Silver spoon oligarchs: How America’s 50 Largest Inherited-Wealth Dynasties Accelerate Inequality

Chuck Collins | Joe Fitzgerald | Helen Flannery

Omar Ocampo | Sophia Paslaski | Kalena Thomhave

Introduction

Much of the media’s focus today is on new wealth billionaires like Jeff Bezos, Mark Zuckerberg, or Elon Musk, who have become centi-billionaires in their lifetimes. Lurking behind these dynamic first-generation stories, however, are persistent examples of even greater multi-generational dynastic wealth.

In healthy, equitable democratic societies, great fortunes dissipate over a few generations as initial wealth holders have children and grandchildren, pay their fair share of taxes, and make charitable gifts. But our country’s wealth is accumulating in fewer hands, including among people who may be up to seven generations removed from the original source of their family’s wealth.

At a certain stage, some of these wealth holders — or their descendants — shift resources to consolidate their wealth, fend off competition, and create monopolies. As this report will show, they focus less on creating new wealth and more on preserving existing systems that extract ongoing rents from consumers and the real economy.

America’s dynastic families, both old and new, are deploying a range of wealth preservation strategies to further concentrate wealth and power — power that is deployed to influence democratic institutions, depress civic imagination, and rig the rules to further entrench inequality. This tax avoidance means less support for the infrastructure we all rely on to preserve our health, safety, and quality of life.

In the summary on this page, we document the scale of America’s dynastic wealth, the threats this poses to our society and democracy, and offer detailed recommendations for how to reverse these trends.

In the full report, available in the PDF below, we look more deeply at how dynastically wealthy families use their financial, political, and philanthropic clout to advance their dynasty-building agenda. We also include an appendix of the 50 wealthiest dynastic families in the U.S. today — and look at a few counter-examples of entrepreneurs and inventors who could have built wealth dynasties, but did not.

Key findings

- Dynastic families control a staggering amount of wealth. In 2020, America’s 50 wealthiest billionaire family dynasties together held $1.2 trillion in assets. By comparison, the bottom half of all U.S. households — an estimated 65 million families — shared a combined total wealth of just twice that, at $2.5 trillion.

- Dynastic family wealth grew 10 times the rate of ordinary families. For the 27 families that were on both the Forbes 400 list in 1983 and the Forbes Billion-Dollar Dynasties list in 2020, their combined assets have grown by 1,007 percent over those 37 years. This is an increase from $80.2 billion to $903.2 billion in inflation-adjusted dollars. In contrast, between 1989 and 2019, the wealth of the typical family in the U.S. increased by just 93 percent in inflation-adjusted dollars.

