Global Economy

The Global Economy Program provides research, communications, and networking support to dynamic economic justice movements in the United States and around the world. Our goal is to speed the transition to an equitable and sustainable economy while reversing today’s extreme levels of economic and racial inequality and excessive corporate and Wall Street power. The program focuses its work on six inter-related areas:

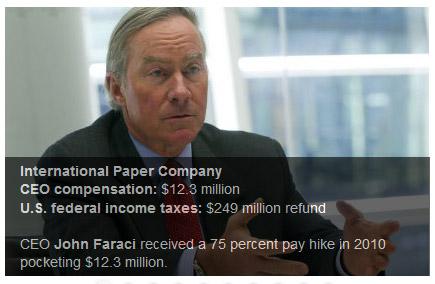

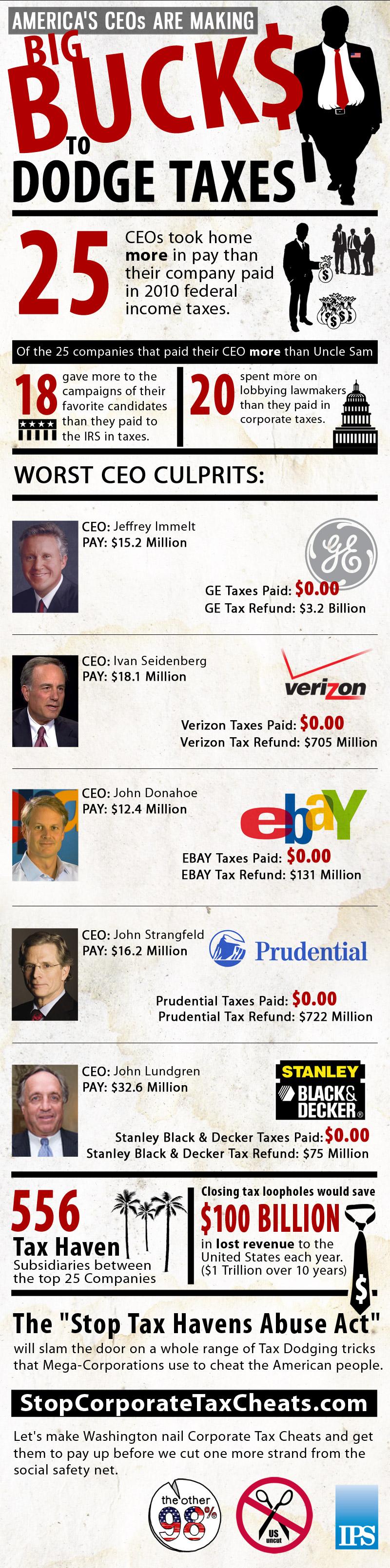

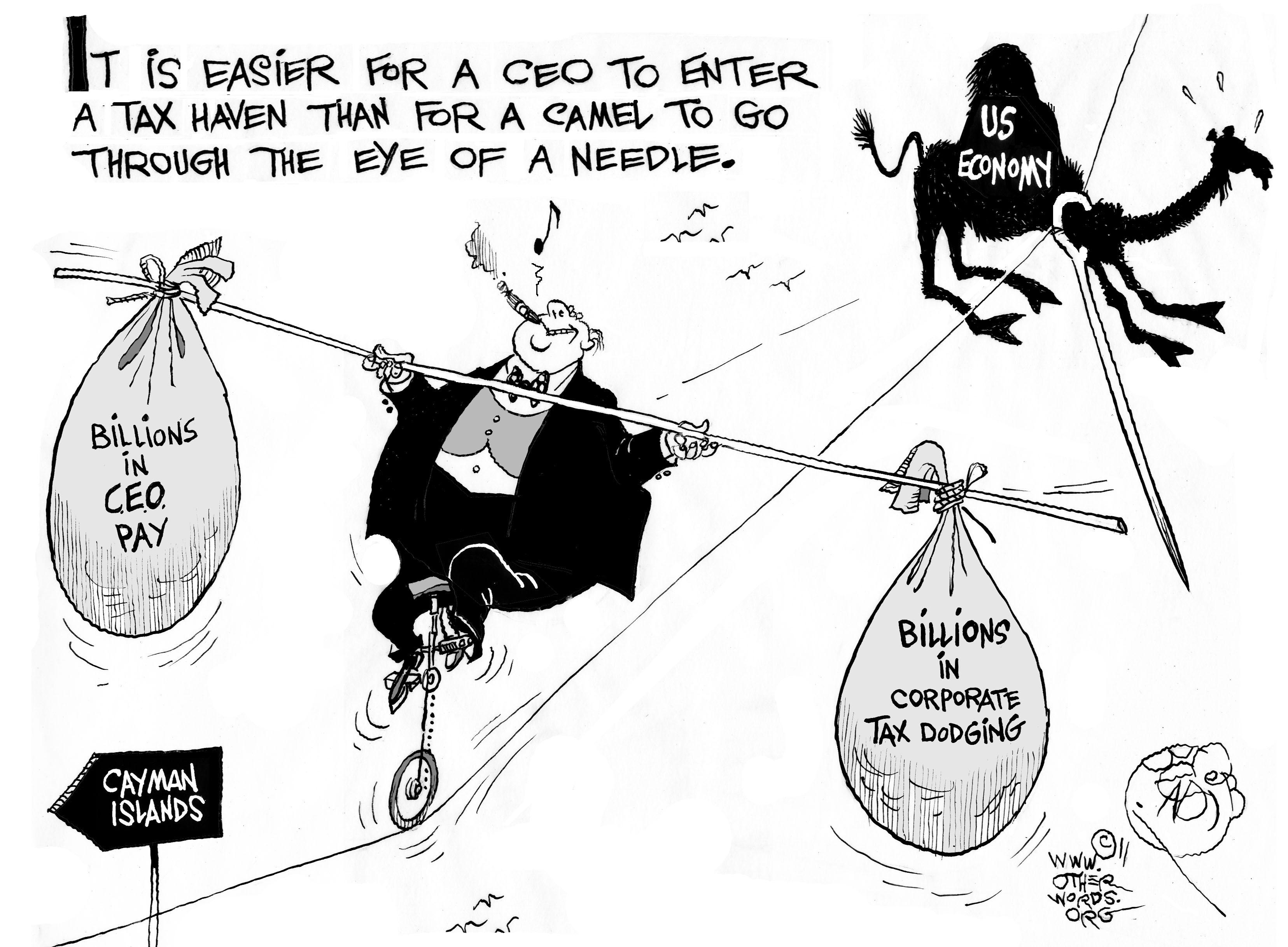

Inequality and CEO Pay

The program collaborates with a broader IPS team to produce Inequality.org and a related weekly newsletter that highlights the latest data and the sharpest strategies to reverse extreme inequality in the United States and around the world. The program is also a leading resource on one key driver of inequality — runaway CEO pay. For more than two decades, our annual report series “Executive Excess” has drawn extensive media coverage to the issue of CEO pay and practical solutions. A newer report series, “A Tale of Two Retirements,” is the first to track the staggering gap in retirement benefits between wealthy CEOs and ordinary Americans.

Trade, Investment, and Mining

The program works with grassroots activists around the world to advance alternative international trade and investment policies that elevate environmental, human, and labor rights above narrow corporate interests. In recent years program staff have played a lead role in supporting a successful campaign in El Salvador to defend against global mining corporations’ attempts to steamroll local resistance to harmful extractives projects.

Black Workers Initiative

The Black Worker Initiative aims to help expand opportunities for black worker organizing and thereby greatly contribute to the revitalization of the U.S. labor movement as a whole. This program is deeply committed to helping achieve both the historic and contemporary aims of the labor and civil rights movements.

