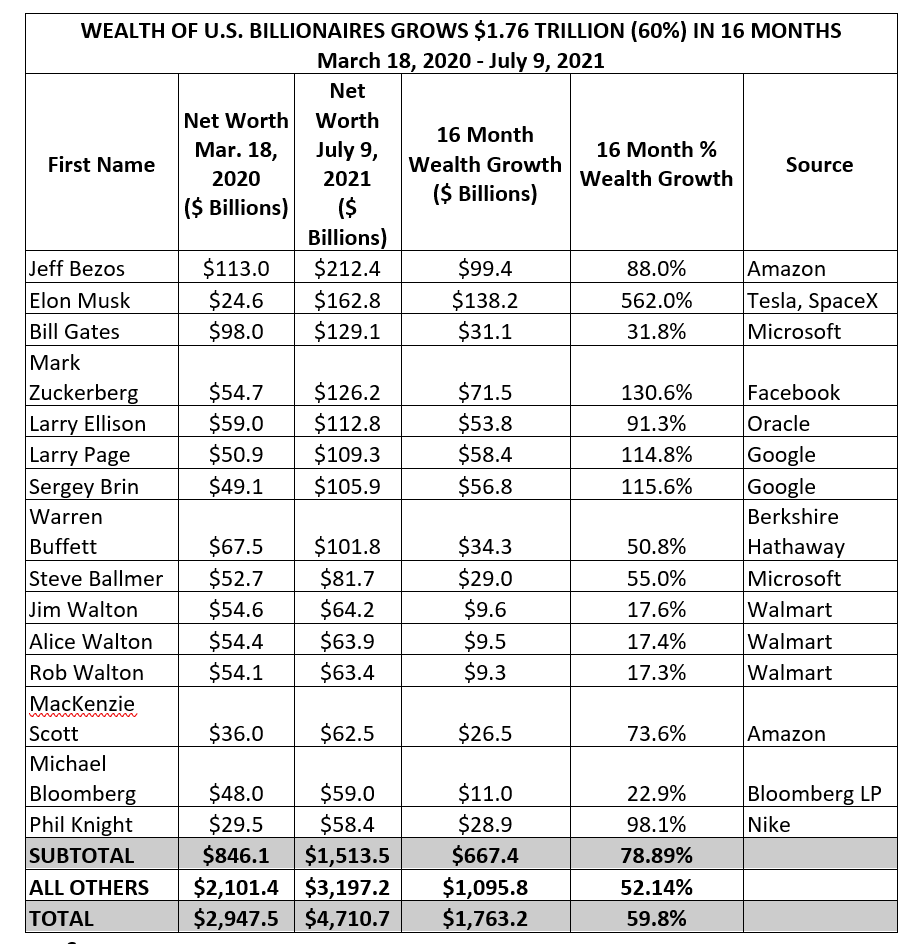

Over the last 16 months, since the formal beginning of the pandemic lockdown, the combined wealth of 713 U.S. billionaires has surged by $1.8 trillion, a gain of almost 60 percent. The total combined wealth of U.S. billionaires increased from $2.9 trillion on March 18, 2020 to $4.7 trillion on July 9, 2021.

Billionaire wealth has steadily increased since 1990, but one-third of their wealth gains have occurred during the pandemic. U.S. Billionaire wealth increased 19-fold over the last 31 years, from an inflation adjusted $240 billion in 1990 to $4.7 trillion in 2021.

See the full analysis prepared by the Americans for Tax Fairness (ATF) and the Institute for Policy Studies (IPS) analyzing Forbes wealth data. A table of the Forbes data can be found here and a table of the top 15 billionaires is below.

The Institute for Policy Studies Program on Inequality (www.inequality.org) has been tracking billionaire wealth gains, in conjunction with our partners at the Americans for Tax Fairness, since the April 2020 publication of Billionaire Bonanza 2020: Wealth Windfalls, Tumbling Taxes, and Pandemic Profiteers.

This provides a case study of what’s broken with our current economic and tax systems, as Democrats in Congress rework President Biden’s plan to invest in America’s families by more fairly taxing the rich and corporations.

This rise in billionaire riches alone could almost entirely pay for President Biden’s proposed family investment plan.

