(Flickr / Florida Memory)

Social decency, most people agree, demands a minimum wage, a floor that defines a minimum income for all those who labor. Does social decency also demand a maximum wage, an income ceiling? The newly elected leader of the UK’s Labour Party, Jeremy Corbyn, is shoving this provocative question a lot closer to political center stage. “Why is it,” Corbyn wondered in an interview last month, “that bankers on massive salaries require bonuses to work while street-cleaners require threats to make them work?” “It’s a kind of philosophical question really,” the Labour Party leader continued. “There ought to be a maximum wage. The levels of inequality in Britain are getting worse.” In the wake of Corbyn’s comments, a financial media outlet in the UK is working on an analysis that delves into the pros and cons of the maximum wage notion. I’ve done over the years a good bit of research and writing about those pros and cons, and that outlet put three basic questions about matters maximum to me earlier this week. Those questions — and my answers . . .

Are you in favor of a maximum wage?

Absolutely. In civilized societies, we set limits all the time. We tell hunters they can shoot only so many ducks. We tell motorists they can drive only so fast. We tell developers their buildings can only rise so high. – See more at: http://inequality.org/debate-maximum-wage/#sthash.lPFAxPbi.dpuf

We set limits like these to protect our common well-being. Enormous concentrations of income and wealth endanger that well-being just as profoundly as speeding motorists.

What form would you propose a maximum wage take?

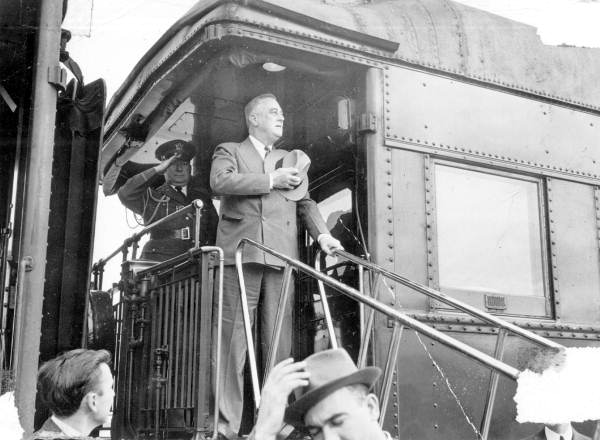

A maximum wage could work in several different ways. Franklin Roosevelt proposed a maximum wage as a fixed amount. In 1942, as President of the United States, FDR proposed a 100 percent tax on all individual income over $25,000, about $365,000 in today’s dollars. But fixed caps have a problem. They leave wealthy people eager to enhance their personal economic well-being with only one recourse: to attack the cap, either by cheating on their taxes or going all-out politically to repeal whatever cap may be in effect. We could lessen this resistance if we set our maximum-wage cap as a ratio, instead of a fixed sum. Going this route would create a healthier political dynamic. If the maximum wage were set as a multiple of the minimum wage, then the wealthiest and most powerful people in our society could see their incomes rise, but only if the incomes of the poorest and least powerful people in our society rose first. The rich, in other words, would have a vested interest in improving the well-being of the poor. I think many of us would like to live in a society with that social dynamic.

How successful might a “super tax” be in keeping a lid on high pay?

In the United States, we had a super tax of sorts in the middle of the 20th century. Between 1944 and 1964, the federal income tax rate on income over $400,000 averaged around 90 percent. Those years saw America’s wealthiest take home a steadily decreasing share of the nation’s income. But this egalitarian surge could not be sustained. The rich beat it back. To forge a more lasting egalitarian society, we would need to revise our approach to a “super tax.” We could, for instance, have a new super tax rate kick in at 50 times the minimum wage. Any dollars over 50 times what a minimum-wage worker earns over the course of a year would face a 90 percent tax rate.