Small business owners like me have for too long served as poster children for a misleading campaign led by the super wealthy to weaken or abolish the estate tax. I’m the proud owner of Maine’s Borealis Breads, and I want to make something crystal clear: The estate tax impacts neither me nor the vast majority of small business owners. In fact, I support a stronger estate tax.

In 2009, a married couple could leave $7 million tax-free to their heirs. Most small business owners’ annual incomes are too little to accumulate enough wealth to pay the estate tax. In 2009, individuals earning less than $82,000 declared 95 percent of all small business income, according to the Congressional Research Service. It should then be no surprise that the nonpartisan Tax Policy Center estimates that fewer than 100 American small business or farm estates were expected to pay the estate tax in 2009.

A provision in the tax cuts passed under President George W. Bush made 2010 the first year since 1916 that estate taxes were not levied, resulting in the loss of billions of dollars in federal revenue. For generations, even with the estate tax in effect, families have been able to pass their small businesses and farms onto their descendents. These same generations of small family businesses have enjoyed and benefited from the unprecedented opportunities found in America.

A provision in the tax cuts passed under President George W. Bush made 2010 the first year since 1916 that estate taxes were not levied, resulting in the loss of billions of dollars in federal revenue. For generations, even with the estate tax in effect, families have been able to pass their small businesses and farms onto their descendents. These same generations of small family businesses have enjoyed and benefited from the unprecedented opportunities found in America.

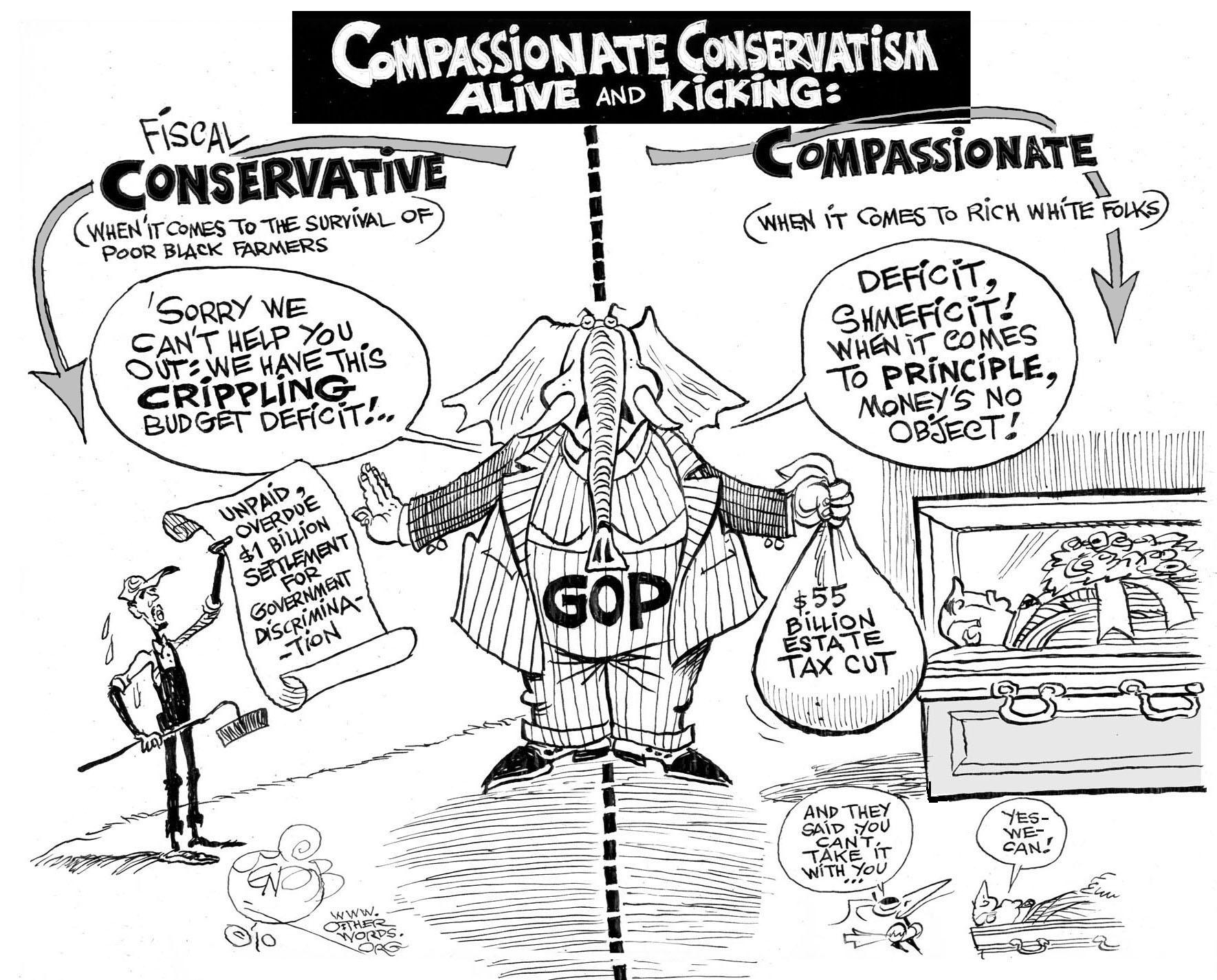

So if the estate tax has no real impact on an overwhelming majority of small businesses, why then do its opponents so adamantly assert that it does? I believe the answer to that question is that opponents are trying desperately to convince average Americans that they’ll be affected by the estate tax. In reality, the estate tax is deliberately designed to affect only society’s wealthiest households.

It’s no coincidence that the underwriters of the anti-estate tax campaign are heirs to some of the largest private fortunes in the world. The Nordstroms, Waltons, Marses, and other extremely rich families have spent tens of millions of dollars lobbying Congress to repeal the estate tax. They’re vying for the right to pass billions in wealth from huge corporations like Wal-Mart to their descendents in perpetuity, without any tax responsibility. Wal-Mart and corporations like it hurt small businesses. They drive us out of our communities and impede our ability to successfully compete in local markets. It’s unreasonable to give tax breaks to a few extremely wealthy families while Main Street business owners like me struggle through this recession.

The estate tax is a boon to small businesses. The estate tax revenue that comes from extremely wealthy families can fund things like small business and student loans so future generations of entrepreneurs have opportunities to secure their own prosperity. Moreover, small businesses like mine rely heavily on the health of the public sector. Well-maintained highways, telecommunications, and legal systems are all critical components of any small business’ ability to succeed.

The absence of an estate tax in 2010 has allowed the late George Steinbrenner to pass over 1 billion tax-free dollars to his heirs, even when taxpayer subsidies made building the new Yankee Stadium possible. Public investment enabled Steinbrenner’s business to survive and expand, so it makes sense that his estate should be required to give back to public coffers.

We must make more public investments that will strengthen our economy, and the estate tax is one way to make that happen. That’s why I support the Responsible Estate Tax Act (S.3533), sponsored by Sens. Sanders, Harkin and Whitehouse. This bill would keep the 2009 exemption of $3.5 million per spouse, and tax amounts above that at 45-55 percent, with a 65 percent rate for billionaire couples, allowing for the highest revenue collection of any estate tax proposal.

Our nation is struggling economically. Don’t let opponents of the estate tax frighten you. The estate tax is good for small businesses and helps to facilitate the economic dynamism that has defined American markets. Recovery and prosperity demand a marketplace in which small businesses can emerge and compete. Progress requires a tax system that creates opportunities for all and helps to ensure that wealth and prosperity are broadly shared, and not just reserved for the likes of the Waltons and Steinbrenners.