The debate in the United States on global climate change is shifting from whether to do something about the problem to what to do.1 Prudent people do not want to risk unacceptable adverse economic impacts, even if they are extremely concerned about global climate change. On the other side, equally prudent people do not want to risk accomplishing too little. The debate is stymied, even though several bills on global warming have been introduced into Congress. “There will be no climate change legislation coming out of my committee this year,” Senator Pete Domenici (R-NM) recently announced. “Frankly, I don’t know how to write it, and I don’t think anybody does.”2

The conventional wisdom focuses on “cap and trade,” also known as tradable emissions permits. This system sets a cap on total emissions, distributes by allocation or auction to market participants emission allowances (or tradable permits) equal to the cap, and then requires participants to have an allowance for every unit of pollutant they emit. Participants must buy allowances if they don’t have enough, and they may sell them if they have more than they need. The Kyoto protocol, for instance, has instituted a cap-and-trade system for greenhouse gases (GHGs), and the system has been successfully used for reducing sulfur dioxide emissions from existing power plants in the United States.

But this conventional focus on cap and trade is inhibiting progress on combating global warming. The inherent problems with the approach are too formidable. I t is extremely difficult to figure out the economic and environmental effects of an economy-wide cap-and-trade system for GHGs. To avoid negative economic impact, most such cap-and-trade proposals are extremely modest and thus would likely accomplish very little. Also, cap and trade would not work well on a global basis.

Given the irreconcilable problems with cap and trade, we need to transcend the conventional wisdom and shift the debate to a more viable strategy. In FPIF’s strategic dialogue on this issue, William Nordhaus has reached the same conclusion.3 So has Larry Lohmann, though for somewhat different reasons.4

A more viable strategy relies on performance standards for new sources of GHG emissions. These standards would strictly regulate the pollutants from direct sources of emissions such as power plants and autos. They would also mandate greater efficiency for new capital such as appliances and buildings that rely on fossil fuel combustion for the generation of electricity, heating, and cooling.

Standards have been out of favor in recent years because they are not “market based.” But cap and trade is not purely market-based; it requires a great deal of government intervention. Also, the market plays a very large role in meeting standards most cost-effectively. This debate on government versus market, however, is largely beside the point. Performance standards on new sources have proven effective, as demonstrated by the success of the standards on chlorofluorocarbons (CFCs) introduced in the 1980s that reversed the depletion of the earth’s ozone layer.

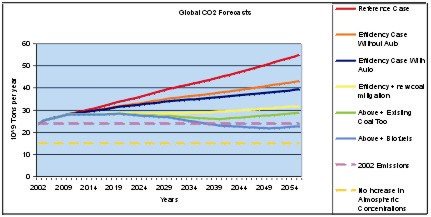

Performance standards on new sources—first in the United States and then globally—can eliminate the huge projected increase in global carbon dioxide (CO2)5 emissions by 2050, since new sources are increasingly responsible for global emissions.Also, performance standards could be supplemented by a more narrowly focused cap-and-trade program on existing power plants, which would further reduce global emissions. After 2050, perhaps supplemented by cap and trade (or an equivalent carbon tax), performance standards could reduce carbon emissions still further by continuing to drive and leverage ongoing technological advances.

Unlike cap and trade, it is relatively easy to predict the environmental and economic effects of performance standards. Relying on standards would allow substantial progress toward reducing GHGs without unacceptable adverse economic consequences. Finally, performance standards can be more easily applied on a global basis.

Unfortunately, the current administration has done very little to address global warming. The proponents of meaningful action have focused on cap-and-trade proposals, which are stalled in Congress. Performance standards can break this deadlock.

Why Not Cap and Trade?

A cap-and-trade system has the theoretical advantage of reducing pollutants most efficiently. Such a system has worked very well in reducing sulfur dioxide and nitrogen oxide pollution from existing power plants in the United States.6 However, just because a cap-and-trade system worked well in the relatively narrow context of existing power plants does not mean that it can work well for greenhouse gas emissions across all sectors of the U.S. economy or across all national boundaries.

