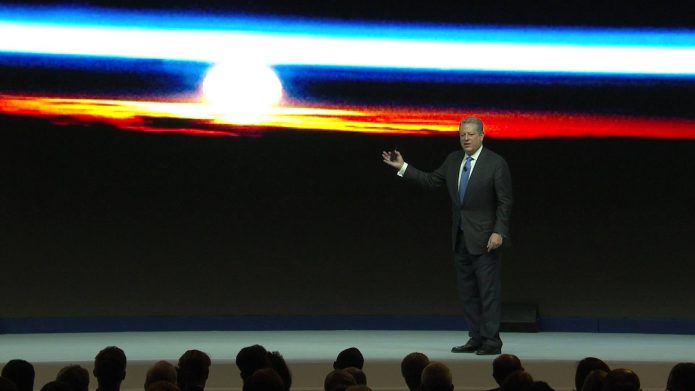

(Image: YouTube)

Remember An Inconvenient Truth?

In addition to proving that people will pay good money to watch a movie costarring Al Gore and a PowerPoint presentation, that Oscar-winning documentary elevated climate change to an issue that everyone should fret about.

In the decade since the movie’s release, Gore’s presentation has grown flashier — and he’s changed, too.

His mild Tennessee accent hasn’t faded, and he doesn’t look older. But the former vice president has cheered up. He’s more confident in humanity’s potential to stop cooking the planet.

“We are going to win this,” he says in his latest Ted Talk. “The only question is how long will it take to get there.”

Why is he so optimistic?

A worldwide transition toward an economy driven by renewable energy instead of fossil fuels is underway and speeding up. Coal-fired power plants are closing across the United States, China, and other countries. Within one or two decades, electric vehicles could become dominant. Once that happens, Big Oil will be stranded on the side of the road and out of gas.

At the rate solar and wind power are expanding due to innovation and rapidly declining installation costs, those industries may start growing with the velocity that led mobile phones to eclipse landlines in developed countries and leapfrog older technology in the Global South.

Here in the United States, the government is touting the returns on its clean-energy investment in the 2009 stimulus package. That burst of federal money helped jack up solar electricity generation by a factor of 30 and triple the watts powered by wind, the White House says.

The wind and solar rushes could proceed at an even faster pace now, thanks to the extension of targeted tax credits in late 2015.

“This is the biggest new business opportunity in the history of the world,” Gore declares. “We are seeing an explosion of new investment.”

When he says “we,” he means it.

A few years after he left the White House with less than $2 million to his name (that’s “dead broke” in Clintonese), Gore co-founded the Generation Management investment firm with Goldman Sachs veteran David Blood. Their “Blood and Gore” global equity operation, with $12 billion in climate-conscious assets under management, outperforms most of its competitors. Gore’s net worth has reportedly rocketed to $200 million.

And “explosion” is right. Solar, wind, and other green energy options drew a record total of $329 billion in investment last year, despite stiff competition from bargain prices for oil, natural gas, and coal.

Meanwhile, fossil-fuel bastions are growing defensive and desperate.

T. Boone Pickens sold all of his oil holdings in early February. The oil baron cashed in just days after defying most energy experts by predicting that oil prices will rebound to $100 a barrel before long. Now, he says he won’t invest in the industry again until crude inventories start to fall.

That will take a while. U.S. commercial stockpiles recently hit the 500-million-barrel mark, higher than any time since 1930 — at the height of the East Texas oil boom.

As for desperate, what else can you call Saudi oil minister Ali Al-Naimi’s dramatic effort to rebrand petroleum by drawing parallels to the Star Wars franchise’s bad guys?

“For too long the oil industry has been portrayed as the Dark Side, but it is not,” Al-Naimi declared at an energy confab in Houston the other day. “It is a force, yes, but a force for good.”

As Gore emits more optimism, the world’s most powerful oilman is spouting hot air.