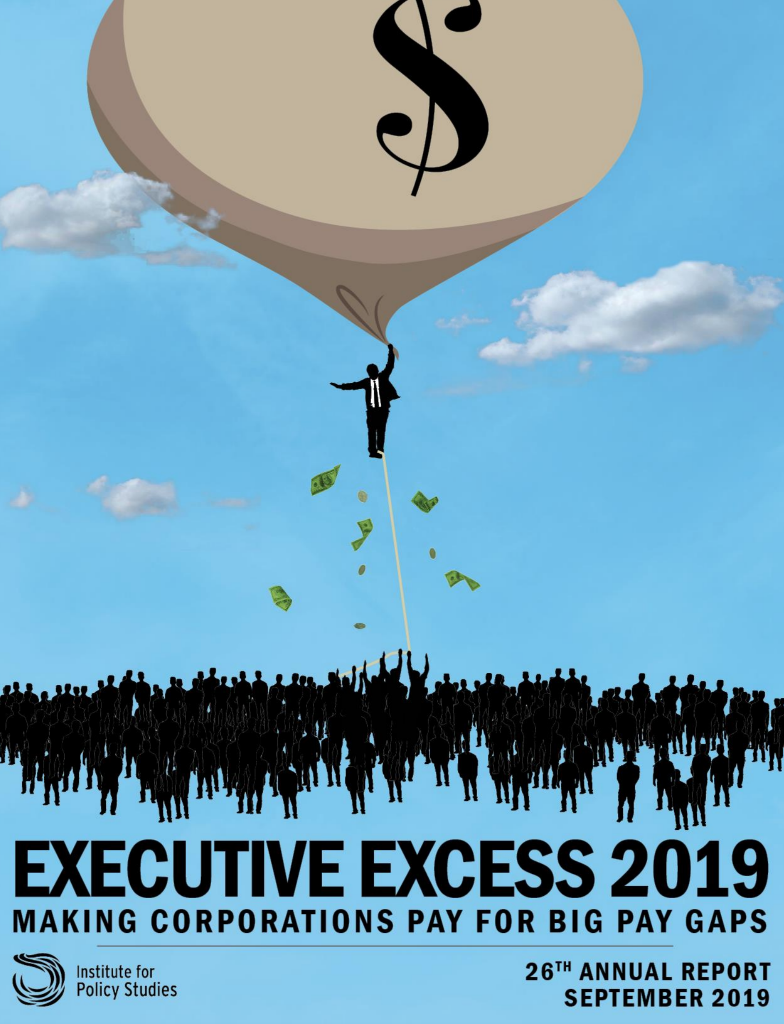

Executive Excess 2019:Making Corporations Pay for Big Pay Gaps

Sarah Anderson | Sam Pizzigati

Introduction:

For two full years now, publicly held corporations in the United States have had to comply with a federal mandate to report the gap between their CEO and median worker compensation. The resulting disclosures, this report makes clear, have produced truly staggering statistical results.

Americans across the political spectrum have been decrying the yawning gaps between CEO and worker compensation for several decades now. Yet Americans still, the research shows, vastly underestimate how wide these gaps have become. Today, with corporations required to disclose their pay ratios, the public can finally see the actual size of pay gaps at individual firms. These excessively wide compensation gaps hurt us on three major fronts:

- Corporate pay gaps help drive extreme inequality in the U.S.

- Wide pay gaps undermine business efficiency and effectiveness

- Runaway CEO pay endangers our democracy and the broader economy

Key Findings:

- At the 50 publicly traded U.S. corporations with the widest pay gaps in 2018, the typical employee would have to work at least 1,000 years to earn what their CEO made in just one..

- Among S&P 500 firms, nearly 80 percent paid their CEO more than 100 times their median worker pay in 2018, and nearly 10 percent had median pay below the poverty line for a family of four.

- S&P 500 corporations as a whole would have owed as much as $17.2 billion more in 2018 federal taxes if they were subject to tax penalties ranging from 0.5 percentage points on pay ratios over 100:1 to 5 percentage points on ratios above 500:1.