Wall Street and Global Finance

IPS staff play lead roles in coalitions working to restore the financial sector to its proper purpose of serving the real economy. We track the reckless Wall Street bonus culture, for example through our annual “Off the Deep End” report on the size of the financial industry bonus pool versus the cost of paying restaurant servers and domestic workers a living wage. We also advance innovative reforms such as a small tax on Wall Street speculation to curb short-term trading and generate massive revenue for urgent public needs, such as fixing our crumbling national infrastructure.

Low-Wage Workers

IPS staff play lead roles in coalitions working to restore the financial sector to its proper purpose of serving the real economy. We track the reckless Wall Street bonus culture, for example through our annual “Off the Deep End” report on the size of the financial industry bonus pool versus the cost of paying restaurant servers and domestic workers a living wage. We also advance innovative reforms such as a small tax on Wall Street speculation to curb short-term trading and generate massive revenue for urgent public needs, such as fixing our crumbling national infrastructure.

Inequality.org

Inequality.org and a related weekly newsletter are key resources for the public at large, journalists, teachers, students, academics, activists, and others seeking information and analysis on wealth and income inequality. Here, we collect the latest developments on inequality and keep readers abreast of relevant information concerning the widening wealth gap. We highlight stories from activists on the front lines of the fight against extreme inequality and share information that can be used for ongoing campaigns.