Peabody Energy filed for bankruptcy today, but its top executives will still be enjoying the millions they pocketed before the collapse of coal.

While it remains to be seen whether Peabody will honor its $1.47 billion in environmental liabilities, the company has ensured its executives won’t have to worry about money for the rest of their lives. In 2015, the Institute for Policy Studies exposed Peabody’s executive compensation cushioning system in our Executive Excess 2015 report.

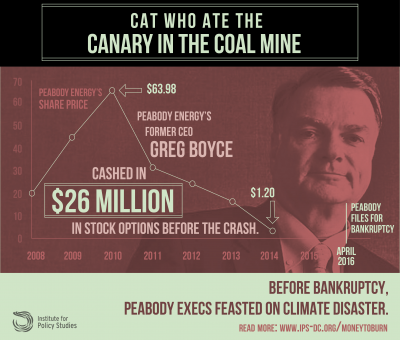

The report found top executives at Peabody cashed in stock options worth $47 million in the four years before their industry began to implode in 2010, with former CEO Greg Boyce pocketing a whopping $26 million. Peabody stock has been trading in recent days at around $2 per share, down from $64 at the end of 2010.

The report found top executives at Peabody cashed in stock options worth $47 million in the four years before their industry began to implode in 2010, with former CEO Greg Boyce pocketing a whopping $26 million. Peabody stock has been trading in recent days at around $2 per share, down from $64 at the end of 2010.

IPS has long criticized stock options and other forms of equity-based pay for offering executives the possibility of hitting massive jackpots while times are good, while shielding them from downside risks.

According to IPS executive compensation expert Sarah Anderson, “Peabody’s former CEO Greg Boyce was like the cat who ate the canary in the coal mine. Before investors caught on to the coming implosion of the coal industry, he managed to cash in tens of millions in stock options that would soon be worth next to nothing. Shareholders and coal industry workers have wound up paying the price.”