Billionaire Enabler States: How U.S. States Captured by the Trust Industry Help the World’s Wealthy Hide Their Fortunes

Kalena Thomhave | Chuck Collins

Introduction:

After Russia’s invasion of Ukraine, Ukraine’s allies zeroed in on a possible weak spot for the attacking country: the hidden fortunes of Russian elites. Russian wealth has been parked in assets such as homes, apartments, art, yachts, and more — from oligarch Igor Makarov’s private trust company in Wyoming to Igor Sechin’s superyacht docked in France.

Oligarchy, however, is not confined to Russia. The clandestine world of financial secrecy stretches around the world, all the way back to the United States. And if Russian oligarchs can enjoy the tax haven of the United States, that means that elites from all over the world — including from the United States itself — can too.

Our research at the Institute for Policy Studies has shown that billionaire wealth has skyrocketed over the past several years, including during the pandemic. Since the start of the U.S. COVID-19 crisis in March 2020, known billionaire wealth has increased by more than 50 percent, to nearly $5 trillion. And trillions more are probably secretly sequestered in trusts.

This swelling tide of wealth is not lifting all boats. As wages continue to stagnate and everyday Americans still face health and economic harms from the pandemic, wealth inequality is a yawning chasm.

Trusts are key to this story. These financial vehicles facilitate tax avoidance and evasion and help to entrench the status and fortune of wealthy elites.

The International Consortium of Investigative Journalists (ICIJ) made a splash in October 2021 with the publication of the Pandora Papers, a trove of documents that highlight how the world’s wealthy elites use trusts to evade taxation and hide often-illicit wealth from the public. One of the greatest revelations from the Pandora Papers was that the U.S. has become a major global tax haven.