Contrary to the conventional wisdom, a cap-and-trade system is not purely market-based. Such a system7 requires a great deal of government intervention in determining the annual cap on total emissions, the ceiling on the price of allowances, how many allowances would be auctioned and how many allocated, and so on. Also, the government would allocate the funds it “earns” from auctioning allowances as it sees fit. If the allowance prices were high enough to stimulate meaningful reductions in CO2, the total value allocated or auctioned by government would exceed corporate income tax receipts in 2004. As such, most cap-and-trade schemes amount to a tax on CO2 emissions where the government spends all the money.

Further, cap and trade has formidable drawbacks. First, it is very difficult to estimate the economic costs and environmental effects of a cap-and-trade system. Second, again contrary to the conventional wisdom, such a system in the United States would probably not work well on a global basis .

Current cap-and-trade system designs use a “safety valve” (or ceiling on the price of an allowance) to limit the economic costs of the program. Such a safety valve establishes a maximum allowance price per ton of emissions. At this price, say $7 per ton of carbon dioxide, a company could buy an unlimited number of additional allowances (or permits to emit) rather than incur the costs of reducing emissions. The lower the safety valve, the higher total emissions would be, and vice versa. Unfortunately, it is extremely difficult to predict either the market price of allowances associated with a limit on total emissions or the total emissions that would result from the “safety valve” price. The problem is simply too complex. We don’t know enough yet and will not for many years.

In 2004, the bipartisan National Commission on Energy Policy proposed a safety valve of $7 per ton of carbon dioxide, apparently believing that this low level was politically acceptable and that it could be raised over time.8 However, this price would not result in meaningful emissions reductions. To stabilize global emissions at current levels by 2050, technologies must be employed to remove at least 85% of the CO2 emissions from new coal-fired power plants.9 This technology costs about $25 per ton of CO2, more than three times the proposed safety valve.10

Also, to stabilize global CO2 emissions by 2050, major efficiency gains would be required in transportation, buildings, and industry. Absent other policies, the allowance price might have to be still higher than $25 per ton to achieve these efficiency gains. This is because purchase decisions of efficiency in these sectors are made as if the financing costs (i.e., the interest on the debt and the required returns on the equity used to make the purchase) are very high. The so-called “behavioral” financing costs—the amount of additional money that people think they have to pay each year in order to buy a more efficient refrigerator or automobile—exceed the actual financing costs.11 In the case of a hypothetical purchase of an automobile that is 50% more efficient in fuel use but costs $1,000 more, the average consumer would only be persuaded to buy the more efficient auto if the value of an allowance (or the tax) were $135 per ton of CO2 (in this example), due to the effect of behavior financing costs.12

A $7 per ton price cap (as proposed by the bipartisan National Commission on Energy Policy) would result in no CO2 control on new coal-fired power plants and inadequate efficiency gains. Our solution for one of the major issues of our time would be much ado about nothing.

A national cap-and-trade system would not, contrary to popular belief, interface well with similar global systems, such as Kyoto. The Kyoto protocol is not going well in Europe, where the Kyoto goals will probably not be met. These countries are accustomed to working with each other in the European Union, and the required institutions already exist. Nevertheless, Europe is having great difficulty in designing and implementing a workable program.13 This does not bode well for the rest of the world, where countries are not used to working together and the required institutions do not exist. “It is highly unlikely that anything approximating the rigor of the US system can be devised to control climate change worldwide,” writes Ruth Greenspan Bell in Foreign Affairs. “Even if a more rigorous compliance regime could be instituted, obtaining accurate measurements of actual emissions would be difficult.”

Also, a cap-and-trade system would invite and support additional corruption by giving countries the opportunity to misuse the enormous value of allowances—globally, over $1 trillion per year (about $35 per ton times over 30 billion tons per year). The leaders of these countries could sell “excess” allowances even if they were not really excess.

In short, we need a better approach that is less risky to our economy, more likely to be effective in stabilizing GHGs, and easier to implement on a global basis. A better approach would rely on performance standards for new sources.

