While the likes of Comcast and Time Warner Cable have every right to profit from their investments and services, they shouldn’t abuse their dominant market share to remake our Internet in their image.

Read moreEconomic Justice

Combating inequality means both lifting up and building power at the bottom, and breaking up concentration of wealth and power at the top. That’s why we work at the intersection of economic and racial justice through projects designed to build leadership and self-empowerment of black workers, immigrant workers, and low-wage workers, youth and families affected by incarceration, along with projects aiming to reverse the rules that criminalize poor people of color, and projects fighting to ensure that the wealthy and Wall Street corporations pay their fair share of taxes.

Latest Work

One Weak Domino

Other countries have problems, but Greece’s are an encyclopedia of bad behavior.

Read moreAfghanistan’s Corrupt Oligarchy

The brothers of Hamid Karzai, Afghanistan’s incompetent, impossibly vain, and dishonest president, have amassed astonishing fortunes.

Read moreBilked by Banks

Wall Street’s misdeeds haven’t loomed large this election year.

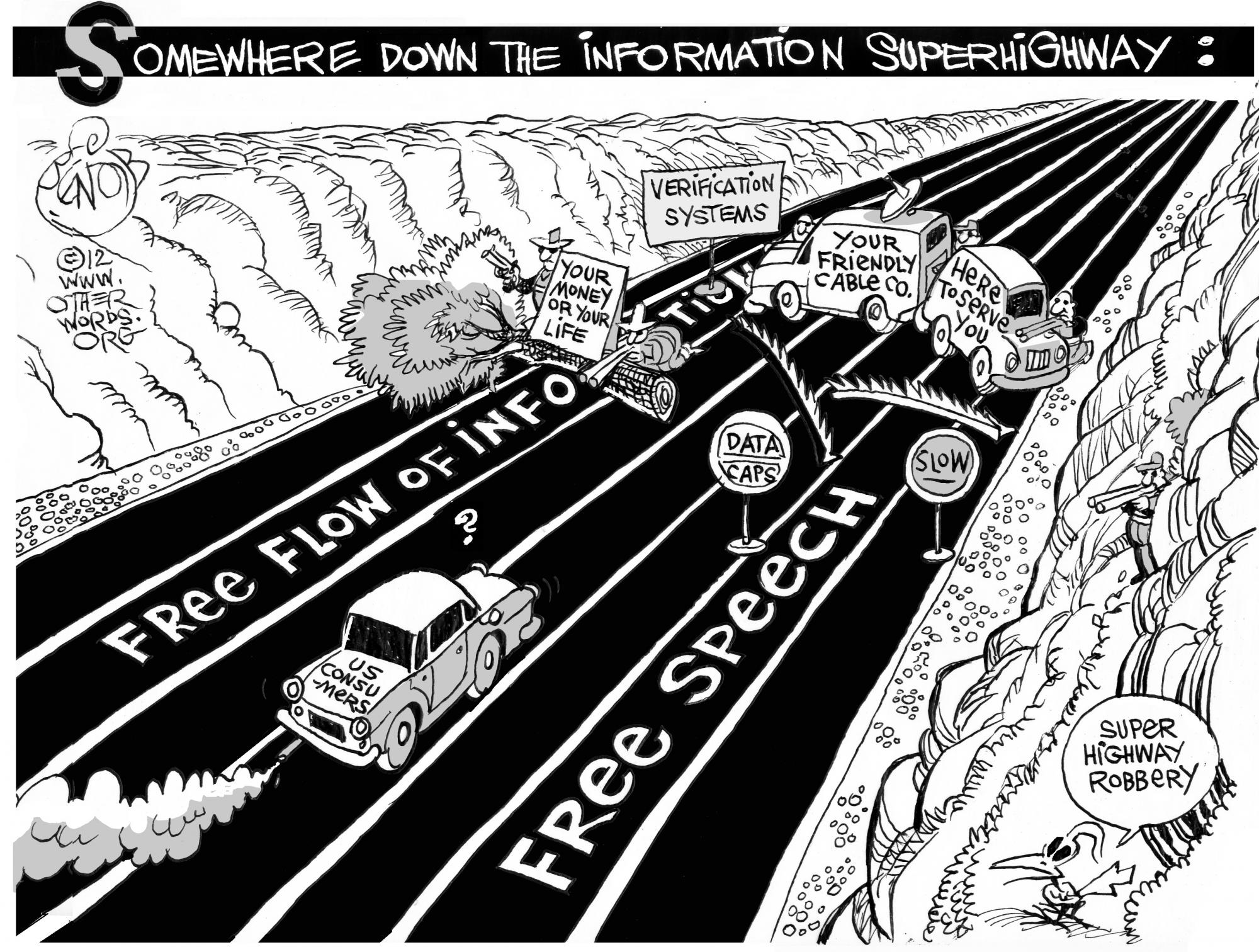

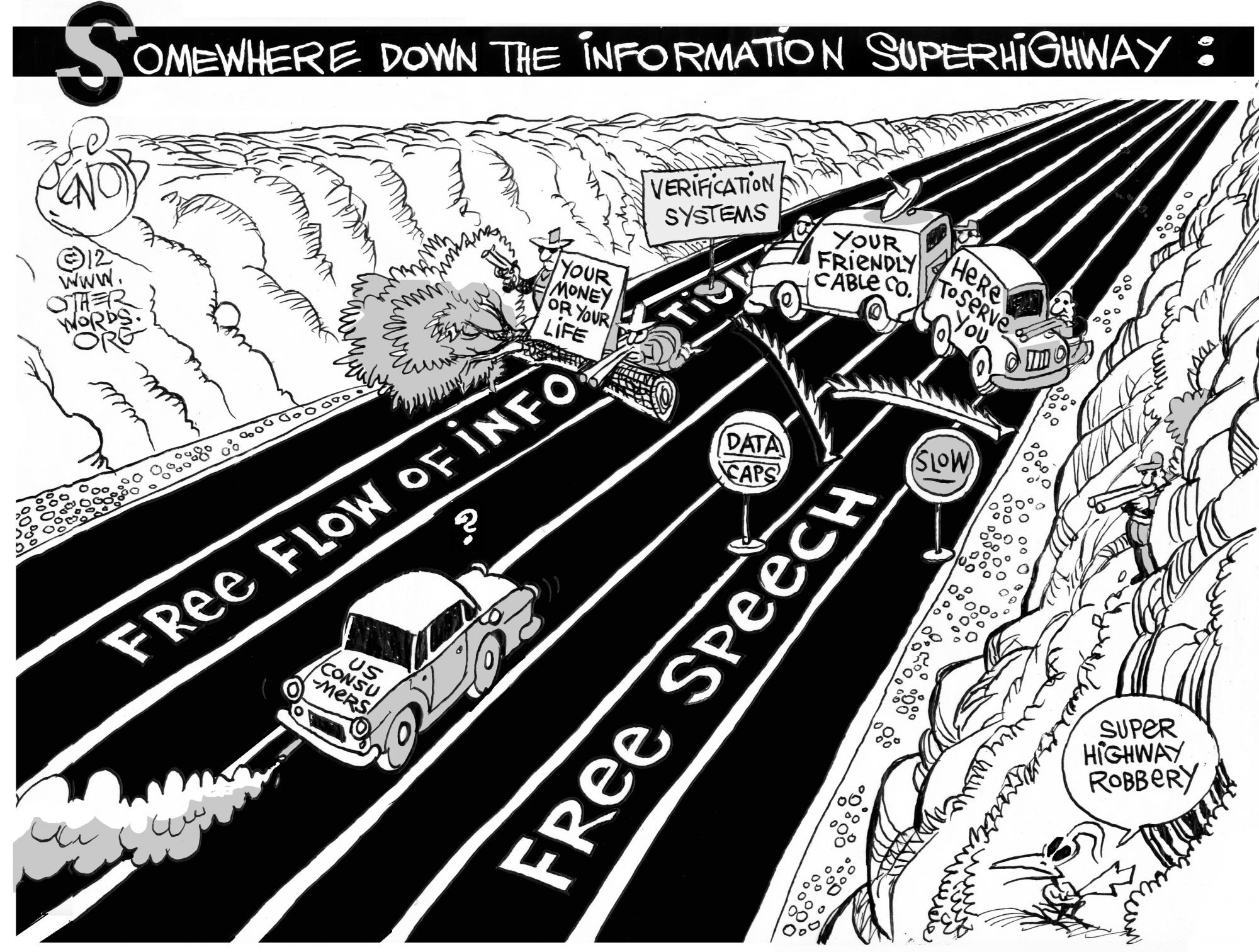

Read moreSuper Highway Robbery

Your friendly cable company is here to serve you.

