Josh worked previously as a Legislative Aide for U.S. Senator Bernie Sanders of Vermont, the longest serving independent in Congressional history, both in his office in Washington, DC and on his successful 2012 re-election campaign. Josh is excited to work in the IPS New England office and enjoys frequent trips to the ocean and the mountains.

Latest

Who Exactly Is Benefiting from the Rise in Stock Markets? Probably Not You.

When we cheer for the growth in stock prices, what we’re really cheering for is the further swelling of the bank accounts of the already wealthy.

Houston, We Have an Inequality Problem

Houston, Texas has been segregating at a rapid pace. Unfortunately, the twin ills of rising inequality and increased gentrification have become too familiar in urban America.

Why Not Tax Heirs Directly?

Children born to poor parents have little real chance at becoming rich — or even middle class. A federal inheritance tax could help solve this.

How a Global Tax on Billionaires Could Help End Extreme Poverty

New paper makes the case that a global tax on concentrated wealth is ethical, politically viable, good for growth, and could solve a lot of the world’s problems.

Health Care Repeal Is a Stealth Tax Break for Millionaires

If Obama’s health law is reversed, taxes will go down for the rich and up for the poor, while millions lose coverage.

Reducing Inequality in the Trump Era

With Washington looking hopeless, it’s up to local communities to close the gap between the richest and the rest.