The “Problem” with Performance Standards

Performance standards have been out of favor as not “market based.” However, we have already seen that cap and trade is not a pure market-based approach, since it requires a great deal of government involvement. Further, there is a very large market-based element in an approach that relies on performance standards. Performance standards set the goal and create the market for new technologies. The market participants then figure out how to best serve this market. Just as with cap and trade, the market finds the most cost-effective options. Performance standards do not specify what the technologies should be. But performance standards can and should be technology-forcing and thereby drive the sort of technological innovation that the global warming problem demands. They create the market for new technologies. The market participants develop, select, and perfect the new technologies.

Performance standards do not work particularly well with existing sources. Case-by-case standard-setting for existing sources, such as under the State Implementation Plans (required by the Clean Air Act Amendments of 1970), is a much less efficient and effective process. Cap and trade has proven to be far superior to case-by-case standard-setting for existing sources where retrofits have been required, such as for additional sulfur dioxide and nitrogen oxide controls on existing power plants. The focus of the acid rain program, for instance, was almost exclusively on existing power plants that had viable retrofit options, including switching to lower sulfur coals and installing various kinds of sulfur-removal technologies.14

This experience with performance standards for existing sources may be why standards have fallen into disrepute. But the distinction must be made between existing sources and new sources. Performance standards may not work well for existing sources, but they work extremely well for new sources.

Consider the most famous example, the Montreal Protocol,15 which set standards on a global basis for phasing out the production of CFCs and solved the global ozone-layer problem. Similarly, the Clean Air Act Amendments of 1970 set initial auto emission standards that eventually led to a 90% reduction in emissions at reasonable cost. The corporate average fuel economy (CAFE) standards set new car fleet average requirements, again at reasonable costs. (In retrospect, these standards would have been much more effective without loopholes for “light duty trucks” that permitted the enormous influx of gas-guzzling SUVs. Also, these standards could have been tightened over time so that technological advances could have increased fuel efficiency rather than simply the power and weight of the vehicles.)16

The revised new source performance standards for coal-fired power plants promulgated in the late 1970s used a “sliding scale” to reduce compliance costs. They also did not require one control technology that would have favored coal from one region over another. The result was technological innovation and cleaner new coal plants at reasonable costs. The appliance efficiency standards have accomplished a great deal, without imposing large price increases. The classic example is the refrigerator that uses about 25% of the energy of a 1970 model, despite the required phase-out of the most cost-effective coolant (CFCs). Building efficiency standards have had similar success.

None of these standards picked a technology.17 Whatever technology worked most cost-effectively could meet the new performance standards—and frequently more efficiently than anticipated when the standards were set.

Focus on New Sources

In coming years, most global CO2 emissions will come from new sources—new power plants, new cars, new appliances, new buildings, and new factories. As existing sources are retired and replaced with new sources, they will become a minor part of the problem.18

While mitigating new sources is relatively cheap, mitigating existing sources can be very expensive. Retrofit costs are always higher than including the same technology in the design of a new source. The remaining useful life of the existing source is not as long as for a new source, resulting in a shorter period over which to amortize the higher capital costs. Also, replacing an existing source with a new source is almost always very expensive. Why not simply set performance standards on new sources, including new autos, and leave existing sources alone, since past mistakes can be very expensive to correct?

This focus on new sources would accomplish a great deal. Global CO2 emissions could be stabilized at current levels by 2050, avoiding the projected huge increase in CO2 emissions coming primarily from the developing world. This could be accomplished with little or no attention paid to existing sources. As necessary, programs to address existing sources could be designed, debated, and implemented after effective programs for new sources are already in place, particularly if it turns out that the existing capital stock is more durable than expected and if we believe we must stabilize global CO2 emissions sooner than about 2050.19

After 2050, performance standards, perhaps supplemented by a global cap-and-trade system or a CO2 tax, could reduce global emissions down and below the absorptive capacity of the environment,20 so that atmospheric concentrations of CO2 would begin to decrease.