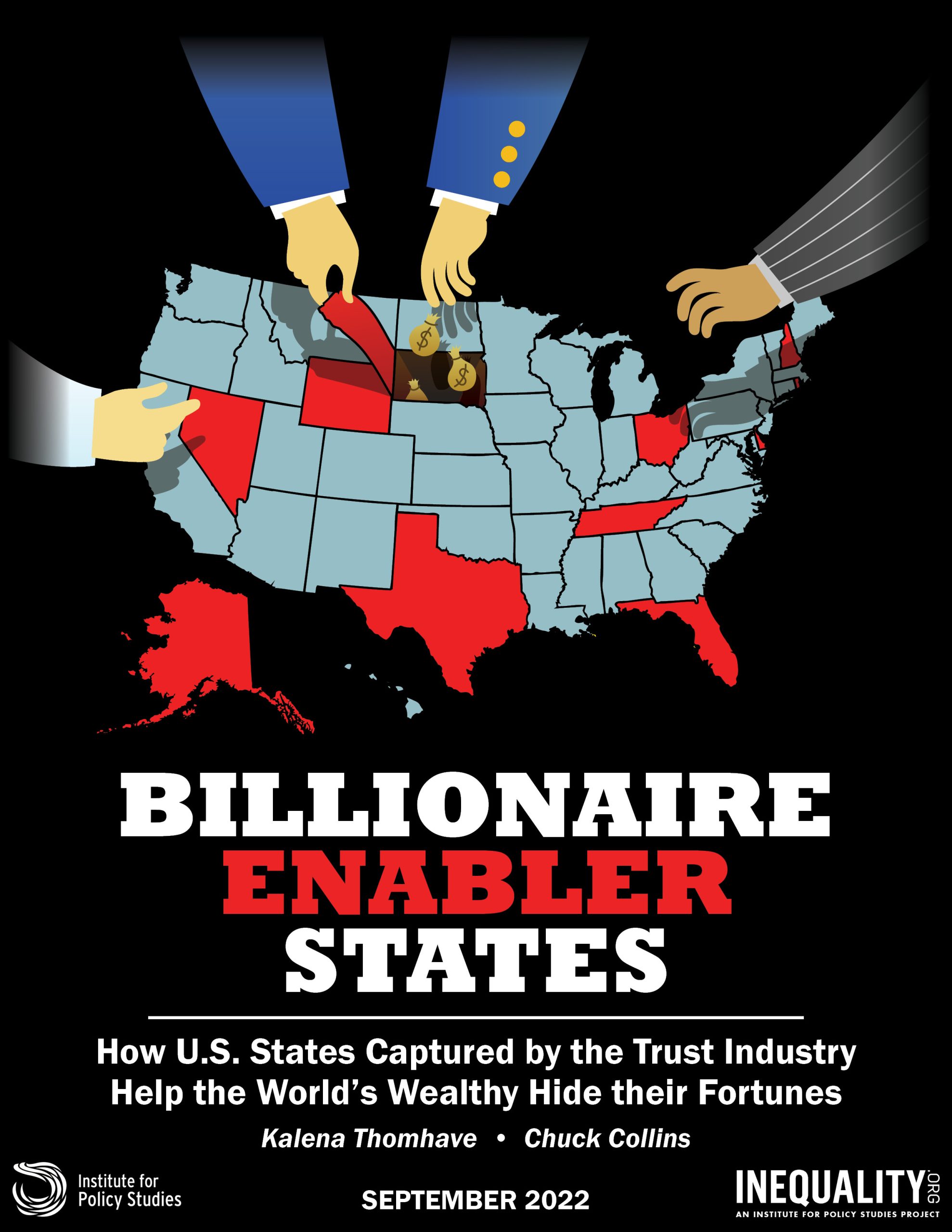

The ICIJ shone a spotlight on several U.S. states at the center of this trust business, aided by an influential trust industry. And each year since 2012, trust and estate lawyer Steve Oshins has compiled a popular list of the top dynasty trust states in the United States.

The most recently published ranking debuted in late 2020: South Dakota tops the list, followed by Nevada, Tennessee, Alaska, Rhode Island and Wyoming (tied for fifth), Delaware and Ohio (tied for seventh), Missouri, New Hampshire, Illinois, and Florida.

Our report looks at each of these states plus Texas in more detail, grouping them into the Biggest Enablers, the Bad Actors, and the Emerging Enablers. We examine how they got there, and what it means for the people who live there.

This shadow system of trust companies in the United States is growing larger, increasingly eroding both tax revenue and public accountability to help the rich get ever richer. The concept of the “offshore” tax haven has very much washed ashore.

Read the full version of this report for more information on trusts, the states that enable them, and what to do about it.

Key Findings

The U.S. hosts an estimated $5.6 trillion in trust and estate assets.

- Much of these assets belong to the uber-wealthy — both international and domestic — and are held in trust in states subservient to the trust industry.

U.S. trust-subservient states enable illicit wealth hiding and tax avoidance.

- As the International Consortium of Investigative Journalists’ Pandora Papers investigation revealed, some U.S. states have allowed international kleptocrats to avoid accountability at home and hide their ill-gotten wealth abroad.

- These states also enable wealthy Americans to avoid federal taxation, cheating the U.S. out of revenue with which it could combat poverty or invest in infrastructure.

- Trusts, therefore, affect every U.S. citizen and resident.

- These states pass laws to cut or abolish taxes or hide trust records from prying eyes.

- More than two thirds of states allow trusts to last for at least 150 years or forever.

- Additionally, more than a third of states allow trusts to be established by the person benefiting from the trust, shielding their assets from creditors and tax authorities.

There is a significant correlation between regressive state taxation systems, which hurt the poorest residents, and trust-subservient state laws.

- Of the 13 states captured by the trust industry we have profiled here, eight are among the 15 most regressive tax states in the country.

- These states often cut taxes for the wealthiest and instead rely on the poor to pay a disproportionate amount of their income in taxes.

The trust industry says it simply helps its clients obey laws — but it often writes the laws.

- Trust and estate lawyers regularly lobby state legislatures and sometimes work in official capacities with states to write legislation favorable to the industry.

- In small states with part-time or “citizen” legislatures, there is no countervailing power that matches the clout of the financial services industry.

- This trust deregulation is often bipartisan.

The trust industry offers little benefit to states.

- Though billions may be held in trust in a state, state coffers — and the public — will never see it.

- States charge only small fees to trust companies; the trust industry creates very few jobs; and trust owners have no reason to physically move to or even visit the states where they have established trusts.

- Boosting federal and state oversight of complex trust transactions.

- Requiring trust registration and disclosure.

- Outlawing trusts designed to obfuscate ownership.

- Establishing a federal rule against perpetuities.

- Reforming estate, gift, and generation-skipping taxes.