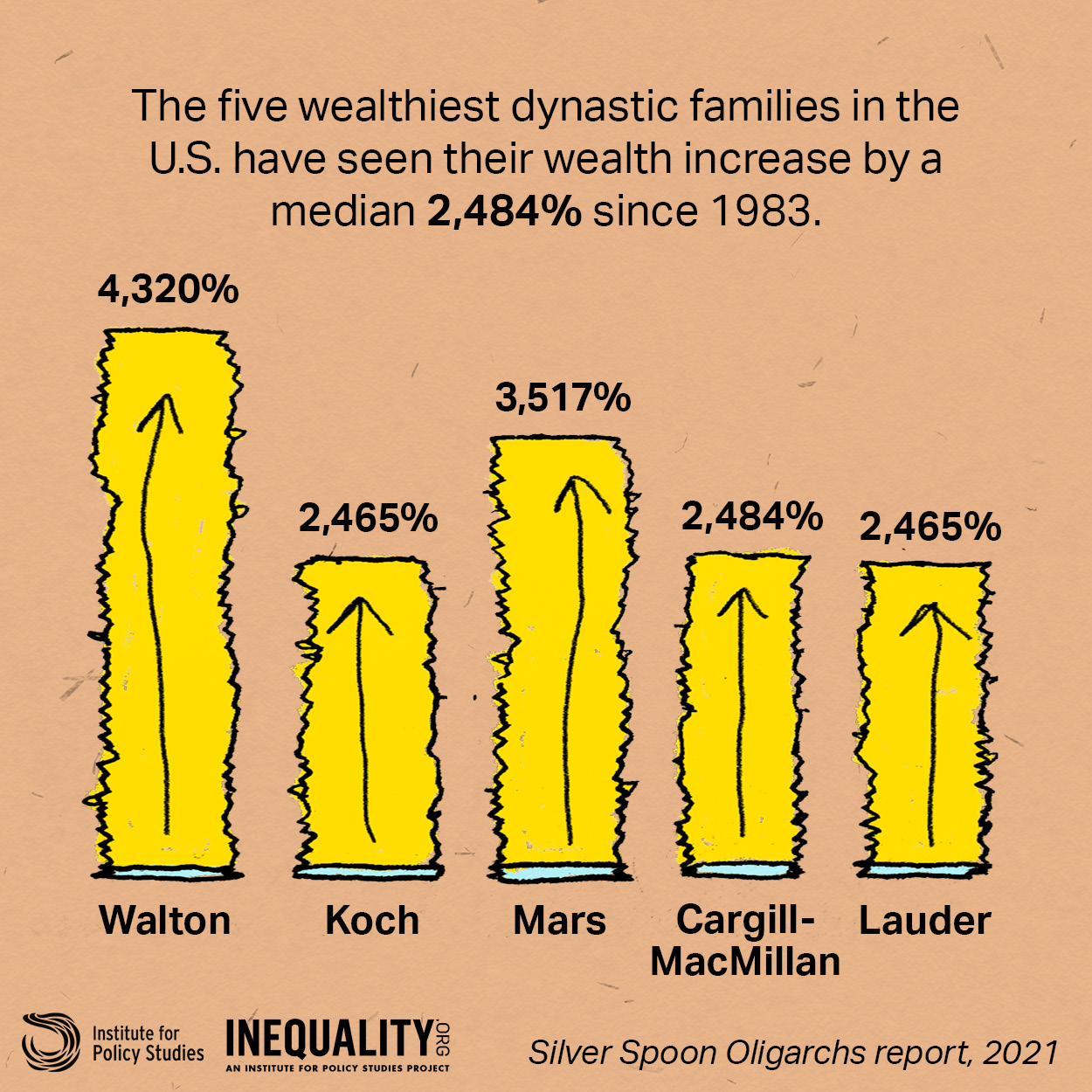

- Those at the very top are blowing away even their closest competition. The 27 families on the Forbes list this past year who were on the Forbes 400 list in 1983 had a median increase in their net worth, adjusted for inflation, of 904 percent over those 37 years. And the five wealthiest dynastic families in the U.S. have seen their wealth increase by a median 2,484 percent from 1983 to 2020.

- In 1983, Wal-Mart founder Sam Walton and his children were worth just $2.15 billion (or $5.6 billion in 2020 dollars). By the end of 2020, Walton’s descendants had a combined net worth of over $247 billion, an inflation-adjusted increase of 4,320 percent.

- The Mars candy dynasty has seen its wealth increase 3,517 percent over the past 37 years, from $2.6 billion in 1983 (in 2020 dollars) to $94 billion by 2020. The family has also spent large sums on public policy advocacy to change tax laws.

- Cosmetics magnate Estée Lauder and her descendants have seen their wealth grow from just $1.6 billion in 1983 (in 2020 dollars) to $40 billion in 2020. This is a growth rate of 2,465 percent.

- Dynastic wealth is becoming increasingly persistent. Of the top 50 dynastically wealthy families on the 2020 Forbes Billion-Dollar Dynasties list, 27 were also on the Forbes 400 list in 1983. Of the 20 wealthiest families on the list in 2020, 13 were already in the top 20 in 1983. Only 4 of the top 20 wealth dynasties are new to the list since 1983.

- Dynastic families have seen their wealth grow significantly during the COVID-19 pandemic. Since the start of the pandemic in March 2020, the top 10 families on the Forbes dynasty list have had a median growth in their net worth of 25 percent.

- Dynastically wealthy families wield a great deal of political power, and use it to further their interests. Some dynastic families spend millions lobbying for favorable tax, labor, and trade policies. Several have corporate political action committees which give millions to candidates and campaigns. Many family members give to candidates and PACs; several serve on policy advisory boards; and a few have served in government themselves, including as governors, cabinet members, and even vice president.

- Dynastic families exploit their philanthropic power too, through charities and foundations. The top 50 families have set up more than 248 foundations between them, housing more than $51 billion in assets. While many move much-needed revenue to broader public interest charities, others fund groups working to reduce taxes on the wealthy and roll back regulations that constrain corporate profits. Some funnel millions to donor-advised funds, which can fund dark-money political advocacy. And in a few cases, family members have used them to compensate themselves.