The U.S. government has much experience in setting performance standards on new sources and can reasonably be expected to do a decent job, given the political will, support, and oversight. It is relatively easy to predict the economic costs and environmental effects of a performance standard on a new source. For each category of new sources, the problem can be narrowly scoped and well defined. Cost and effectiveness data on alternative, existing, and emerging technologies can be readily gathered and assessed.

Performance standards on new sources would have a much less adverse effect on our economy than a cap-and-trade system that addresses existing sources too. Compliance with standards would be required only for new sources, with lower-cost mitigation options. Every year, only a small portion of emissions would be affected by the standards (only the new sources). The much lower costs of performance standards (as opposed to cap and trade) would obviate the difficult “class” concerns raised by Athanasiou and Baer. It is much easier to figure out how to pay for lower costs that are realized gradually over time than for higher costs that are imposed faster.

Performance standards would be much easier to implement and monitor on a global basis. It would be relatively easy to determine whether a new coal-plant has the required control technology or whether a new appliance meets efficiency standards. This would be much easier than trying to figure out, for example, whether a country has allocated only its “target” level of allowances to its sources of GHG emissions, or whether it is consistently ensuring that no source emits more than its allowances, or even whether GHG emissions are measured correctly.

First Steps

The United States is the world’s largest emitter of greenhouse gases, but the growth in GHG emissions will be greatest in developing countries, such as China and India. Before urging other countries, particularly in the developing world, to take meaningful steps to reduce green house gas emissions, the United States must act first.

One meaningful first step would be to set a performance standard on all new coal-fired power plants permitted after the date the legislation is signed into law. This standard would require at least 85% removal of CO2. Coal-fired power plants should be the major near-term target since they emit a great deal of GHGs, many are likely to be built in the next decade or so, and they have a lifespan well in excess of 50 years.

Another meaningful first step would be to set performance standards for average annual new car fleet efficiency—in miles per gallon (mpg) of oil-equivalent or CO2 per mile—that become more stringent over time, such as 30 mpg in 2010 and increasing by 5 mpg every five years. The new car fleet should be defined to include all vehicles used for personal transportation, including “light-duty trucks.”

Another would be to set efficiency standards for new household appliances and new buildings and update them at least once every three years, taking into account the external costs of energy consumption (such as the environment, national security, and our balance of payments). Performance standards should also be applied to new industrial facilities that are major emitters of greenhouse gases, such as cement kilns and refineries, and for processes across all industry, such as electric motors, compressed air, lighting, space conditioning, and waste heat utilization.

The rules implementing these performance standards should be neutral across technologies. They should also take advantage of certain features of a cap-and-trade system. For instance, increased emissions at new plants could be offset by reduced emissions at existing plants; this would simultaneously stimulate the development of retrofit technologies, which may be needed eventually to stabilize global emissions sooner. In the case of the efficiency standards, this flexibility would permit companies to average not only across their own fleet but also across the fleets of other companies as well (enabling trading of efficiency gains).

This basic program would result in meaningful reductions in greenhouse gases in the United States over time, and then these performance standards could be recommended to the rest of the world, particularly the developing countries where most of the growth in emissions will occur. An ultimate goal would be to have a set of performance standards that apply across the globe.

Whether developing countries would follow the U.S. lead with performance standards is, of course, not certain. However, they are more likely to take meaningful steps if the United States, the world’s largest emitter, takes meaningful steps first and if the required steps impose only modest burdens on their economies. Also, an effective global GHG emissions mitigation strategy would be in the self-interest of the major Asian emitters such as China and India, since potential sea-level increases would inundate hundreds of millions of people in these countries.21

Absent leadership from the executive branch, individual states are taking meaningful actions on their own, including an aggressive program in California, the Regional Greenhouse Gas Initiative of Eastern States, and Renewable Portfolio Standards in many states. Coalitions of industry, public interest groups, and concerned citizens (such as the National Commission on Energy Policy) are recommending comprehensive solutions. Federal legislation has been offered to codify these solutions. Unfortunately, all of these bills reflect the conventional wisdom by incorporating a version of cap and trade. Since the inherent difficulties with cap and trade cannot be overcome, particularly the unavoidable uncertainty as to economic costs and environmental effects, there has been no progress.

