ote: this is an updated and expanded version of an article that first appeared in Inside Philanthropy in March, 2021. Recent reports and responses from National Philanthropic Trust and other DAF sponsors have only underscored just how poorly they’re responding to critiques that we and others have raised.

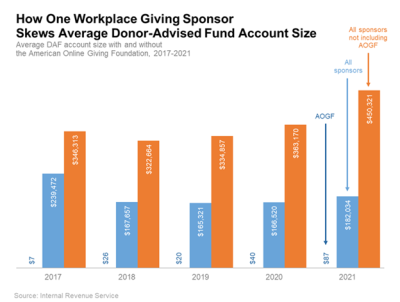

One of the more disingenuous arguments that supporters of donor-advised funds (DAFs) make is that DAFs help to “democratize philanthropy” by serving as vehicles for smaller donors, not just the wealthy. As evidence, they note that the size of the average DAF has been trending downwards—from $279,479 in 2017 to $182,842 in the latest report from National Philanthropic Trust (NPT).

Leaving aside the bizarre notion that someone with over $180,000 to give away in charitable donations is in any way a small donor, the figures are misleading. And they highlight the lack of transparency in the aggregate figures the industry reports provide (or, indeed, in the IRS form 990s on which they are largely based). As critics frequently point out, whether describing account sizes or payout rates, the sweeping averages that industry leaders cite fail to provide a clear picture of how these giving mechanisms truly function.

Regarding the question of donor size, it’s like the inverse of the “Bill Gates walks into a bar” adage.

An updated version of that old saw might go, Elon Musk walks into a bar and all the patrons suddenly become billionaires (on average). The case of the DAF reports is the opposite: By crowding the bar with masses of small donors, they want us to believe Musk isn’t nearly as wealthy as he actually is, “because averages.”

If you brought 750,000 people into Elon’s place and averaged their wealth, Musk’s worth would drop to a mere fraction of his $147 billion. (Of course, Musk has recently succeeded in bringing down his net worth all by himself.)

Similarly, in its recent annual donor-advised fund reports, NPT has been adding in literally hundreds of thousands of workplace giving accounts that are administered as donor-advised funds by American Online Giving Foundation (AOGF). Throw these into the mix and, poof, the size of your average DAF account shrinks dramatically:

These small accounts are great vehicles for spurring and managing automatic payroll deduction contributions and employer-matching donations through workplace giving programs. And they are an entirely different animal than the mini-foundations that most other DAFs have become and that have raised such strong concerns for reformers.

Participating employees do not stash hundreds of thousands or millions of dollars into charitable accounts to maximize their tax deductions, and virtually all of the money that comes into the accounts goes out to working charities in the same year.

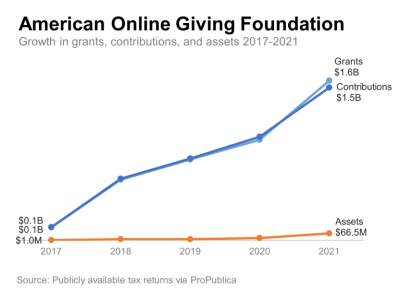

In its most recent publicly available filing (fiscal year ending March 31, 2021), AOGF reported that its 766,186 funds received $1.5 billion in contributions and granted $1.6 billion to charities, or 105% of those contributions. At the end of its prior fiscal year, AOGF reported the total assets in its DAF accounts as only $21,661,006. Using the payout rate formula preferred by NPT and other DAF sponsors (current year grants divided by prior end-of-year assets), AOGF’s rate would be 7,171%.

Using a more rational formula suggested by Ray Madoff of Boston College Law School and James Andreoni of the University of California at San Diego, the rate would be a far more intelligible 96%. As Madoff and Andreoni point out, the commonly used payout formula is another source of problematic data on DAF activity.

But for our purposes, the point is that AOGF is clearly operating differently than most other DAFs: it’s not warehousing wealth in any way, shape, or form. Workers donate money from their paychecks to their preferred charities. By contrast, the rest of the DAF world’s average payout rate would be a mere 16%.

In other words, 84% of available assets remain in the DAFs rather than being distributed to working charities. You can see how averaging these types of funds together presents a skewed picture of donors and their giving habits.

Why does this matter?

22 percent of all individual charitable dollars are now given to donor-advised funds – an industry that is dramatically under-regulated compared to private foundations. The trend is especially worrisome as wealthy donors use DAFs to evade the rules and transparency that govern foundations, much the same way investors use offshore locations and shell companies to operate out of reach of U.S. or European financial regulators.

This is why accurate information on the size of individual DAF accounts matters. Few would claim that modest sized accounts – like workplace giving accounts that move a couple of thousand dollars a year from payroll deductions to working charities – are using those accounts to hoard money while taking advantage of immediate and preferential tax breaks.

Lumping hundreds of thousands of these modest givers in with the overall DAF statistics allows NPT and opponents of reform to vastly understate the average size of DAF accounts. This is especially true within the “national charity” category where NPT includes the workplace giving accounts. NPT claims that the average size of a DAF account for these sponsors in 2021 was around $134,000. But if you take out those 766,186 AOGF accounts from the calculation the size soars to over $416,000.

And what about those crowds who flooded Elon’s bar? Using NPT’s formula, the average size of an AOGF account would be $87. Again, workplace giving accounts are not there to warehouse charitable assets, and should be counted in a category of their own. That would both give them their due and also highlight the ever-increasing accumulation of assets in the other DAF categories.

