Program on Inequality and the Common Good

Extreme inequalities of income, wealth and opportunity undercut democracy, social solidarity and mobility, economic stability, and many other aspects of our personal and public lives. The Program on Inequality and the Common Good focuses on these and other dangers that income disparities pose for the U.S.

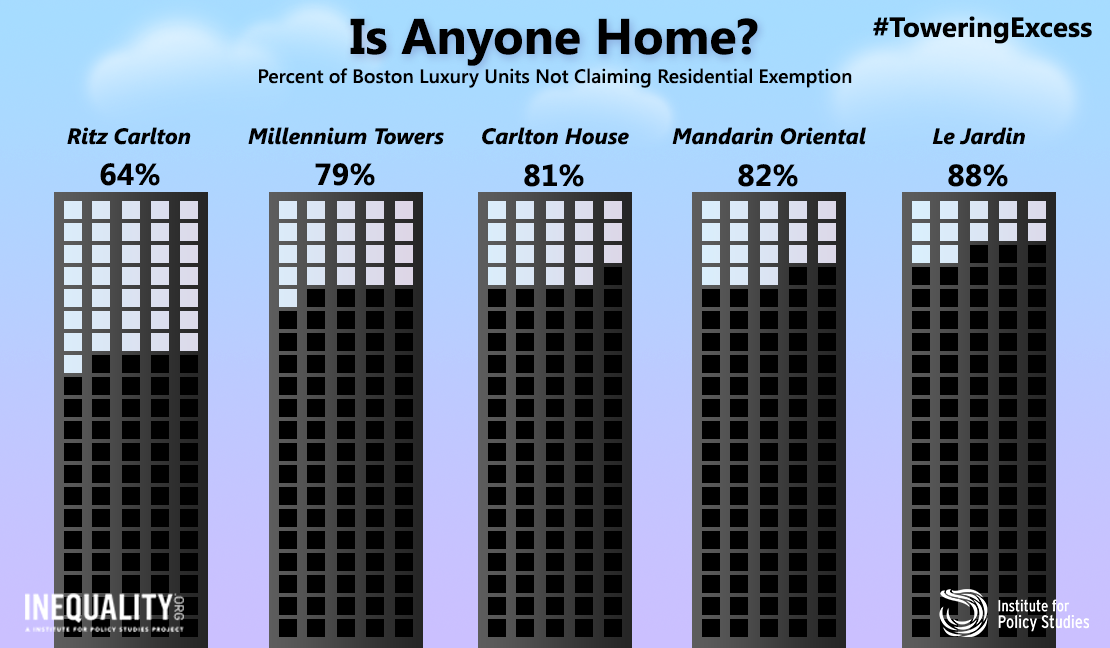

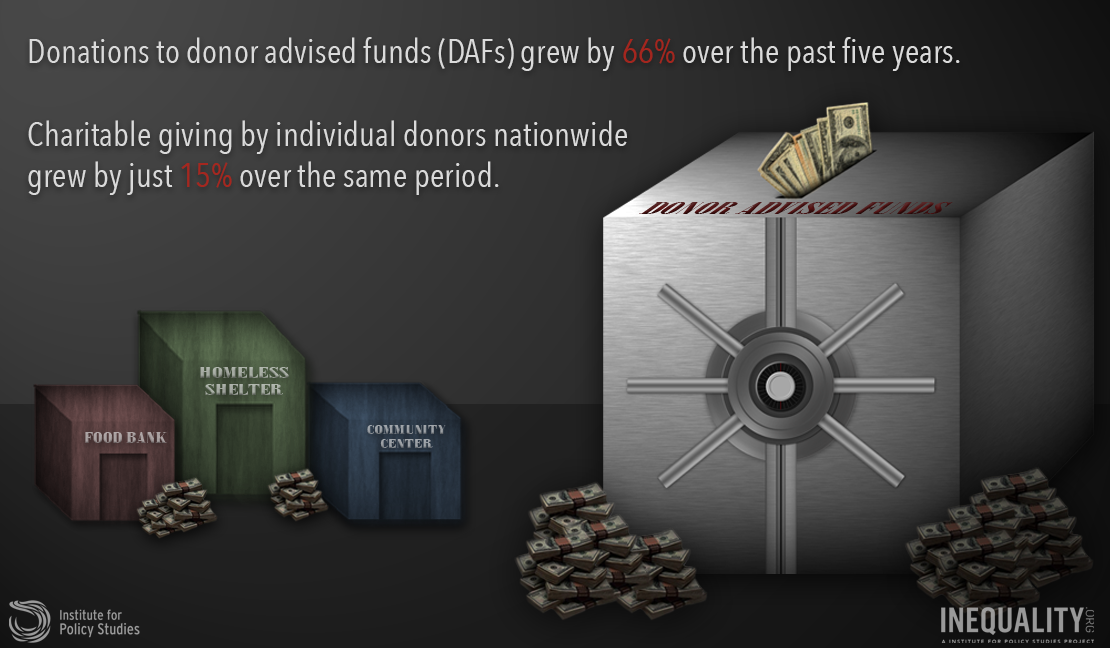

Through research and reporting, this program encourages policy interventions that can reduce extreme wealth inequality, and close the growing gap between the rich and poor. Recent reports have examined the estate tax, the racial wealth gap, inequality in philanthropy, and other topics related to extreme wealth concentration. The central theme of the program is that without significant reform and a systemic view of inequality on both a national and global level, the overall wealth divide will continue to grow exponentially.