Read moreLetter From Financial Industry Professionals in Support of Financial Transaction Taxes

As individuals with first-hand knowledge and significant experience in the financial industry, we urge you to introduce small financial transaction taxes (FTTs).

Read moreThe Lineup: Week of June 18-24, 2012

Matias Ramos weighs in on President Obama’s new immigration policy.

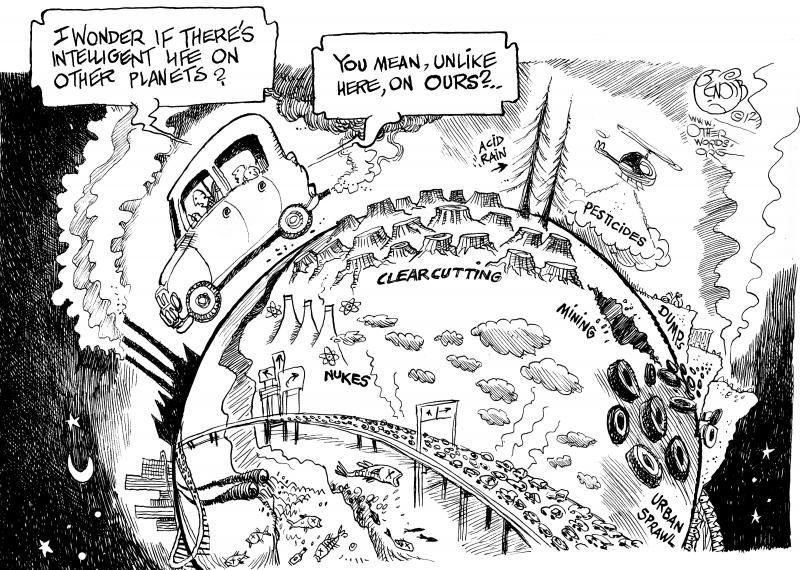

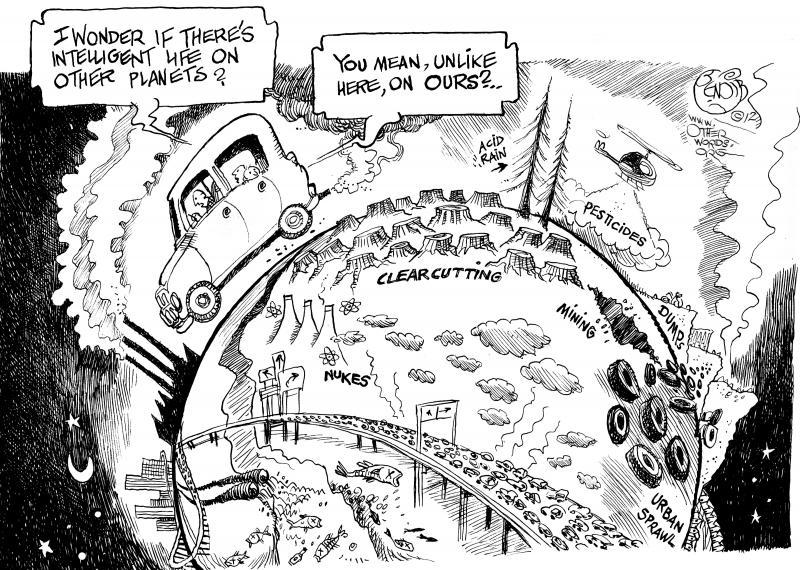

Read moreThe Elephant in Rio

Don’t bank on a new “green economy” to solve our climate challenges.

Read moreObama’s DREAM Gambit

With this new immigration policy, Obama is galvanizing his reelection prospects and potentially boosting support for many Democratic congressional candidates in November.

Read moreLow-Wage Nation

Poverty and inequality are threatening our democracy.

Read more