In contrast to the workplace giving accounts, the data for the other categories reveal a fundamental design flaw in DAFs: they have no mandated payout requirement. Donors get a tax deduction when they place funds in a DAF but have no incentive to move funds to an active charity. This is what leads to warehousing.

Policymakers are considering new proposals to spur charitable giving — among them, a push to require DAFs to have minimum payouts to discourage the warehousing of wealth. A vast majority of voters would support such a proposal. The debate is clouded, however, by misleading and confusing data on what current DAF payouts actually are and who benefits from the advantages these giving mechanisms offer.

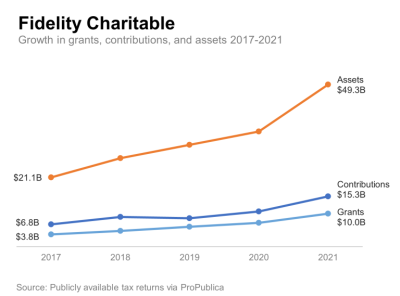

Were the industry as a whole moving money the way the workplace DAFs do there would in fact be far less need for reform. But that’s simply not the case. Consider the contrast between the sponsor that manages the most DAF accounts (AOGF) versus the one that manages the most DAF assets (Fidelity) in the following charts:

While AOGF’s contributions and grants grow sharply and in tandem, its assets remain relatively flat: almost all of the money that comes in moves out again quicky. By contrast, consider Fidelity, whose growth in assets far outpaces its growth in grants – a recipe for warehousing:

The difference between these models is striking – and is precisely what NPT’s reports obscure. This is how NPT responded to our 2021 critique:

We are always evaluating ways to evolve and improve the Donor-Advised Fund Report—including how to categorize each DAF sponsor. The DAF Report first noted workplace giving models in 2018 and has reported on their continued rise in popularity in the years since. We recognize this trend has a significant impact on the DAF sector and has implications for our peers in the nonprofit world. We welcome all suggestions, including reconsidering criteria for the DAF sponsor categories in future reports. We take seriously our responsibility to accurately report the data and make meaningful observations in the DAF Report.

In the nearly two years since our original article in Inside Philanthropy appeared, however, NPT has not changed its treatment of the workplace giving accounts at all, raising questions regarding just how seriously they take this responsibility. In fact, when the Chronicle of Philanthropy’s Alex Daniels covered NTP’s most recent 2022 report and included similar critiques from Ray Madoff, NPT CEO Eileen Heisman wrote back taking issue with the Chronicle’s coverage:

The report has always included every type of DAF model and sponsor. We include DAFs that operate differently, as they all represent alternative uses of this flexible vehicle. We believe the workplace DAF donors and the nonprofit organizations they support should be included. The DAF marketplace has changed over the years, and we wish to capture that change.

This a flashing red herring: the issue isn’t whether to include workplace accounts, but how to include and report on them. NPT continues to obscure the data on workplace DAFs and so the critiques remain valid. And, as the Chronicle noted in reply to Heisman, NPT has a self-interest in papering over the distinctions between the workplace accounts and their own model, and fails to adequately take into account more recent reports whose methodology differs from their own:

Heisman suggests the Chronicle erred in quoting experts who recommended that the study include account-level data because such information is not publicly available. That is true, but other researchers, notably the Council of Michigan Foundations, conducted a well-publicized study by obtaining access to such data. As for Heisman’s concern that it was misleading to include a quote from an expert about whether the trust has an agenda, the Chronicle’s goal was simply to explain that the National Philanthropic Trust runs donor-advised funds itself and to help our readers understand the background of the research, as we do with all studies.

The Council of Michigan Foundations study (June, 2021) was one of several groundbreaking reports in the past couple of years, alongside a wider study of community foundation DAFs by the DAF Research Collaborative (DAFRC) in March, 2022, and, the most comprehensive to date, a report on DAF sponsors in California by the state Attorney General’s office in October, 2022.

These new reports’ major innovation is that, as the Chronicle notes, in all three cases researchers were able to analyze data for a large sample of individual DAF accounts, not just aggregated figures for each sponsor. This increased access to account-level data reveals just how misleading NPT’s aggregated and cherry-picked data can be. For example:

- In 2020, 57% of the DAF accounts in the Michigan study paid out less than 5% of their assets, and 35% did not make a single grant to a charity.

- The median 4-year payout rate for all DAF accounts in the DAFRC report was just 11% – just half the average aggregate rate NPT and other industry reports boast. And 35% paid out less than 5%.

- The California AG report showed that an average 42% of community foundation DAF accounts paid out less than 5%.

Community foundations have argued that their payout rates are so low because of the number of endowed DAFs they manage. Alongside the workplace giving accounts, this is another category of DAFs that remains largely unstudied, and it goes unmentioned in NPT’s reports. One reason is that information on them is not included in the IRS 990 forms on which those reports rely – a flaw that should be corrected with greater transparency in IRS reporting.

The payout rates for these endowed DAFs is generally even lower than the 5% distribution requirement for private foundations. For some sponsors 5% is the maximum rather than the minimum distribution rate, while for others the maximum can be as low as 4% or 4.5%. A recent DAFRC sample found the average was 4.4%.

This is a much better apples-to-apples comparison with private foundations than the broader averages, since most DAFs are not endowed. And it undermines the industry’s assertion of how much greater DAF payout is than that of private foundations.