Notes on a Victory for D.C. Domestic Workers

Domestic workers, almost all of whom are women and mostly women of color, are explicitly left out by law in most places in the country. That changes now.

Domestic workers, almost all of whom are women and mostly women of color, are explicitly left out by law in most places in the country. That changes now.

Qatar has our world’s attention, but nearby — and deeply unequal — Dubai might be charting our future

A little history might just inspire us to try that taxing again.

So argues a gripping new book from an activist physician who’s helped divine the keys to long and healthy life.

A delegation of farm workers lobbied Congress ahead of the holiday weekend to pass legislation that would provide a pathway to citizenship for thousands of workers who provide the food for our tables.

Taylor Swift fans had their time wasted and pockets emptied by Ticketmaster. Now they’re calling to break up the company’s live events monopoly – and joining the movement to crack down on monopolies, period.

Climate activists are demanding total elimination of the anti-democratic investor-state dispute settlement system.

Voters approved proposals to tax the rich, build worker power, and make housing and education more affordable.

You never know when an editorial can come in handy. Just ask Jeff Bezos.

Politicians in the Sunshine State would rather keep taxes on the wealthy low than average families safe.

A let-the-rich-be government has opened the doors to the smiling heirs of Italy’s neofascist factions.

The UN’s secretary-general is speaking truth – about inequality — to our world’s leaders.

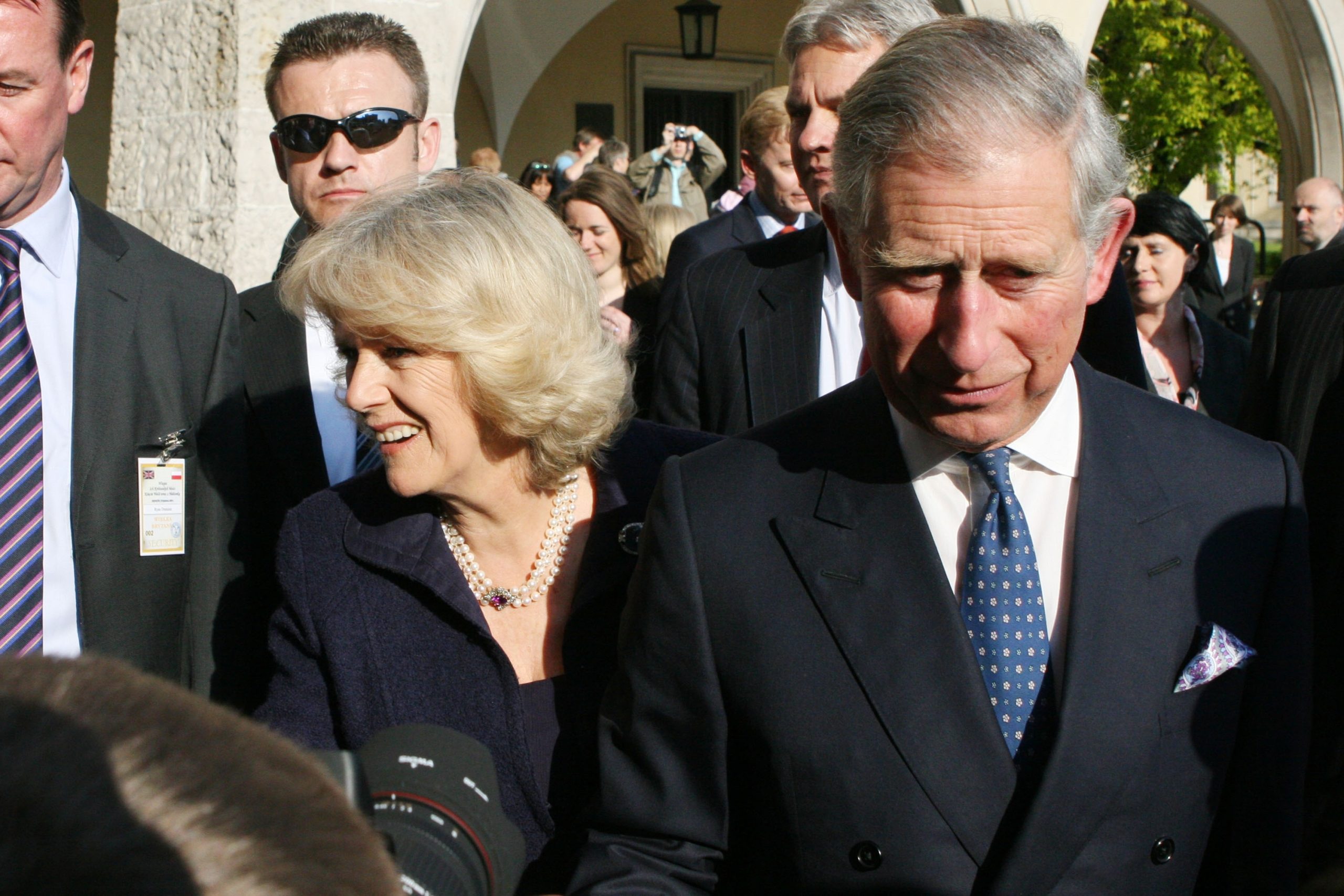

We expected Charles to get the crown. We didn’t expect him to make a billion-dollar fortune first.

Patagonia founder Yvon Chouinard, a reluctant billionaire, puts company in trust devoted to address ecological crisis.

The Maryland Democrat draws from his constitutional scholarship in analyzing the proposal that will be on the September 4 ballot in Chile.