This includes the $1.8 trillion ten-year cost of the American Families Plan’s vital investments in education, childcare, healthcare, nutrition and more for tens of millions of Americans. Billionaire pandemic wealth gains are also one-half the $3.5 trillion rumored cost of the investment package that Democrats in the U.S. Senate may put up for a vote as early as next week.

The $138 billion wealth growth of Tesla founder Elon Musk alone could cover the ten-year costs of tuition for 5.5 million community college students and feeding 29 million low-income public school kids over the summer — and still leave Musk $4 billion richer than he was before COVID.

But very little if any of that ballooning billionaire wealth will ever be put to such public use. That’s because even though such asset growth is the main source of income for the rich, under current rules almost none of that income will ever be taxed.

ATF and IPS have tracked the pandemic-era growth in fortune of the nation’s richest individuals since summer of 2020. This latest report covers the period March 18, 2020 through July 9, 2021. The billionaire wealth bonanza over the past 16 months is particularly shocking when contrasted with the coronavirus misery of ordinary Americans: over 83 million have lost jobs, almost 34 million have been sickened by the virus, over 600,000 have died from it.

President Biden has proposed tax reforms that would more fairly tax the wealthy, including billionaires, and the big corporations they own through their stock holdings. Because Congressional Republicans have universally rejected such reforms — despite overwhelming public support for them –Democrats are now working out a tax-and-spending plan that can pass without GOP votes.

The virtual tax-free status of billionaire wealth growth was highlighted last month by a report from ProPublica. It revealed that 25 top billionaires paid on average only a tiny share (3.4 percent) of their wealth-growth income in federal taxes and that several, including Jeff Bezos (as of July 9 worth $212 billion) and Elon Musk (around $163 billion), went multiple recent years paying zero federal income.

Because of gaping loopholes in the tax code, increased wealth like that enjoyed by America’s billionaires and the richest 1 percent can go untaxed forever and even when it is taxed the rate is about half that of wage income. President Biden would end those special breaks for millionaires and billionaires as part of his plan to tax wealth and not just work.

Among Biden tax reforms that would tap some of this billionaire wealth growth are:

- Raising the corporate tax rate to 28 percent (Revenue raised over 10 years: $858 billion) Corporate taxes are largely paid by the owners of corporations, which means the stockholders in the companies. Billionaires are among the wealthiest 1 percent that own over half of all corporate stock.

- Curbing offshore corporate tax dodging ($1 trillion) Biden would raise by half the U.S. corporate tax on the foreign profits of American firms and make it harder for corporations to game the system with phony headquarters’ shifts and accounting that exploits offshore tax havens.

- Reforming the taxation of capital gains ($324 billion) Growth in wealth such as billionaires have experienced is a kind of income known as “capital gains.” That kind of income currently enjoys special tax treatment, including a nearly half-off top tax rate and the possible avoidance of all tax on a lifetime’s worth of gains. For those making over $1 million a year (which very likely includes all billionaires), Biden would end the tax-rate discount and require lifetime gains be taxed before the underlying assets are passed to the next generation.

Americans wholeheartedly support Biden’s proposed tax reforms. A poll from June from ALG Research and Hart Research found that two-thirds of the public endorse higher taxes on the wealthy and corporations; respondents believed by over a two-to-one margin that higher taxes on the rich and big firms would help the economy; and by a seven-to-one ratio, poll participants preferred paying for Biden’s proposed investments through such tax reforms rather than adding the cost to the national debt.

A more direct way to tax billionaire wealth is to tax the wealth itself instead of just its growth. If the wealth tax proposed by Sen. Elizabeth Warren had been in effect in 2020, billionaires alone would have paid $114 billion for that year — and would pay an estimated combined total of $1.4 trillion over 10 years.

March 18, 2020 is used as the unofficial beginning of the coronavirus crisis because by then most federal and state economic restrictions responding to the virus were in place. March 18 was also the date that Forbes picked to measure billionaire wealth for the 2020 edition of its annual billionaires’ report, which provided a baseline that ATF and IPS compare periodically with real-time data from the Forbes website. PolitiFact has favorably reviewed this methodology.

March 18, 2020 data: Forbes, Forbes Publishes 34th Annual List Of Global Billionaires” March 18, 2019 July 9, 2021 data: Forbes, “The World’s Real-Time Billionaires, Today’s Winners and Losers,” accessed July 9, 2021.