Inequality.org

Inequality.org

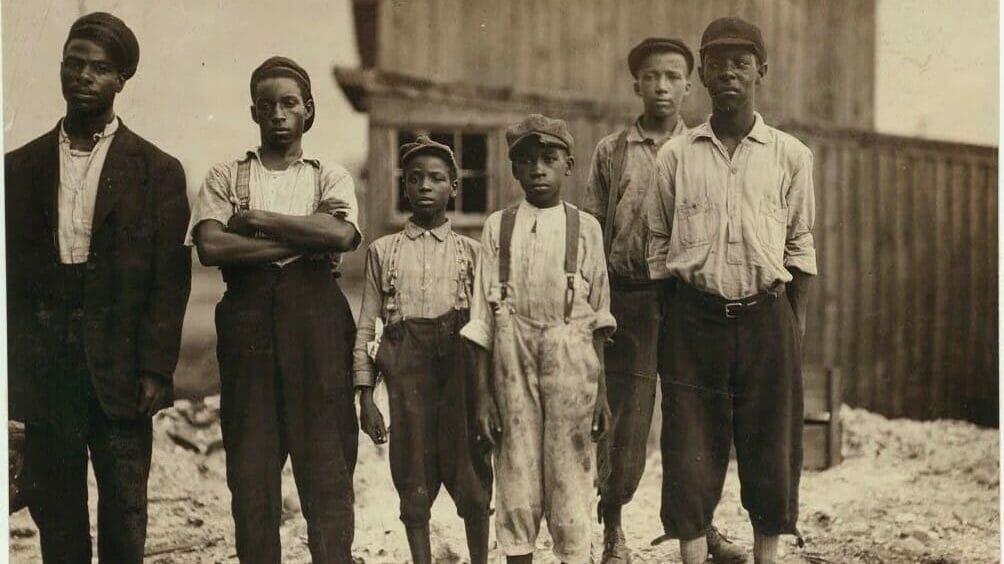

Inequality.org is the premiere portal for the public at large, journalists, teachers, students, academics, activists and any others seeking information and analysis on wealth and income inequality. Here, we collect the latest developments on inequality in the United States and keep readers abreast of relevant information concerning the widening wealth gap. We highlight stories from activists on the front lines of the fight for economic justice, and share information that can be used for ongoing campaigns.

Inequality.org is the premiere portal for the public at large, journalists, teachers, students, academics, activists and any others seeking information and analysis on wealth and income inequality. Here, we collect the latest developments on inequality in the United States and keep readers abreast of relevant information concerning the widening wealth gap. We highlight stories from activists on the front lines of the fight for economic justice, and share information that can be used for ongoing campaigns.

Our content is created by our team of contributors, each with unique expertise and analysis that we combine to form a comprehensive picture of contemporary inequality. Ultimately, our mission is to create and curate high-quality research and information, along with compelling stories, with the goal of ending economic inequality in the U.S. and abroad.