As wealth has become concentrated in fewer hands, dynastically wealthy families have gained massive and unaccountable financial, political, and philanthropic power. They are stockpiling ever more billions in bank accounts, trusts, private foundations, and donor-advised funds while giving relatively little back to the society that has enabled their fortunes. And, all the while, the assets and income of low- and middle-income households have continued to stagnate.

By placing vast family fortunes into perpetual institutions such as shell corporations, dynasty trusts, and private foundations, the benefits of wealth become entrenched, passed down from generation to generation. And that hereditary wealth — corporate, personal, and philanthropic — can be used to further preserve and accelerate imbalances of power and influence.

But we can choose to move in a new direction: to enact economic policies that strengthen society as a whole, ensuring equal opportunity and dignity for all, not just the very few. To reverse these trends, we need a more progressive tax system as well as new efforts to shut down the hidden wealth system.

Current Proposals for More Progressive Taxation

Greater oversight and enforcement. Representative Ro Khanna (D-CA) has introduced the Stop Cheaters Act, legislation to strengthen tax enforcement and crack down on tax dodging by the wealthy. President Biden has proposed investing $80 billion over the next decade to rebuild IRS enforcement and oversight capacity aimed at wealthy tax filers.

An emergency pandemic wealth tax. In July 2020, several U.S. Senators introduced the Make Billionaires Pay Act to levy a one-time 60 percent pandemic wealth tax on billionaire gains over 2020. By one estimate, this would have raised $420 billion for health care.

An annual wealth tax. Senator Elizabeth Warren (D-MA) has proposed an annual wealth tax on households with wealth starting at $50 million, roughly the 200,000 wealthiest households in the U.S. The 2 percent annual levy would increase to 3 percent on every dollar of net worth above $1 billion. The proposal would raise almost $3 trillion over the next ten years while exempting 99.9 percent of taxpayers.

A millionaire surtax. A 10 percent income tax surcharge on incomes over $3 million, whether from capital or wages, would raise $660 billion over the next decade entirely from households in the top 0.1 percent. And this would move us closer to a fairer system that eliminates the preferential tax treatment of income from capital over income from wages and work.

A progressive estate tax. Senator Bernie Sanders (I-VT) and Representative Jimmy Gomez (D-CA) have introduced legislation to strengthen the federal estate tax and aggressively close down avoidance mechanisms. The For the 99.5 Percent Act would insert a graduated rate structure to the estate tax, with billion-dollar estates paying a higher rate than $20 million dollar estates.

An inheritance tax on heirs. In aggressive efforts to avoid the estate tax, a lot of money has been shifted to dynasty trusts and other mechanisms outside the reach of estate taxation. Adding an inheritance tax on recipients would capture and tax wealth when it leaves dynasty trusts and it flows to recipient heirs.

State level estate and wealth taxes. Several states, including California and Washington, have legislation pending to institute a wealth tax and make their state estate taxes more progressive, with higher rates on billionaires.

But none of these proposals will succeed unless the U.S. shuts down the tax loopholes, offshore tax havens, and dynasty trusts that enable the very wealthy to hide their wealth at a dizzying pace.

Proposals to Shut Down the Hidden Wealth System

Establish a federal rule against perpetuities. To close down dynasty trusts, William and Mary Law School professor Eric Kades calls for a federal rule to limit the lifespan of trusts — what he calls the National Anti-Feudalism Act. Trusts would not disappear, but the ability to sequester wealth for centuries would be curtailed.

Outlaw certain types of trusts. Sanders’ bill would end tax breaks for dynasty trusts and other sophisticated wealth hiding provisions. And the bill would further:

- Strengthen the generation-skipping tax, which is designed to prevent avoidance of estate and gift taxes, by applying it with no exclusion to any trust set up to last more than 50 years.

- Prevent abuses of grantor retained annuity trusts (GRATs) by barring donors from taking assets back from these trusts just a couple of years after establishing them. This is a way for the wealthy to avoid gift taxes, while still leaving the assets to their heirs tax-free.

- Prevent wealthy families from avoiding gifts taxes by paying income taxes on earnings generated by assets in grantor trusts.

- Limit the annual exclusion from the gift tax — which was meant to shield normal giving done around holidays and birthdays from tax and recordkeeping requirements — for gifts made to trusts.

If Congress fails to act, the executive branch should dust off regulations first proposed in 2015 to address the valuation discounts described above, as well as take additional action to limit the use of trusts that are ripe for abuse, such as intentionally defective grantor trusts (IDGTs) and GRATs.