However, there has been auspicious movement very recently. The recent legislation in California and the Jeffords Bill include cap and trade as an option but do not require it. Also, these bills include provisions for performance standards on new power plants and automobiles as well as new efficiency standards for buildings and appliances.

We need to build on this recent movement to transform the conventional wisdom from an exclusive reliance on cap and trade to the inclusion of, if not primary reliance on, performance standards on new sources as a powerful mechanism for reducing GHG emissions. Performance standards on new sources avoid the inherent difficulties of cap and trade. They would work extremely well and could (and should) be enacted relatively quickly.

End Notes

- The author has benefited from comments from Armond Cohen, Sam Newell, Pablo Paster, Jurgen Weiss, and Loren Cox. The views presented herein are not necessarily attributable to any of these, and the remaining errors are solely the responsibility of the author.

- Press conference, March 6, 2006.

- See William D. Nordhaus, “After Kyoto: Alternative Mechanisms to Control Global Warming,” (Silver City, NM and Washington, DC: Foreign Policy In Focus, March 27, 2006). In this paper Dr. Nordhaus makes some of the same points as this paper on the limitations of cap and trade. He notes two options. One is to rely on GHG taxes, which he recommends. But I believe taxes have most/all of the same formidable problems as cap and trade. The other option is “command-and-control regulation.” Performance standards on new sources are a form of such regulation. He argues that only cap and trade or taxes “have any hope of being reasonably efficient.” I disagree, as explained herein. This is a dialogue that needs to occur.

- Larry Lohmann, “Climate Politics After Montreal: Time for Change,” (Silver City, NM & Washington, DC: Foreign Policy In Focus, January 10, 2006). In this paper, Dr. Lohmann notes that essential progress on global climate change mitigation is inadequate because most countries “are pinning their hopes largely on carbon markets … [But] “this is a mistake.” “Global cap and trade systems … can’t work without much better measurement techniques and enforcement regimes than those possible today.” Also, the Clean Development mechanism serves to delay the transition to “clean energy” and encourages allocation of resources to projects that may have occurred anyway and/or that cannot be adequately verified. Meaningful steps are not being taken to stabilize GHG emissions.

- There are other GHGs in addition to CO2. The most significant of these are methane and black carbon (or soot). Meaningful reductions in the other GHGs could likely be done sooner and cheaper than reductions in CO2 emissions. Such reductions are a necessary but not sufficient element of any strategy to mitigate global climate change. This paper (and most of the global climate change debate) focuses on CO2, because it represents the most formidable challenge. But the other GHGs should not be ignored.

- The author helped design the Acid Rain program—the first use of cap and trade—that was implemented in the 1990s. He was and is an enthusiastic proponent of cap and trade for that problem, where new sources are largely irrelevant and where massive cost-effective retrofits on existing sources were required.

- See Senate White Paper: Sen. Pete V. Domenici and Sen. Jeff Bingaman, “Design Elements of a Mandatory Market-Based Greenhouse Gas Regulatory System,” February, 2006.

- National Commission on Energy Policy, Ending the Energy Stalemate: A Bipartisan Strategy to Meet America’s Energy Challenges, December, 2004.

- Hoff Stauffer, “Economics of CO2 Mitigation,” presented at the EUCI Conference in Miami, December 6, 2005, available upon request.

- The Commission’s proposal would increase this price cap by 5% per year in nominal terms. Assuming inflation of 2.5%, this would be 2.5% in real terms. If the proposal were enacted in 2007, the price cap would increase to about $11 per ton in 2027 (in real terms). This is still far below the $25 per ton (in real terms) required to induce control of coal-fired power plants.

- Paul Joskow, “Utility-Subsidized Energy-Efficiency Programs,” Annual Review of Energy and the Environment, November 1995, at 526-534.

