Our Work

At IPS, our work is centered in our vision: we believe everyone has a right to thrive on a planet where all communities are equitable, democratic, peaceful, and sustainable. Our intersecting programs and initiatives, led by a diverse group of expert staff and associate fellows, are helping to shape progressive movements toward this vision.

Latest Work

Biden FY 2023 Budget Maintains Trump-Era Spending on ICE and CBP

Over the span of 20 years, spending on ICE and CBP more than doubled alongside steady growth in other forms of militarized spending.

When the Left Is Right…Far Right

How is it possible that so many left voters in France are willing to choose a far-right candidate in the second round of the presidential elections?

A Pandemic of the Poor

As we approach 1 million COVID-19 deaths, Americans in poorer counties have died at double the rate of wealthier counties.

About That $900 You Gave Pentagon Contractors

This tax season, I’d rather fund green jobs and disease control than jets that spontaneously combust. Wouldn’t you?

Alice and George

How a brilliant epidemiologist kept herself honest with the help of a gifted mathematician.

The Medic

The trials of an Army medic — and lessons for the years to come.

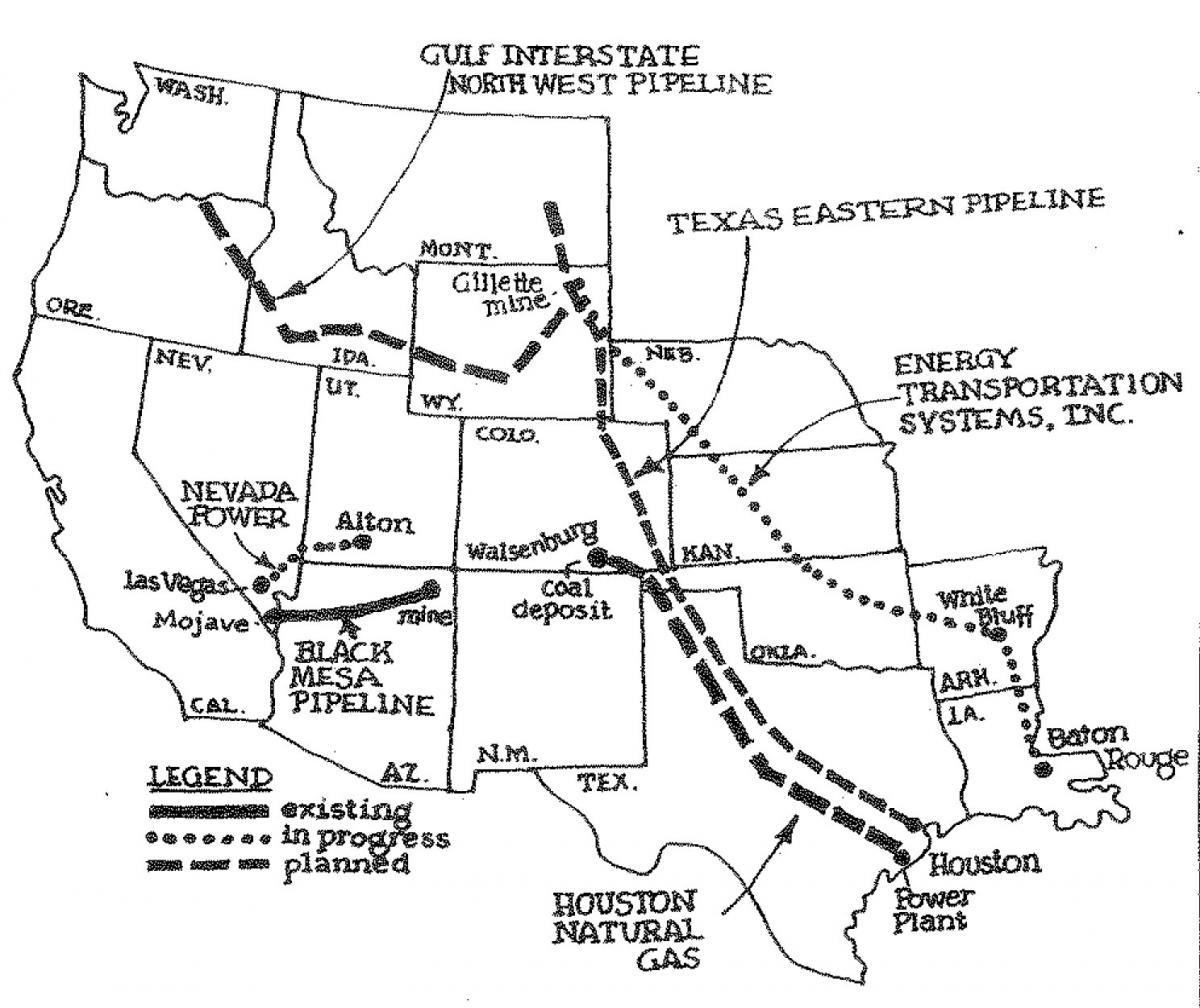

Coal and Water

A clash between ranchers, farmers, and pipeline executives in an arid corner of South Dakota.

Beyond the Headlights

The tangled politics of protecting the water rights of Indigenous communities.

Paul Jacobs and the Nuclear Gang

A movement-building effort to get justice for victims of the nuclear arms race.

Hanford

A decades-long effort to clean up one of the most profoundly contaminated nuclear “sacrifice zones” on the planet.