- Walmart, with a pay gap of 1,076 to 1, would have owed as much as $794 million in extra federal taxes in 2018 with this penalty in place, enough to extend food stamp benefits to 520,997 people for an entire year..

- Marathon Petroleum, with a 714-to-1 gap, would have owed an extra $228 million, more than enough to provide annual heating assistance for 126,000 low-income people.

- CVS, with a 618-to-1 ratio, would have added a revenue stream that could have provided annual Medicare prescription benefits for 33,977 seniors.

- The report also includes the most comprehensive available catalog of CEO pay reform proposals.

At the 50 publicly traded U.S. corporations with the widest pay gaps in 2018, the typical employee would have to work at least 1,000 years — an entire millennium — to earn what their CEO made in just one. Median CEO pay at these 50 off-the-charts firms last year averaged $15.9 million. Median worker pay at the 50 firms averaged just $10,027

The CEO of Barbie manufacturer Mattel took home $18.7 million last year — 3,408 times as much as the company’s median employee. Mattel reports that 82 percent of its employees are working outside of the United States, in countries where wage rates run “dramatically lower.” Joseph Hogan, the CEO of the company that makes Invisalign braces made 3,168 times as much as his firm’s median employee, an associate engineer in Mexico earning $13,180. Other companies pay gaps above 1000 to 1 include McDonald’s, Walt Disney, T-Mobile, and more.

The pay disparities between CEOs and ordinary workers rate as extreme throughout the ranks of America’s 500 largest publicly traded corporations. Within this top-tier group, 393 companies — nearly 80 percent of the total — paid their CEO over 100 times their median worker pay in 2018. At 49 S&P 500 firms, median worker pay in 2018 sat below the $27,005 poverty line for a U.S. family of four.9 At least 3.7 million of the 7.4 million employees at these firms, in other words, earned too little from their jobs last year to keep a family out of poverty.

Companies that pay poverty wages while their CEOs make millions include Gap, Ulta Beauty, Chipotle, and more. And while at Google and Twitter the CEOs take home nominal annual paychecks, these corporate founders are sitting on massive stashes of company stock.

Tax penalties on extreme CEO-worker pay gaps would encourage large corporations to narrow their divides — by lifting up the bottom and/or bringing down the top of their wage scales. Such reforms would also give a boost to small businesses and employee-owned firms and cooperatives that spread their resources more equitably than most large corporate enterprises.

In 2018, 323 profitable S&P 500 firms had CEO-worker pay ratios that stretched over 100 to 1. If these corporations had to pay a corporate income tax penalty, the federal government would have collected as much as $17.2 billion in additional 2018 federal taxes.

Action on CEO pay gap taxes has been moving faster at the state and local than the federal level. In 2018, Portland became the first to apply a tax penalty on publicly traded companies with wide gaps and San Francisco voter will find a similar proposal on the March 2020 ballot. Legislators in seven states — California, Minnesota, Rhode Island, Connecticut, Illinois, Massachusetts, and Washington — have introduced similar pay-ratio tax legislation.

Tax penalties on extreme gaps in CEO-worker compensation represent one promising approach to building corporate pay equity. But activists and experts are also advancing a host of other innovative ideas for creating more equitable and effective corporate compensation systems. This report offers the most comprehensive available catalog of policy options for reining in CEO pay.

These options cover reforms in everything from corporate governance to government contracts and subsidies. Members of Congress have introduced legislation that speaks to some of these options. Others are pending before legislative bodies in U.S. cities and states — and nations around the world.

How best to evaluate the CEO pay reforms currently pending in the United States and beyond? IPS has developed, as a guide, five principles for effective and equitable corporate compensation.

Download our Press Release [PDF]

Additional CEO pay ratio resources: Since 2017, IPS has maintained aresource guide that spotlights related policy analysis, draft legislation, and statements from institutional investors and other advocates.

Media Contacts:

Robert Alvarez

robert@ips-dc.org

202-787-5205