- The exhibit below presents an example of a purchase decision for a more fuel efficient auto, which costs $1,000 more but gets a 50% improvement in fuel economy, worth $333 per year. (The point here is to illustrate the effect of behavioral discount rates. The point is not to debate the long-run cost of improved auto fuel efficiency.) If actual financing costs were used to make the purchase decision (e.g., an auto loan for 75% of the price at 9% interest plus an opportunity cost of 18% on the remaining 25% of the price), a four-year payback would be required; the fuel savings would have to be worth at least $250 per year to sum to the $1000 of increased investment over four years. In this example, the fuel savings are $333 per year, and the more efficient auto would presumably be purchased. The allowance price required to induce the purchase would be less than zero. However, if the purchase decision were made using “behavioral” financing costs so that the required payback period were two years (e.g., no auto loan with an opportunity cost of 50% on the entire purchase price), then the fuel savings would have to be $500 per year (to sum to the $1000 of increased investment over two years). But the fuel savings remain $333 per year in this example, and the purchase of the more efficient auto would not be made, absent a very high allowance price. The allowance price would have to increase to $135 per ton to induce this hypothetical consumer to purchase the more efficient auto, which would actually save him/her money.

| ——Financing Costs—— | ||

| Behavioral | Actual | |

| Additional Capital Costs | $1000 | $1000 |

| Payback | 4 | 2 |

| Annualized Capital Costs | $250 | $500 |

| Increased Maintenance Costs | $50 | $50 |

| Total Fixed Annual | $300 | $550 |

| Base Fuel Economy (mpg) | 20 | 20 |

| Higher Fuel Economy (mpg) | 30 | 30 |

| Fuel Price ($/gallon) | $2.00 | $2.00 |

| Miles per year | 10,000 | 10,000 |

| Base Annual Fuel Costs | $1,000 | $1,000 |

| Annual Fuel Costs with Higher mpg | $667 | $667 |

| Annual Fuel Savings | – $333 | – $333 |

| Total Change in Annual Costs | – $ 33 | – $217 |

| Tons CO2 Removed | 1.6 | 1.6 |

| Cost per ton Removed | – $ 21 | + $135 |

Hence, higher behavioral discount rates can have a dramatic effect on the required allowance price. This point is not yet widely understood, but it is keenly relevant in assessing the potential costs and effects of cap and trade schemes and/or CO2 taxes.

- See J Reilly and S Paltsev, “An Analysis of the European Emission Trading Scheme,” MIT Joint Program on the Science and Policy of Global Change, Report No. 127, October, 2005, pp. 3-8. The conclusion that the Kyoto goals will not be met is drawn by the author based on the information in this reference, inter alia.

- One of the reasons that cap and trade is judged to be so successful for SOx is that the actual costs of the program proved to be much less than estimated. Some of this can be attributed to the efficiency of the market, but some of it must be attributed to analytic errors made by this author and others in estimating the costs. The major error was in underestimating the supply and overestimating the cost of low-sulfur coal.

- Dr. Richard E. Benedick, “Contrasting Approaches: The Ozone Layer, Climate Change, and Resolving the Kyoto Dilemma,” to be published as a chapter in a forthcoming book, Global Biogeochemical Cycles in the Climate System, to be published by the Max-Planck-Institute for Biogeochemics.

- If the weight, performance, and mix of cars and trucks had been held at 1982 levels, the average fuel economy of new cars and trucks would be 50% greater.

- A counter example is the recent MBTE and ethanol requirements recently imposed by Congress. In each case, Congress picked a technology rather than set a performance standard. Further, the deadlines were probably too tight, resulting in price distortions as the industry was unable to adjust efficiently to the new requirements so quickly.

- For a rigorous analysis supporting this point, please contact the author at hoff@hoffstauffer.com. Article forthcoming.

- The potential reductions in CO2 emissions from the IEA Reference Case Scenario (World Energy Outlook, 2004) are primarily the result of performance standards on new sources. However, about 10% of the total reduction could be from existing coal-fired power plants, as a result of accelerated retirement of the least-efficient plants and some retrofits of carbon capture and sequestration technology. See exhibit below.

For a rigorous analysis supporting this graph, please contact the author at hoff@hoffstauffer.com.