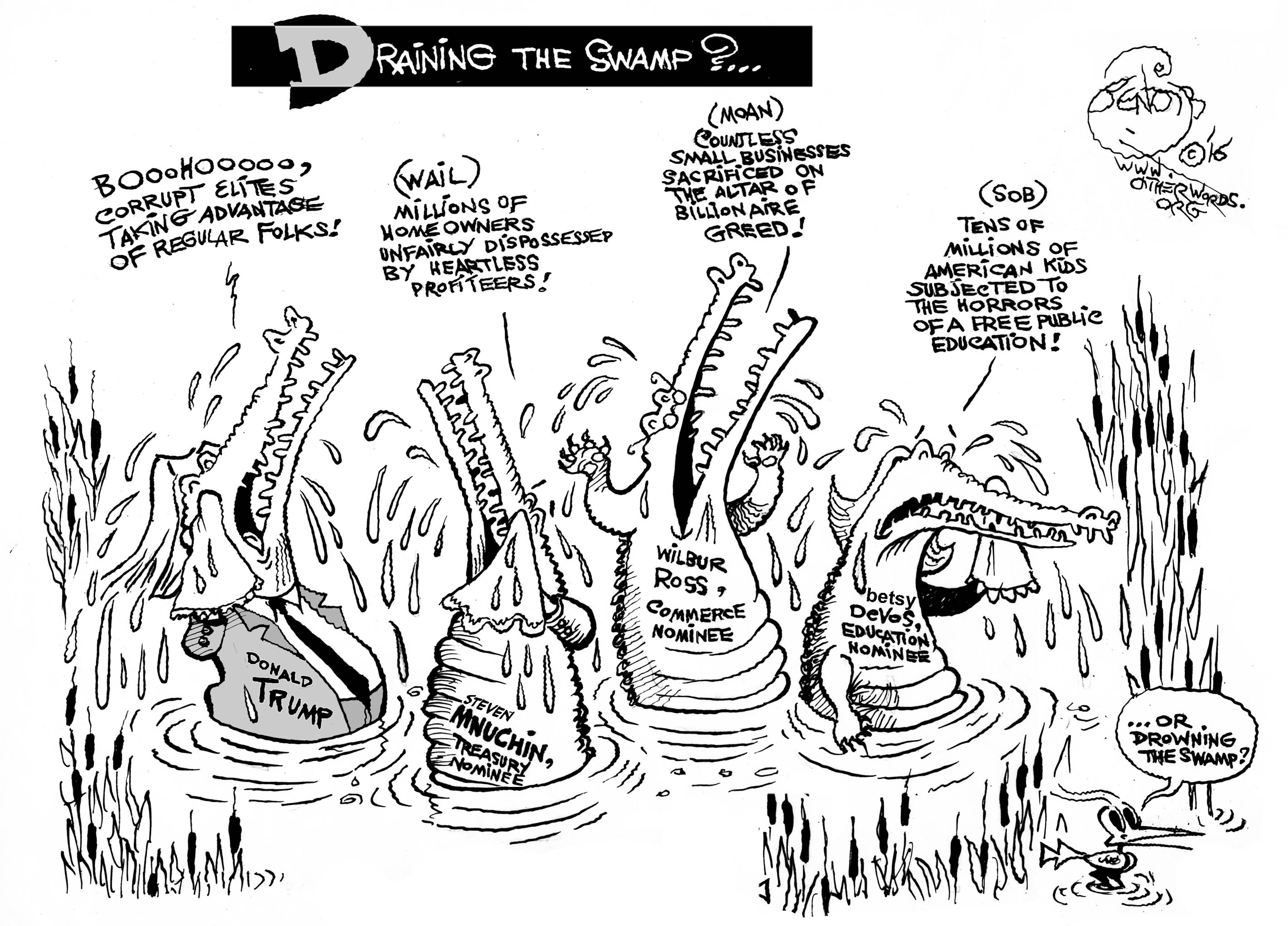

Who Voted for Wall Street?

Trump railed against Wall Street bankers on the campaign trail. Now they’re joining his administration.

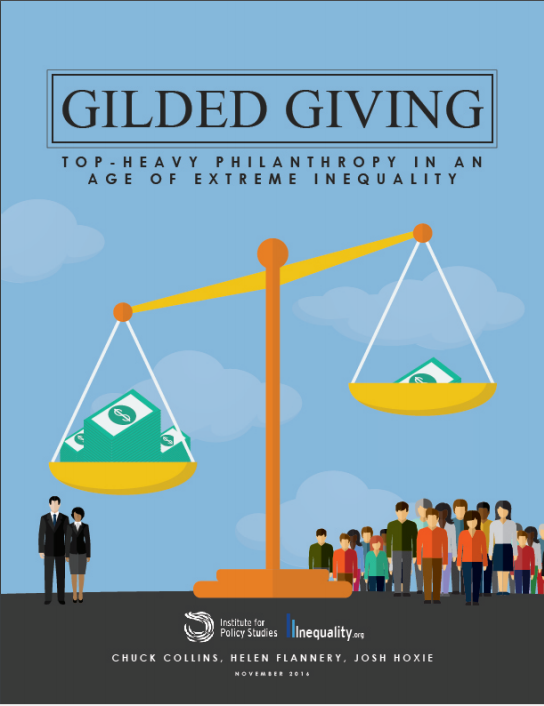

New IPS Report Warns of Increasingly Top-Heavy Philanthropy

Concentrated Giving by Wealthy Donors along with Falling Donations by Non-Wealthy Pose Risks to Independent Sector and Civil Society

Report: Gilded Giving

Top-Heavy Philanthropy in an Age of Extreme Inequality

Minimum Wage Increases Won Big in 2016

Here’s how the key inequality-related ballot initiatives we were tracking turned out.

Inequality Gave Rise to Donald Trump’s Presidency

But few of the 60 million Americans who cast their votes for Trump want to see a more top-heavy America.

Ballot Initiatives to Watch if You Care About Inequality

On Nov. 8, voters in many states will weigh in on a variety of inequality-related issues, from taxing the wealthy to price-gouging on drugs.

Our Society is Unequal By Design

A new book from veteran researcher Dean Baker looks at the rigged rules that drive wealth to concentrate in fewer and fewer hands.

New President Must Make Tax Reform a Top Priority

After the election, we need to focus on forcing the next president to address inequality and fix our upside down tax code.

The Debate’s Top Five Inequality Moments

Inequality circled near center stage as 100 million viewers watched the two candidates debate what to do about America’s huge — and still growing — economic divide.

Another For-Profit College Folds

The closure of ITT Tech should be a warning to other educational institutions looking to make a dime at the expense of students.

Americans Want to Be More Equal

Economic inequality is a problem that unites voters across partisan lines.

What’s Hiding in Trump’s Tax Returns?

A fair and just tax system is an essential part of our social contract, and nowhere in that contract does it say “billionaires exempt.”

A Post-Racial Society Wouldn’t Have an Increasing Racial Wealth Divide

It’s simply not true that race plays less of a role in economic inequality than it did in previous generations, Josh Hoxie tells the Real News Network.

America’s Staggering Racial Wealth Gap Is Getting Worse, Not Better

New report suggest without public policy reform, the wealth divide between white, black and Latino families will continue growing.