors have increased. While itemized charitable deductions from donors making $100,000 or more increased by 40 percent, itemized charitable deductions from donors making less than $100,000 declined by 34 percent.

- The number of donors giving at typical donation levels has been steadily declining. According to one estimate, low-dollar and midrange donors to national public charities have declined by as much as 25 percent over the ten years from 2005 to 2015. These are the people who have traditionally made up the vast majority of donor files and lists for most national nonprofits since their inception.

- The rate of decline in small-dollar donors correlates strongly with indicators of overall economic security in the United States, such as wages, employment, and homeownership rates. This correlation indicates that donor declines are likely due, in large part, to changing economic conditions.

Read the full report here [PDF].

Shareable Graphics: